Lihat juga

28.03.2025 09:19 AM

28.03.2025 09:19 AMIf you don't get it the first time, you will the second. The S&P 500 sell-off, led by U.S. and foreign automaker shares, continued a second day after the imposition of 25% tariffs. Donald Trump threatened the European Union and Canada with retaliation should they respond jointly to the import duties, and companies have begun tallying up losses. The broad stock index is confidently moving toward the lower boundary of its medium-term trading range of 5500–5790, but blaming only the White House occupant for all its troubles would be misguided.

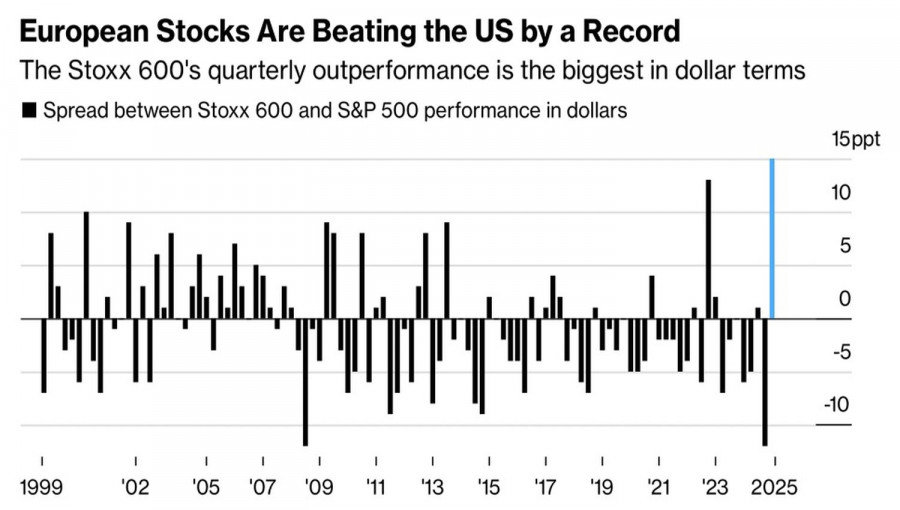

The sell-off of overvalued "Magnificent Seven" companies, slowing corporate profit growth, and a weakening U.S. economy contribute to a capital shift from North America to Europe. European indices are currently outperforming the S&P 500 by a wide margin. However, according to the world's largest asset manager, this advantage may not last long. BlackRock believes that Germany's fiscal stimulus will primarily benefit banks and defense companies — a very narrow group. Therefore, one shouldn't count on the EuroStoxx 50 and DAX 40 rally to continue at the same pace.

By contrast, the U.S. stock market will likely receive a fresh boost once the situation surrounding Donald Trump's protectionist policies becomes clearer. Many companies will adapt to the tariffs, enabling the S&P 500 to grow again.

But first, the broad stock index would do well to shed some dead weight. In 2025, that weight comes from the "Magnificent Seven" stocks. Back in February, they were trading at 45 times forward earnings. Only the sell-off has brought the P/E ratio down to 35 — still high, though the 11% drop in that figure is striking.

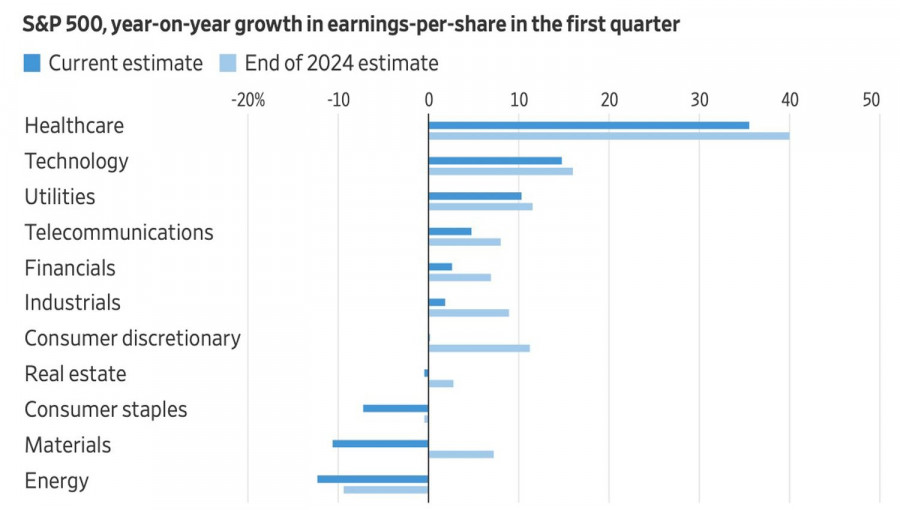

Q1 earnings season kicks off in a few weeks, and Wall Street's 7.1% earnings forecast is impressive. But that's four percentage points lower than what experts were projecting at the end of 2024. The discrepancy in estimates is above the historical average. Forecasts have been cut across all 11 S&P 500 sectors, and earnings growth is expected to slow in nine.

