Lihat juga

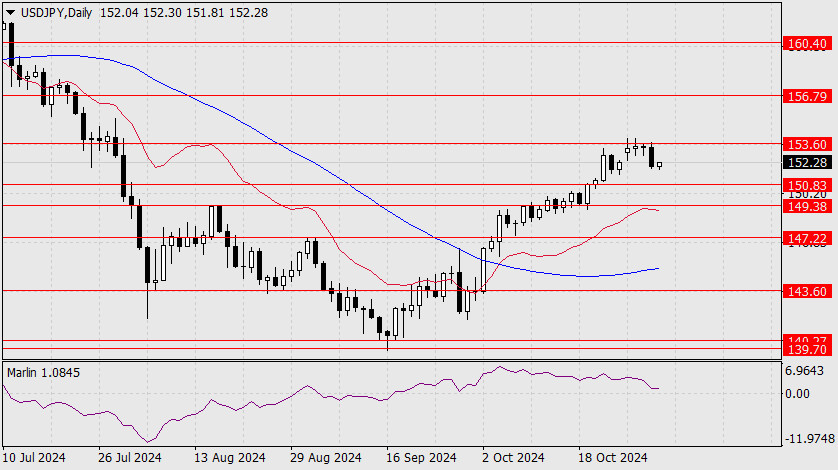

The USD/JPY pair closed the gap formed on Monday and is now poised to resume its upward movement above the 153.60 resistance, potentially aiming for the target at 156.79 (the May 14 high). However, the pair's readiness for growth remains weak, as the mere intention to move upwards to create a technical divergence cannot yet be called readiness. For this, the Marlin oscillator needs to turn upward, and the price needs to approach the 153.60 resistance. Like other currencies, the yen awaits the outcome of the U.S. elections, and the 150.83-153.60 range has become familiar and comfortable territory.

In addition to the U.S. elections, the yen is affected by the formation of Japan's government and the Bank of Japan's policy. As the head of the central bank, Kazuo Ueda, stated yesterday, the central bank also closely monitors political and economic events.

Today, U.S. labor and manufacturing activity data for October will be released, with optimistic forecasts. If these expectations are met and the stock market recovers, the USD/JPY pair may resume its upward trajectory.

On the four-hour chart, the price has consolidated below both indicator lines, but a consolidation above them (152.52) would indicate the falseness of this action and serve as an independent signal for the development of an upward trend. Marlin could approach the zero line during the price's consolidation above 152.52.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.