Lihat juga

24.10.2022 09:25 AM

24.10.2022 09:25 AMAnalysis of transactions in the EUR / USD pair

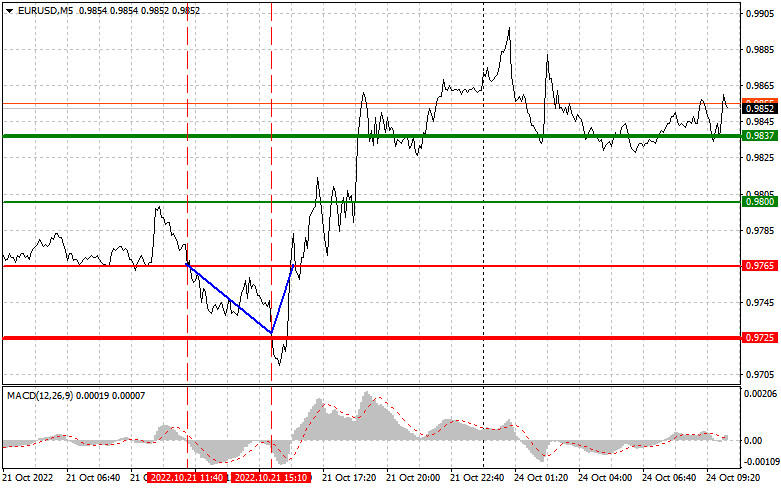

The test of 0.9765 occurred at the time when the MACD line was just starting to move below zero, which was a good reason to sell. It resulted in a price decrease of over 40 pips. As for purchases at 0.9725, they sent euro up another 40 pips. No other signals appeared for the rest of the day.

Having no reports in the Euro area last Friday morning put pressure on euro. Then, it intensified when consumer confidence in the region came out weaker than forecasts. Demand only returned when rumors spread that the ECB is ready to act more aggressively on its monetary policy.

Today, reports on business activity in Germany, France, Italy and the whole Eurozone are due, followed by the composite PMI of the region. A decrease in the latter will lead to a fall in euro. In the afternoon, similar reports are expected on the US, which could prompt a rise in dollar, provided that the figures are at a more or less acceptable level. If, for some reason, the indices also start to decline sharply, euro will rise against dollar.

For long positions:

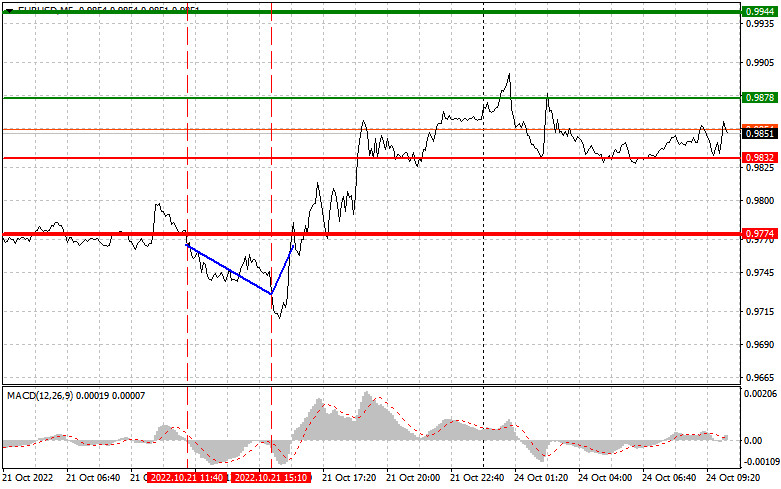

Buy euro when the quote reaches 0.9878 (green line on the chart) and take profit at the price of 0.9944. Growth will occur if statistics in the Eurozone exceed expectations.

Take note that when buying, the MACD line should be above zero or is starting to rise from it. Euro can also be bought at 0.9832, but the MACD line should be in the oversold area as only by that will the market reverse to 0.9878 and 0.9944.

For short positions:

Sell euro when the quote reaches 0.9832 (red line on the chart) and take profit at the price of 0.9774. Pressure will intensify if economic statistics in the Euro area are weaker than expected.

Take note that when selling, the MACD line should be below zero or is starting to move down from it. Euro can also be sold at 0.9878, but the MACD line should be in the overbought area as only by that will the market reverse to 0.9832 and 0.9774.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Analisis Dagangan dan Tip untuk Berdagang Yen Jepun Ujian harga pada 145.64 bertepatan dengan penunjuk MACD yang baru memulakan pergerakan ke bawah dari garis sifar, mengesahkan titik masuk yang

Analisis dan Tip Perdagangan Pound British Ujian harga pada 1.3455 semasa separuh pertama hari berlaku tepat ketika penunjuk MACD mula meningkat dari tanda sifar, mengesahkan titik kemasukan pasaran yang

Analisis Perdagangan dan Tip untuk Euro Ujian harga pada 1.1269 bertepatan dengan penunjuk MACD yang mula meningkat dari garis sifar, mengesahkan titik kemasukan pasaran yang sah. Akibatnya, pasangan mata wang

Ujian harga pada 144.59 berlaku apabila penunjuk MACD bergerak dengan ketara di atas garisan sifar, menghadkan potensi kenaikan pasangan mata wang ini. Oleh sebab itu, saya tidak membeli dolar. Penerbitan

Ujian harga pada 1.3461 pada separuh kedua hari berlaku apabila penunjuk MACD sudah bergerak secara signifikan di bawah tanda sifar, yang mengehadkan potensi penurunan pasangan mata wang. Atas sebab

Ujian pertama pada tahap harga 1.1302 pada separuh kedua hari berlaku apabila penunjuk MACD telah bergerak jauh di bawah paras sifar, yang mengehadkan potensi penurunan pasangan ini. Atas sebab

Euro, pound dan aset berisiko lain — termasuk yen Jepun — terus mengalami penyusutan pantas berbanding dolar AS, dan terdapat sebab-sebab objektif yang menjelaskannya. Selain daripada minit mesyuarat Rizab Persekutuan

Analisis Dagangan dan Nasihat Mengenai Berdagang Yen Jepun Ujian pertama pada paras harga 144.14 berlaku apabila penunjuk MACD telah pun bergerak jauh di bawah paras sifar, yang mengehadkan potensi penurunan

Analisis dan Petua Dagangan untuk Pound British Ujian pada paras 1.3488 pada separuh pertama hari ini berlaku tepat apabila penunjuk MACD mula bergerak naik dari garis sifar, mengesahkan titik kemasukan

Analisis Dagangan dan Petua untuk Berdagang Euro Ujian pertama pada paras 1.1327 berlaku apabila penunjuk MACD telah pun bergerak jauh di atas paras sifar, yang mengehadkan potensi kenaikan pasangan

Corak grafik

petunjuk.

Notices things

you never will!

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.