Lihat juga

11.07.2024 05:41 PM

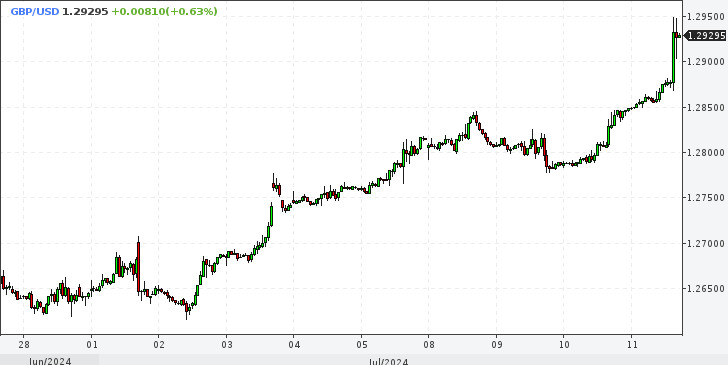

11.07.2024 05:41 PMIt seemed that the pound's rally was broken down against technical barriers and Jerome Powell's sober assessment of the prospects for lowering interest rates. The Federal Reserve Chairman did not give a clear signal that the central bank is ready to cut interest rates in September. Today the pound sterling is helped by a new macroeconomic report.

UK GDP grew stronger than expected in May, which reduces the likelihood of an interest rate cut on August 1 by the Bank of England.

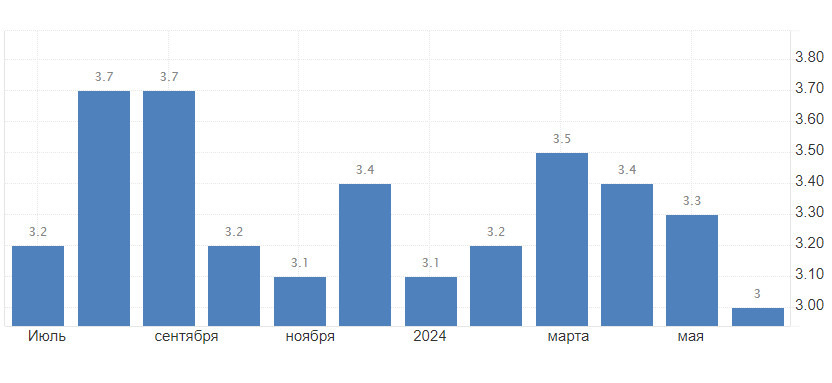

The annual core US consumer price index rose by 3.3%, below market expectations and logging a downtick a 3.4% increase in May. The US dollar came under heavy selling pressure due to the immediate reaction to tepid inflation data.

As for British data, GDP increased by 0.4% month-on-month. The British pound reached a 4-month high against the US dollar.

Economic growth is nearly double the consensus estimate of a 0.2% rise, well ahead of April's stagnation of 0%.

The driving force behind economic growth was the services sector, the largest in the country's economy, which showed an increase of 0.3% in May 2024.

Equals Money said: "GDP data provided another argument in favor of markets supporting the pound." The current rate of the GBP/USD pair is above 1.2900, which is significantly higher than the forecast made by more than thirty investment banks.

In the 3-month period to May 2024, the UK economy expanded by 0.9% compared with the previous three months, largely driven by a 1.1% increase in the services sector.

These indicators prove the country's sustained strong economic recovery, reducing the need for additional stimulus measures from the Bank of England, such as interest rate cuts.

Members of the Monetary Policy Committee (MPC) now face the question of whether they will be able to cut rates in August, given that the economy may have posted two consecutive quarters of growth of 0.7%.

Strong economic performance and rising output in the services sector suggest that inflation in this sector is likely to remain high. Hugh Pill, chief economist at the Bank of England, said on Wednesday that services inflation remains under close watch.

During a speech in London, Pill pointed to a possible interest rate cut, although he did not specify a particular time frame.

The pound sterling strengthened following Pill's comments as investors assess the likelihood of a Bank of England rate cut at less than 50% on August 1.

The pound was the top gainer yesterday after Hugh Pill's remarks cooled expectations of a rate cut in August. He noted that service and wage inflation levels remained unacceptably high despite headline inflation reaching the Bank's 2% target in May. The analyst added that June macroeconomic data was unlikely to change the overall picture.

The release of GDP data on Thursday further moderated expectations, which in turn contributed to the growth of the British pound.

According to experts from Capital Economics, the central bank will still cut interest rates on August 1, although the exact timing of the first cut will greatly depend on inflation data for June and on May labor market statistics, which will be published next week.

For now, to maintain momentum building, the pound must not break below 1.2805 with minor support at 1.2825. The barrier now is the level of 1.2900, which has been broken, but the hesitation of traders above this level is visible to the naked eye.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pasaran saham Amerika Syarikat menamatkan sesi dagangan dengan penurunan selepas Amerika Syarikat dan China memuktamadkan perjanjian perdagangan yang telah lama dinantikan. Walaupun latar belakang berita tersebut bersifat positif, para pelabur

Pasaran saham Amerika Syarikat telah mencapai paras unjuran dan kini memasuki "fasa peninjauan yang tenang" sementara para pelabur menantikan pelepasan data inflasi utama. Data yang bakal dikeluarkan ini berkemungkinan menentukan

J.M. Smucker merosot selepas unjuran pesimis Bank Dunia menurunkan unjuran pertumbuhan global bagi 2025 Nikkei meningkat, niaga hadapan Wall Street dan euro menurun Dolar hampir tidak berubah, bon menanti data

Indeks S&P 500 dan Nasdaq 100 mencatatkan kenaikan yang ketara, didorong oleh jangkaan positif menjelang rundingan perdagangan Amerika Syarikat-China yang akan datang. Para pelabur bertaruh pada kemungkinan pengurangan tarif, yang

Robinhood Jatuh Setelah Platform Dibuang Dari S&P 500 Warner Bros. Saham Jatuh Setelah Syarikat Mengatakan Rancangan Untuk Mengasingkan Perniagaan Saham Eropah Jatuh Berikutan Penurunan UBS, Perbincangan Perdagangan AS-Cina Menunggu McDonald's

Laporan CPI bagi bulan Mei dijadualkan pada hari Rabu Rang undang-undang belanjawan menjadi tumpuan di tengah pertelingkahan antara Trump dan Musk Saham Alphawave melonjak susulan rancangan pengambilalihan oleh Qualcomm Saham

Dow -0.25%, S&P 500 -0.53%, Nasdaq -0.83% Tesla Jatuh ketika Perselisihan Terbuka Trump-Musk Semakin Memuncak Tuntutan Pengangguran Awal Meningkat untuk Minggu Kedua Berturut-turut Saham Adidas, Puma Jatuh Selepas Lululemon Memotong

Dow -0.22%, S&P 500 mendatar, Nasdaq +0.32% Sektor perkhidmatan menguncup pada bulan Mei buat kali pertama dalam tempoh hampir setahun Saham CrowdStrike merosot akibat unjuran pendapatan suku tahunan yang pesimis

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.