Lihat juga

20.05.2024 01:38 PM

20.05.2024 01:38 PMGBP/USD

Analysis:

Since April 22, the main pair of the British pound has been moving upward on the price chart. The quotes form a counter-correction with reversal potential from the potential reversal zone's lower boundary. If confirmed, the short-term trend direction of the pair will change.

Forecast:

In the next couple of days, we can expect a change in the course of the major pair of the British pound. There may be pressure on the calculated resistance, with a brief breach of its upper boundary. At the end of the week, the chance for a reversal and resumption of the price decline will appear.

Potential Reversal Zones

Recommendations:

AUD/USD

Analysis:

The unfinished large-scale wave structure on the Australian dollar chart has a downward vector, starting from July 13 last year. Since April this year, a corrective upward wave has been forming, with no signs of imminent completion. The price is trapped in a narrow corridor between strong opposing zones.

Forecast:

A continuation of the rise is likely in the next couple of days. Pressure on the calculated resistance zone cannot be ruled out. In the second half of the week, a change in direction can be expected, with a price decline anticipated towards the weekend.

Potential Reversal Zones

Recommendations:

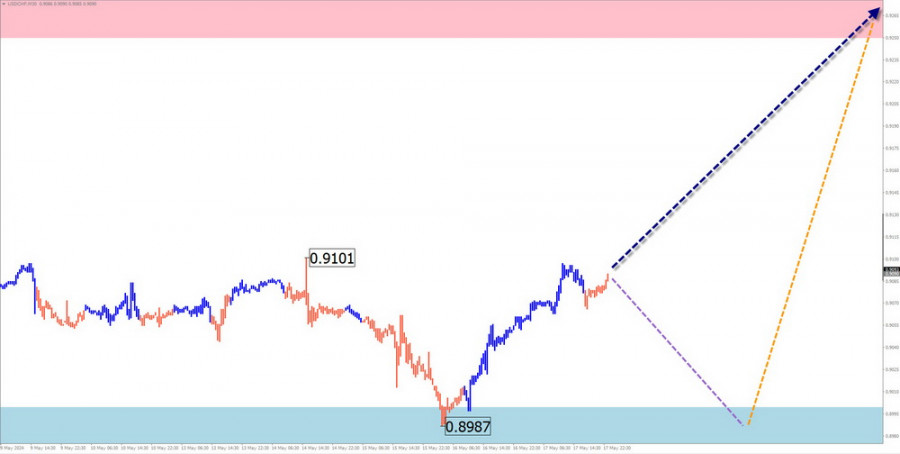

USD/CHF

Analysis:

Since December last year, the Swiss franc has strengthened the main pair. Quotes are approaching the upper boundary of a strong resistance zone on the higher timeframe. Since the beginning of May, the price has been correcting downward, and the correction is nearing completion. The calculated resistance is within the potential reversal zone on the daily timeframe.

Forecast:

The downward movement is likely to continue in the first half of the upcoming week. Then, a reversal formation, predominantly sideways, can be expected. Price growth resumption is anticipated closer to the weekend.

Potential Reversal Zones

Recommendations:

EUR/JPY

Analysis:

For the past three years, an ascending wave algorithm has determined the trend direction of the euro/yen cross pair. In the short term, the unfinished segment of the main trend has been ongoing since December last year. A correction has been forming since the end of April, primarily developing in a sideways plane.

Forecast:

The pair price is likely to move slightly upward in the coming days. Near the resistance zone, a sideways transition and reversal conditions are expected. During the trend change, a brief breach of the upper boundary of the zone is possible. A decline may start towards the end of the week.

