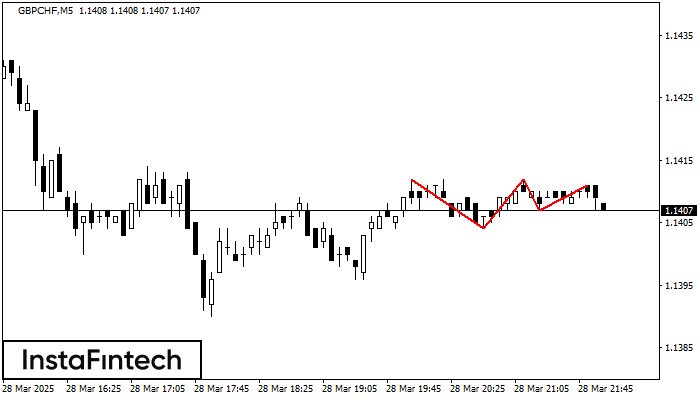

Тройная вершина

сформирован 28.03 в 22:01:13 (UTC+0)

сила сигнала 1 из 5

На графике GBPCHF M5 образовалась фигура «Тройная вершина». Данная фигура относится к типу разворотных и имеет характеристику: Верхняя граница 1.1412/1.1411; Нижняя граница 1.1404/1.1407; Ширина фигуры 5 пунктов. Прогноз: В случае пробоя нижней границы 1.1404 вероятно дальнейшее нисходящее движение к уровню 1.1397.

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Сондай-ақ қараңыз

- Все

- Все

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- Все

- Все

- Покупка

- Продажа

- Все

- 1

- 2

- 3

- 4

- 5

Double Top

was formed on 01.05 at 18:30:14 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on EURNZD M5. Characteristics: the upper boundary 1.9131; the lower boundary 1.9070; the width of the pattern is 61 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 01.05 at 17:39:48 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on #KO M5. It has the following characteristics: resistance level 71.64/71.57; support level 71.39/71.35; the width is 25 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

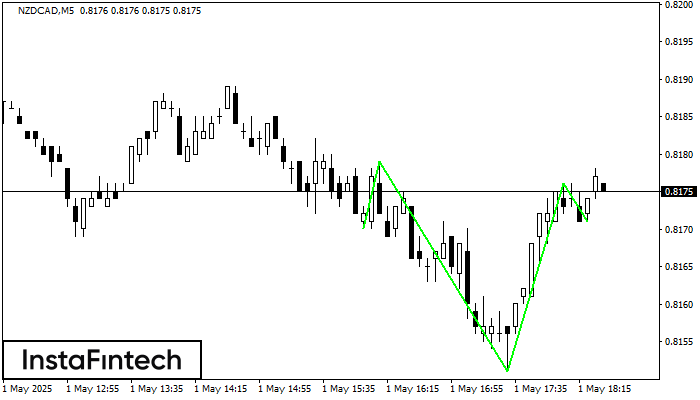

Inverse Head and Shoulder

was formed on 01.05 at 17:30:04 (UTC+0)

signal strength 1 of 5

According to M5, NZDCAD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.8179/0.8176 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window