Lihat juga

31.03.2025 09:07 AM

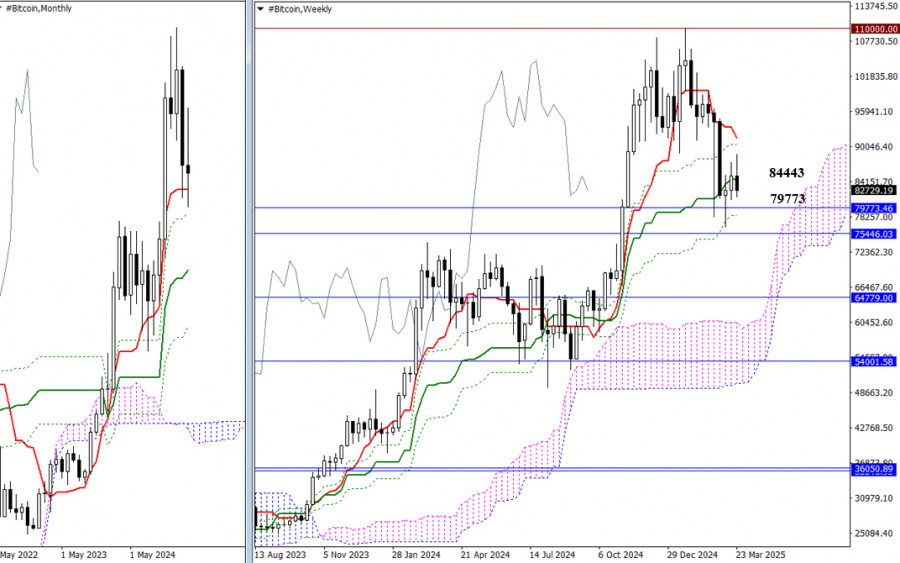

31.03.2025 09:07 AMUncertainty currently dominates the market. Participants have taken a wait-and-see approach. The support of the monthly short-term trend at 79,773 and the weekly medium-term trend at 84,443 continue to influence the situation. To shift the current setup, bears must break the recent low at 76,562 and firmly consolidate below the monthly thresholds at 79,773–75,446. Only then will new opportunities emerge for sellers.

If buyers attempt to regain control by reclaiming the weekly short-term trend level at 91,489, they may still struggle with the influence of the former consolidation zone centered around the 96,000–98,000 range. Surpassing this area would pave the way for Bitcoin to target a new all-time high at 109,986.

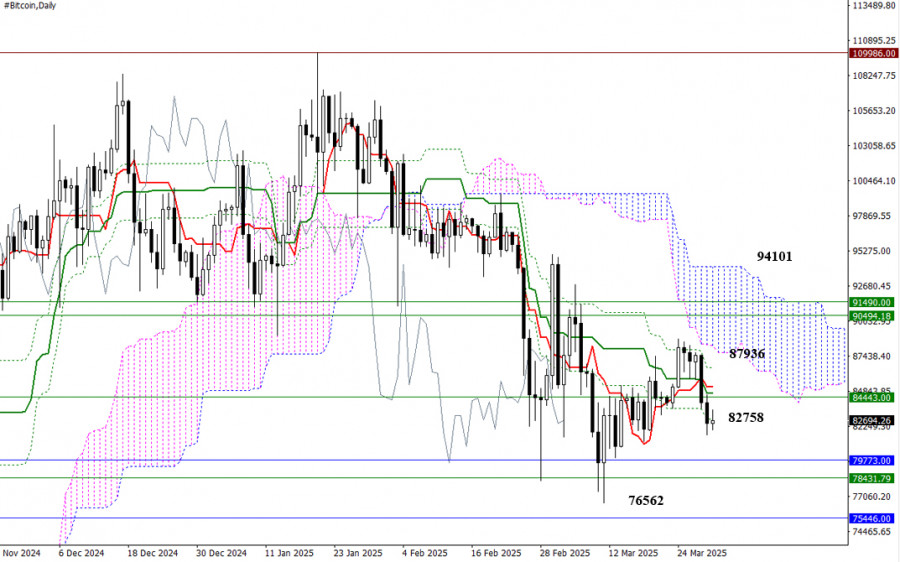

On the daily timeframe, the market is currently operating within the boundaries of the Ichimoku daily cross (87,936–82,758). Bulls must break through the overhead Ichimoku cloud (94,101) and consolidate in the bullish zone. The bears' targets and objectives are tied to higher timeframes and the abovementioned levels: 79,773 – 76,562 – 75,446.

