Lihat juga

28.03.2025 12:16 PM

28.03.2025 12:16 PMThe AUD/USD pair continues its sideways consolidation, remaining within a familiar range near the key psychological level of 0.6300. This movement is driven by several factors impacting global market sentiment.

Recent announcements by U.S. President Donald Trump regarding new tariffs on imported cars and light trucks have had a negative impact on the market. The anticipation of reciprocal tariffs set to take effect next week also contributes to investor uncertainty, as these measures affect the global economy. At the same time, the modest rise in the U.S. dollar is seen as a limiting factor for the growth of the risk-sensitive Australian dollar.

However, the intraday strength of the U.S. dollar has not sparked much optimism. Amid concerns about the potential economic consequences of Trump's aggressive trade policies, markets are now pricing in a 65% probability that the Federal Reserve will cut borrowing costs by 25 basis points in June. This curbs aggressive dollar-buying activity.

In addition, renewed hopes for stimulus from China are helping to limit losses for the Australian dollar.

Today, for additional trading opportunities, attention should be paid to the release of the U.S. PCE – the Personal Consumption Expenditures Price Index. This data will influence the Fed's decisions regarding its future monetary policy, which in turn will play a key role in driving demand for the U.S. dollar and may provide new momentum for the AUD/USD pair.

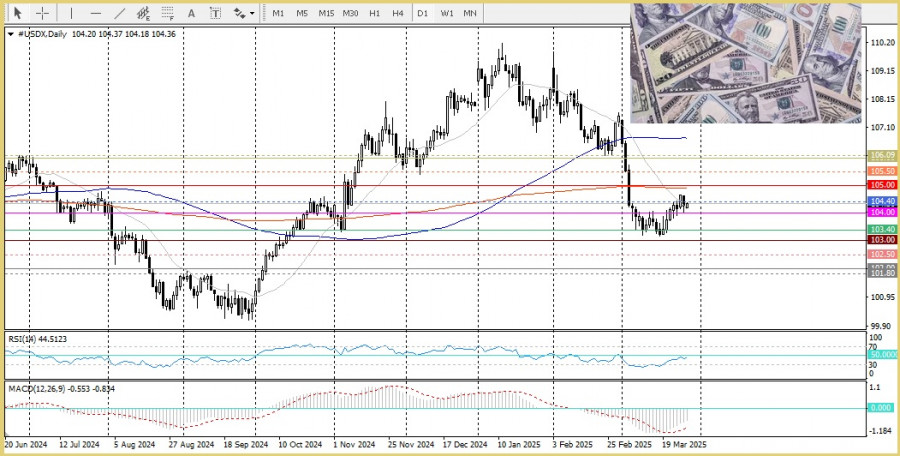

From a technical perspective, the pair needs to break above the round level of 0.6300 to pave the way for further upside. The Relative Strength Index (RSI) has yet to move into positive territory. However, oscillators on the daily chart remain mixed, so it may be wise to wait for the release of key U.S. economic data during the North American session before entering new buy or sell positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Emas terus menarik perhatian pelabur, terutamanya dalam tempoh ketidaktentuan yang tinggi di pasaran kewangan. Ketidaktentuan Perdagangan: Ketidaktentuan yang berterusan dalam hubungan perdagangan antara AS dan China menjadikan emas sebagai aset

Optimisme pasaran, yang didorong oleh manipulasi naratif tarif secara aktif oleh Donald Trump, tidak bertahan lama. Pedagang tetap memberi tumpuan kepada ketegangan yang semakin meningkat antara A.S. dan China selepas

Analisis Laporan Makroekonomi: Beberapa acara makroekonomi dijadualkan pada hari Rabu, dan terdapat juga laporan penting yang akan diterbitkan. Namun begitu, isu utama ketika ini bukanlah sejauh mana signifikan laporan-laporan tersebut

Pada hari Selasa, pasangan mata wang GBP/USD terus menunjukkan pergerakan menaik. Walaupun kenaikan kali ini tidak sekuat lonjakan minggu lalu, pound British terus meningkat dengan stabil, hampir tanpa sebarang pembetulan

Pasangan mata wang EUR/USD kekal hampir mendatar sepanjang hari Selasa. Walaupun kedua-dua pasangan sedang berada dalam aliran menaik, euro dan pound British sejak kebelakangan ini tidak lagi bergerak seiring. Kedua-duanya

Euro menunjukkan reaksi negatif terhadap indeks ZEW yang dikeluarkan pada hari Selasa, yang mencerminkan peningkatan pesimisme dalam persekitaran perniagaan Eropah. Petunjuk utama jatuh ke kawasan negatif buat pertama kali dalam

Kenaikan euro ke kawasan tertinggi dalam tiga tahun menjadi berpotensi ekoran rangsangan fiskal Jerman, dasar perdagangan Donald Trump, dan aliran keluar modal dari Amerika Utara ke Eropah. Apabila pelabur berhenti

Hari ini, yen Jepun menghadapi cabaran untuk meneruskan pengukuhannya disebabkan perkembangan optimistik berhubung rundingan perdagangan dan penangguhan tarif. Kenyataan Presiden Trump mengenai pengecualian yang mungkin untuk industri automotif mungkin memberikan

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.