#FCX (Freeport-McMoRan Copper & Gold Inc.). Exchange rate and online charts.

Currency converter

13 Jun 2025 22:59

(0.17%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Freeport-McMoRan Copper & Gold Inc. (FCX) is an international mining company. As for the stock and output, it is one of the leading copper producers with the lowest expenses in the world. Besides, it is the largest producer of gold and molybdenum.

Currently, Freeport-McMoRan is working in the fields in Indonesia (Grasberg), the North and South Africa, as well as Congo (Tenke). The Grasberg Mine has the largest reserves of gold and copper.

The producer’s shares are listed on the New York Stock Exchange under the ticker FCX. Freeport is an S&P 500 component.

History of the company

The company was founded in 1912 under the name of Texas Freeport Sulphur Company.

In 1971, it changed its name to Freeport Minerals Company.

In 1981, Freeport Minerals Company merged with McMoRan Oil and Gas Company. A year later, Freeport Gold became the largest gold producer in the world.

In 1985, the company sold a 25% interest in some oil and gas projects to Britoil for $73.5 million.

In 1994, Freeport-McMoRan Copper & Gold became an independent company fully focused on Indonesian projects through a spin-off.

In 2006, the company acquired Phelps Dodge and became the world's largest public copper company with a market capitalization of $37.5 billion. Freeport moved its headquarters to Phoenix, Arizona, US.

In 2012, the company acquired affiliated companies, McMoRan Exploration Company and Plains Exploration & Production Company, for a total value of over $20 billion, which added significantly to the company's crude assets.

In 2016, the company announced the sale of 13% ownership interest in Morenci Sumitomo Group for $1 billion in cash.

