Lihat juga

28.01.2025 01:24 PM

28.01.2025 01:24 PMThe U.S. stock market partially rebounded after a sharp decline triggered by the Chinese startup DeepSeek, which caused many investors to question whether the AI market might be in a bubble—especially considering the valuation of a single company, NVIDIA. Notably, NVIDIA lost $600 billion in market capitalization yesterday.

S&P 500 and NASDAQ ended the day down 2% to 3%, and today, futures for these indices are trading with minimal volatility, slightly in the red. This indicates continued uncertainty about how investors and traders will act moving forward, seemingly waiting for statements or decisions from Donald Trump's new administration.

As noted earlier, shares of the chip manufacturer fell nearly 17% as the performance of DeepSeek's language model raised questions about the volume of investments in artificial intelligence. With these developments, the high-profile name in artificial intelligence is heading for its worst day since March 2020.

Investor concerns are growing as competition in the AI space becomes increasingly fierce. The emergence of new players like DeepSeek, capable of showcasing high-performing language models, challenges the dominance of major companies. These changes are prompting a reevaluation of investment strategies and possibly even project plans. While AI investments have been at the peak of popularity for some time, yesterday's events question these established norms and create market uncertainty. For many tech companies, this is a warning sign: the AI landscape is shifting, and caution is the best defense.

NVIDIA was not the only semiconductor company whose shares plummeted due to DeepSeek's developments.

The VanEck Semiconductor ETF (SMH) slid nearly 10%.

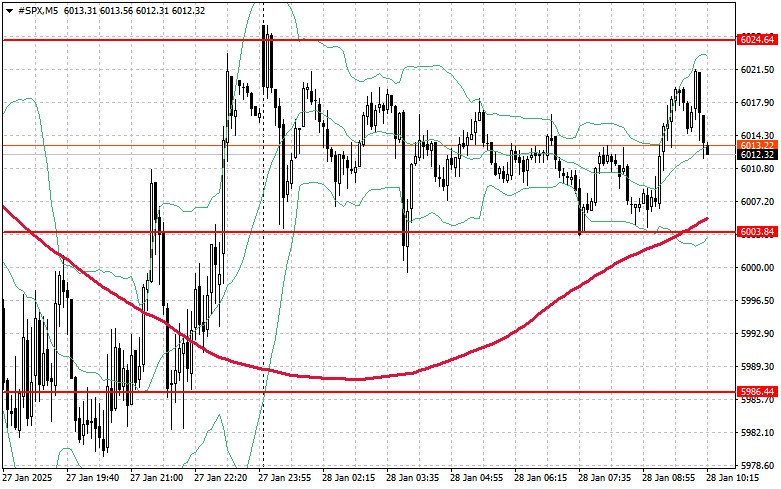

Demand for the S&P 500 remains strong. Buyers' main goal today will be to break through the nearest resistance level at $6024, which would help sustain the upward trend and pave the way for a move toward $6038. A secondary but equally important target for bulls will be holding $6047, which would strengthen buyers' positions.

If the index moves downward amid reduced risk appetite, buyers will need to step up around $6003. A breakout below this level could quickly push the instrument back to $5986 and potentially open the door to $5967.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Di penutupan sesi biasa yang lepas, indeks saham AS berakhir lebih tinggi. S&P 500 meningkat sebanyak 2.03%, manakala Nasdaq 100 naik 2.74%. Dow Jones Industrial Average bertambah sebanyak 1.23%. Saham

Setelah sesi biasa sebelum ini, indeks saham AS ditutup lebih tinggi. S&P 500 naik sebanyak 1.67%, Nasdaq 100 meningkat sebanyak 2.50%, dan Dow Jones Industrial Average naik sebanyak 1.07%. Walau

Menjelang penutupan sesi biasa sebelum ini, indeks saham AS berakhir dengan prestasi yang bercampur-campur. S&P 500 meningkat sebanyak 0.13%, manakala Nasdaq 100 susut sebanyak 0.13%. Dow Jones perindustrian jatuh sebanyak

S&P 500 Gambaran Keseluruhan untuk 18 April Pasaran AS: Trump keras mengkritik Pengerusi Fed Powell, tetapi saham masih stabil Indeks utama AS pada hari Khamis: Dow -1.3%, NASDAQ -0.1%, S&P

Pada penutupan sesi dagangan biasa sebelum ini, indeks saham AS berakhir bercampur. S&P 500 meningkat sebanyak 0.13%, manakala Nasdaq 100 jatuh sebanyak 0.13%. Indeks industri Dow Jones kehilangan 1.33%. Indeks

Selepas sesi biasa sebelumnya, indeks saham AS ditutup dengan penurunan yang ketara. S&P 500 jatuh sebanyak 2.24%, Nasdaq 100 turun sebanyak 3.07%, dan Dow Jones Industrial Average kehilangan 1.87%. Namun

Berikutan sesi biasa sebelumnya, indeks saham AS ditutup sedikit lebih rendah. S&P 500 turun sebanyak 0.17%, Nasdaq 100 susut 0.05%, dan Dow Jones Industrial Average jatuh 0.18%. Lebih ketara, penjualan

S&P 500 Tinjauan pada 16 April Pasaran AS kekal berdaya tahan walaupun menghadapi kekacauan tarif dari Trump Indeks utama AS pada hari Selasa: Dow -0.4%, NASDAQ 0%, S&P 500 -0.2%

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.