Potential Reversal Zones

Recommendations:

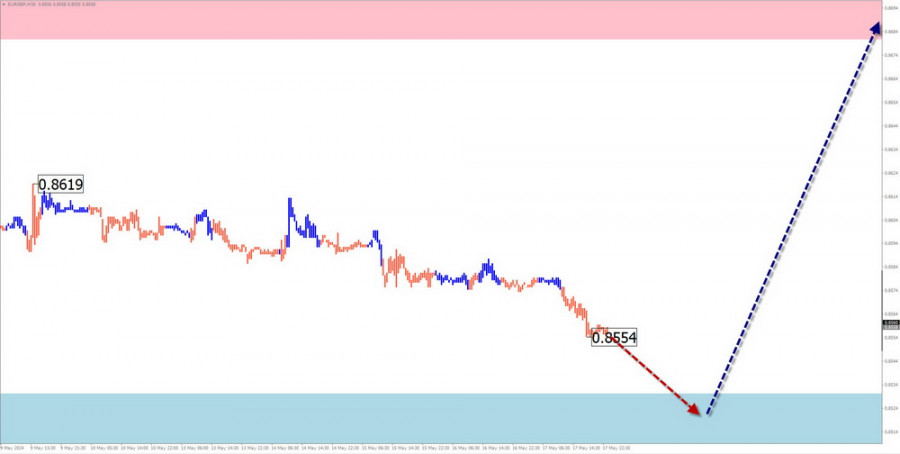

EUR/GBP

Analysis:

The euro in pair against the British pound continues to move sideways. Since December last year, a descending wave algorithm has determined the overall direction of short-term price fluctuations. Throughout the year, quotes have been forming a correction in a sideways corridor between the nearest opposing zones.

Forecast:

At the beginning of the week, pressure on the support zone is possible, though a breach of the lower boundary is unlikely. In the second half, a reversal and resumption of price rises can be expected.

Potential Reversal Zone

Recommendations:

US dollar index

Analysis:

Since April 16, fluctuations in the dollar index have formed an unfinished downward wave. Quotes reached the upper boundary of a strong potential reversal zone, forming a stretched corrective plane. Last week, quotes formed an upward segment with reversal potential.

Forecast:

The index's current upward trend will end in the upcoming week. After a probable decline to the support zone, a resumption of the rise can be expected up to the calculated resistance boundaries. A sideways transition and reversal formation can be expected after that.

Potential Reversal Zones

Recommendations:

The US dollar's weakening has entered its final phase. After the upcoming decline, a trend change can be expected.

Explanation:

In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed for each timeframe. Expected movements are shown with a dashed line.

Note: The wave algorithm does not account for the duration of instrument movements over time.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Struktur gelombang untuk GBP/USD juga telah berubah menjadi corak menaik dan impulsif—disebabkan oleh Donald Trump. Gambaran gelombang hampir serupa dengan EUR/USD. Sehingga 28 Februari, kita dapat melihat pembentukan struktur pembetulan

Pola gelombang untuk GBP/USD juga telah berubah menjadi struktur impulsif kenaikan harga—terima kasih kepada Donald Trump. Gambaran gelombang ini sangat mirip dengan EUR/USD. Sehingga 28 Februari, kita menyaksikan struktur pembetulan

Corak gelombang pada carta 4 jam pasangan EUR/USD telah berubah kepada struktur menaik. Saya percaya tiada banyak keraguan bahawa transformasi ini berlaku semata-mata akibat dasar perdagangan baharu yang diterima pakai

Struktur gelombang bagi pasangan GBP/USD juga telah berubah menjadi corak menaik yang bersifat impulsif — "terima kasih" kepada Donald Trump. Gambaran gelombang ini hampir sama dengan pasangan EUR/USD. Sehingga

Struktur gelombang pada carta 4 jam untuk pasangan EUR/USD telah berubah menjadi kenaikan. Saya percaya tidak ada keraguan bahawa perubahan ini sepenuhnya disebabkan oleh dasar perdagangan baru A.S. Sehingga

GBP/USD Analisis: Carta 4-jam bagi pound British menunjukkan bahawa pembetulan sementara berbentuk mendatar sedang terbentuk dalam gelombang naik dominan yang diperhatikan dalam beberapa minggu kebelakangan ini. Segmen kenaikan yang belum

EUR/USD Analisis: Graf carta jam bagi pasangan utama euro menunjukkan gelombang menaik yang dominan sejak awal Februari. Pembetulan yang dibentuk dalam tiga minggu yang lalu hampir selesai. Bahagian yang belum

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.