Lihat juga

27.01.2025 01:07 PM

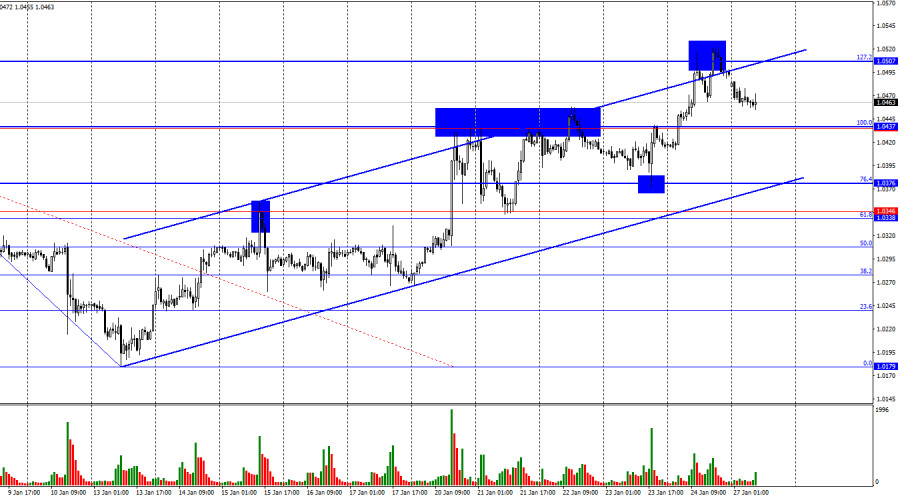

27.01.2025 01:07 PMOn Friday, the EUR/USD pair continued its upward movement, consolidating above the 100.0% Fibonacci retracement level at 1.0437 and testing the 127.2% Fibonacci level at 1.0507. A rebound from this level worked in favor of the U.S. dollar, leading to a decline toward the 1.0437 level. The upward trend channel confirms the bullish sentiment in the market.

The situation with the waves remains clear. The last completed downward wave broke the low of the previous wave, while the latest upward wave (still incomplete) has surpassed the previous two peaks. This confirms the completion of the bearish trend. A new downward wave could soon begin forming, but for the bears to establish a new trend, the price needs to return to the 1.0179 level or form a more complex wave structure that takes control.

The information flow on Friday was favorable for the bulls but not outstanding. I believe bullish traders exceeded expectations for both Friday and the entire past week. The euro appreciated too significantly, considering the informational backdrop, which was mostly absent on most days. By information background, I mean economic data. However, it's possible the market was trading "on Trump." If so, trader sentiment will soon depend on this factor.

On Friday, Germany's business activity indices delivered better-than-expected results, as did those for the Eurozone. U.S. indices were also decent but fell short of their European counterparts. Additionally, the University of Michigan Consumer Sentiment Index came in weaker than traders expected. While the dollar's decline was justified, it was overly strong.

This week will be pivotal, with the ECB and Federal Reserve meetings on the agenda. ECB President Christine Lagarde will deliver speeches almost daily, and news from Donald Trump will likely continue to flood in. Thus, there will be ample news, and its influence on trader sentiment will be significant.

On the 4-hour chart, the pair consolidated above the 127.2% Fibonacci retracement level at 1.0436. This suggests that the upward movement could continue toward the next Fibonacci level of 100.0% at 1.0603. The euro has also broken above the downward trend channel, indicating a gradual shift to a bullish trend. However, how long this bullish trend will last remains unclear. A bearish divergence on the CCI indicator signals a potential decline in the near term.

In the latest reporting week, professional players opened 4,905 long positions and 6,994 short positions. The sentiment of the "Non-commercial" group remains bearish, suggesting a potential continuation of the pair's decline. The total number of long positions held by speculators now stands at 167,000, while short positions amount to 230,000.

For 18 consecutive weeks, major players have been selling the euro. This signifies a bearish trend without exception. While bulls occasionally dominate for individual weeks, these instances are exceptions rather than the rule. The key driver of the dollar's weakness—expectations of monetary policy easing by the Federal Reserve—has already been priced in. Unless new reasons to sell the dollar emerge, the U.S. currency's recovery remains more likely.

On January 27, the economic calendar contains just one notable event, but it is significant enough to moderately impact market sentiment.

Fibonacci levels are plotted from 1.0437–1.0179 on the hourly chart and from 1.0603–1.1214 on the 4-hour chart.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada carta 4 jam, pasangan mata wang komoditi USD/CAD dapat dilihat bergerak di bawah EMA (100) dan kemunculan corak Bearish 123 serta kedudukan penunjuk Pengayun Stochastic yang sudah berada

Dengan keadaan Penunjuk Pengayun Stochastic menghampiri paras Terlebih Jual (20) pada carta 4 jam pasangan mata wang silang AUD/JPY, dalam masa terdekat AUD/JPY berpotensi untuk melemah ke kawasan paras 89.75–89.39

Pada awal sesi dagangan Amerika, emas didagangkan sekitar paras 3,220, menunjukkan tanda-tanda keletihan. Pembetulan teknikal selanjutnya ke arah Purata Bergerak Ringkas 21-hari (21 SMA) dijangka berlaku dalam beberapa jam akan

Dengan kemunculan Perbezaan antara pergerakan harga pasangan mata wang silang EUR/JPY dengan penunjuk Pengayun Stochastic Oscillator yang turut diikuti dengan kehadiran corak Bullish 123 dan diikuti oleh Bullish Ross Hook

Pada carta 4 jam, pasangan silang mata wang GBP/AUD dilihat bergerak di bawah EMA (21), dan penunjuk Pengayun Stochastic berada dalam keadaan Persilangan JUAL (Crossing SELL). Maka, berdasarkan kedua-dua maklumat

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.