The stronger-than-expected Q4 GDP reading of 2.4% shouldn't be misleading. For January–March, Bloomberg analysts expect GDP growth to slow to 1–1.5%, and the Atlanta Fed's leading indicator signals an even weaker pace — just 0.2%. Inflation remains elevated, tying the Fed's hands and preventing the central bank from throwing markets a lifeline.

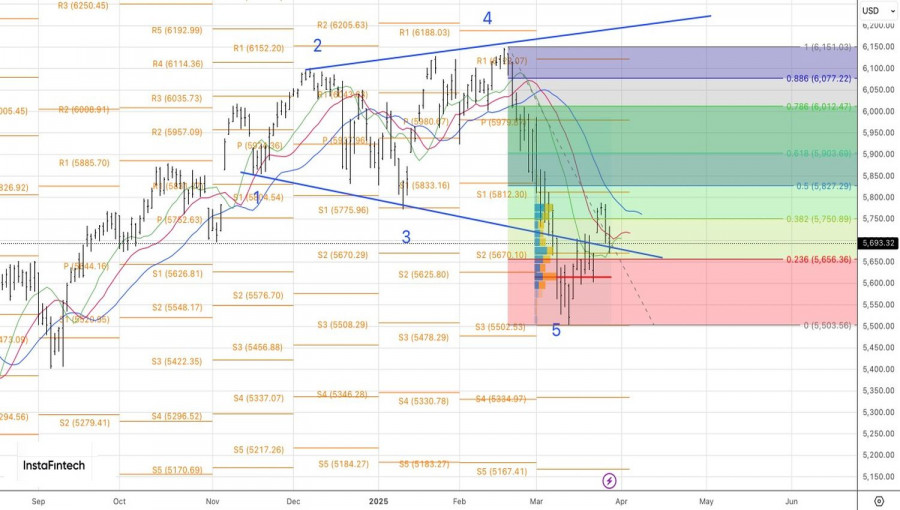

Technically, on the daily chart, the S&P 500 continues its previously forecasted move from the upper boundary of its consolidation range (5500–5790) toward the lower bound. It makes sense to hold and even build on short positions once support at 5670 is broken — especially since the Broadening Wedge pattern is playing out clearly.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Selepas kejatuhan mendadak yang hampir menjejaskan pada bulan Mac dan April, indeks saham utama AS pulih pada bulan Mei, sepenuhnya mengimbangi penurunan tersebut. Keyakinan semakin meningkat di kalangan peserta pasaran

Tidak banyak laporan makroekonomi yang dijadualkan pada hari Rabu. Sudah tentu, kita harus memberi perhatian kepada indeks aktiviti perniagaan sektor perkhidmatan bagi Jerman, UK, EU, dan AS. Namun, kami ingin

Pasangan mata wang GBP/USD didagangkan lebih rendah pada hari Selasa, tetapi penurunannya lemah, sama seperti volatiliti. Lihat saja pergerakan terkini GBP/USD! Bolehkah kita katakan pasaran sudah penat menjual dolar

Pasangan mata wang EUR/USD didagangkan secara relatifnya tenang sepanjang hari Selasa, dan dolar AS malah berjaya mencatat sedikit pengukuhan. Namun begitu, kami tidak memberi terlalu banyak perhatian kepada kenaikan dolar

Donald Trump sedang mempertaruhkan ekonominya sendiri. Inilah kesimpulan yang dicapai oleh negara-negara G-20 dalam sidang kemuncak mereka yang terbaharu. Menurut para peserta sidang, perbincangan tertumpu kepada tarif perdagangan yang dikenakan

Pembeli EUR/USD memulakan minggu dagangan dengan penuh semangat, menguji paras rintangan pada 1.1450 (garisan atas penunjuk Bollinger Bands pada carta harian) dan mencatat paras tertinggi enam minggu baharu pada 1.1455

Masalah datang dari arah yang paling tidak dijangka. Kerajaan kecewa apabila rakan gabungan enggan menyokong rancangan kawalan imigrasinya, Parti Kebebasan membongkar kerajaan Belanda. Negara tersebut kemungkinan besar akan mengadakan pilihan

Laporan CFTC menunjukkan bahawa jangkaan untuk pembalikan dalam dolar tidak menjadi kenyataan. Selepas tiga minggu kestabilan relatif, di mana jumlah kedudukan pendek pada USD berbanding mata wang utama menunjukkan tanda-tanda

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.