See Also

- Technical analysis

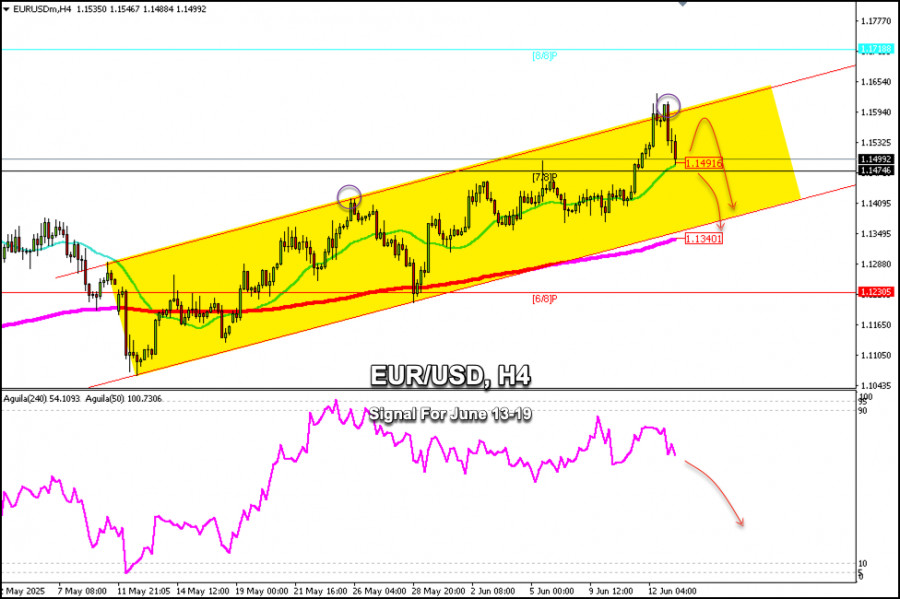

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

4513

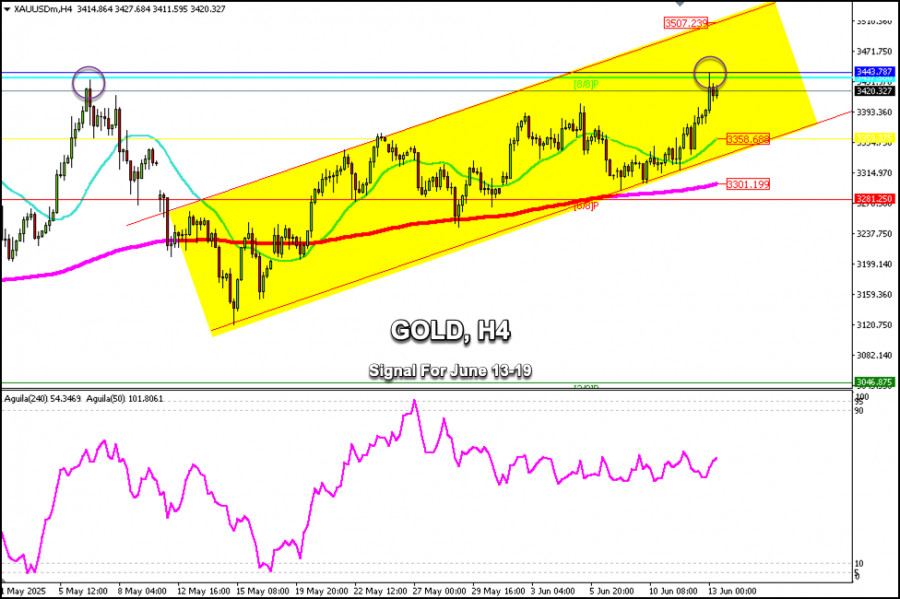

Technical analysisTrading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

3058

Recovery supported by the U.S. dollar reboundAuthor: Irina Yanina

13:09 2025-06-13 UTC+2

2833

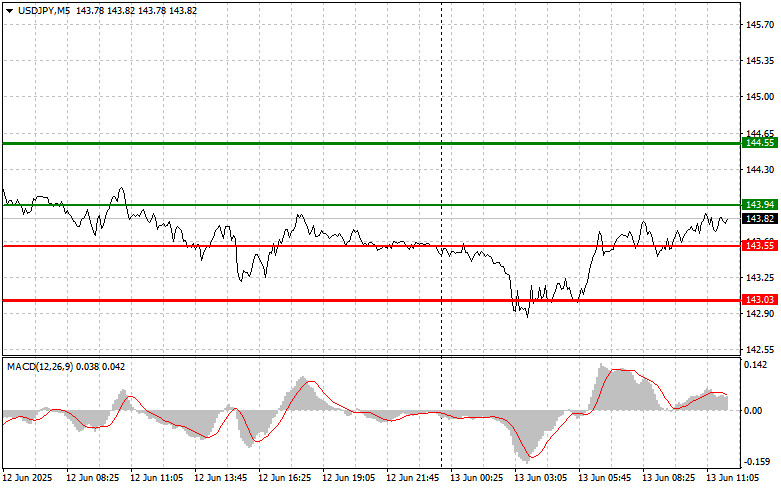

- USD/JPY: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2803

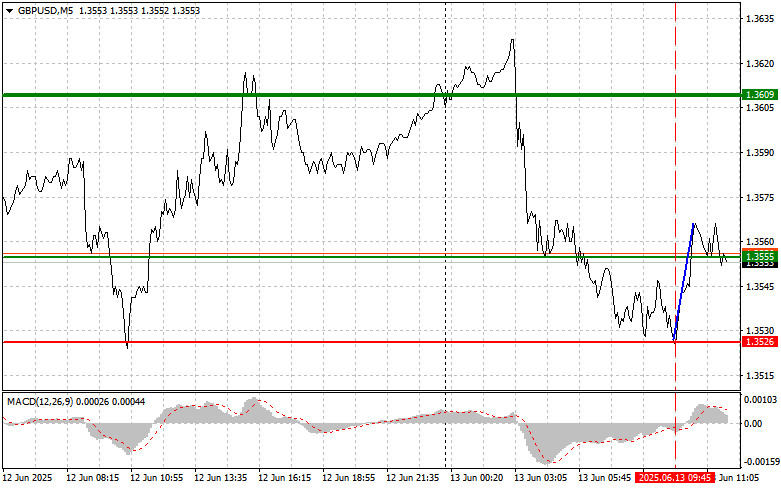

GBP/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)Author: Jakub Novak

12:44 2025-06-13 UTC+2

2713

EUR/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)Author: Jakub Novak

12:41 2025-06-13 UTC+2

2278

- Fundamental analysis

Israeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2218

Pressure persists despite short-term reboundAuthor: Irina Yanina

12:53 2025-06-13 UTC+2

2188

- Technical analysis

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

4513

- Technical analysis

Trading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

3058

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2833

- USD/JPY: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2803

- GBP/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:44 2025-06-13 UTC+2

2713

- EUR/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

2278

- Fundamental analysis

Israeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2218

- Pressure persists despite short-term rebound

Author: Irina Yanina

12:53 2025-06-13 UTC+2

2188