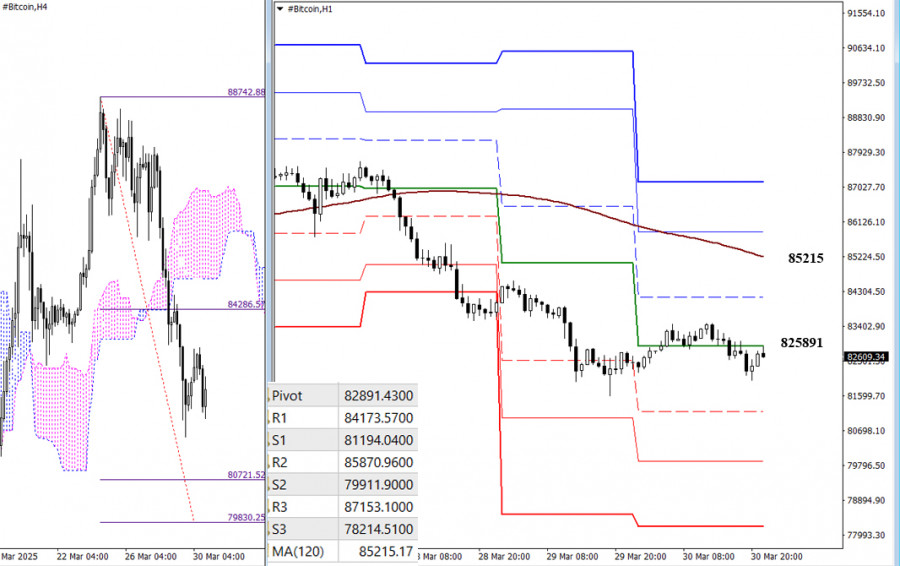

On the lower timeframes, bulls failed to reach the breakout target for the H4 Ichimoku cloud as bears regained key levels and pushed the price lower, forming a bearish breakout target for the H4 cloud at 80,722–79,830. Therefore, if the decline continues, the following points of interest will be the support levels of the classic Pivot Points and the H4 target zone. For bulls to regain momentum, they must initiate a corrective move upward and reclaim the weekly long-term trend level at 85,215. The placement of the classic Pivot Points, which act as the main intraday reference levels, is updated daily.

***

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bitcoin secara beransur-ansur menghampiri paras tertinggi sepanjang masanya dan, menurut beberapa penganalisis, bersedia untuk mencipta rekod baru. Paras semasa sekitar $105,000 adalah lebih daripada sekadar angka ia menandakan bahawa aset

Jika kita melihat carta 4 jam, mata wang kripto Ethereum kelihatan bergerak di atas WMA (21) yang bertindak sebagai sokongan dinamik, di mana cerun WMA tersebut sedang menaik. Berdasarkan maklumat

Pada carta 4 jam, mata wang kripto Uniswap kelihatan mempunyai corak Descending Broadening Wedge, jadi walaupun pergerakan harga Uniswap berada di bawah WMA (21) yang mempunyai kecenderungan menurun, dengan kemunculan

Bitcoin telah melepasi $100,000, manakala Ethereum sedang cuba untuk mengukuh di atas $2,000. Selepas kenaikan mendadak semalam, yang berterusan semasa sesi Asia hari ini, Bitcoin kini didagangkan pada $103,000, setelah

Jika kita melihat carta 4 jam bagi mata wang kripto Ethereum, kelihatan bahawa pergerakan harga berada di atas Purata Bergerak Berwajaran (WMA) dengan tetapan (30 Shift 2), yang turut menunjukkan

Pada carta 4-jam untuk mata wang kripto Bitcoin, penunjuk pengayun Stochastic berada dalam keadaan Terlebih Beli dan kini bersedia untuk Cross SELL dan melepasi bawah paras 80 (Terlebih Beli)

Bitcoin mencapai harga di bawah $100,000, manakala Ethereum mencecah $1,900. Peningkatan besar dalam pasaran mata wang kripto ini sekali lagi mengesahkan pandangan optimis terhadapnya, yang telah banyak dibincangkan kebelakangan

Harga Bitcoin kini berada berhampiran paras psikologi penting, manakala para peserta pasaran sedang bersedia untuk satu lagi lonjakan menaik atau sebaliknya, satu pembalikan mendadak yang mampu menghapuskan jangkaan kenaikan jangka

Niaga hadapan indeks saham AS melonjak dengan ketara pada pembukaan sesi dagangan hari ini susulan berita bahawa wakil-wakil dari AS dan China telah menyambung semula rundingan mengenai perkara perdagangan. Laporan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.