Lihat juga

04.04.2025 10:32 AM

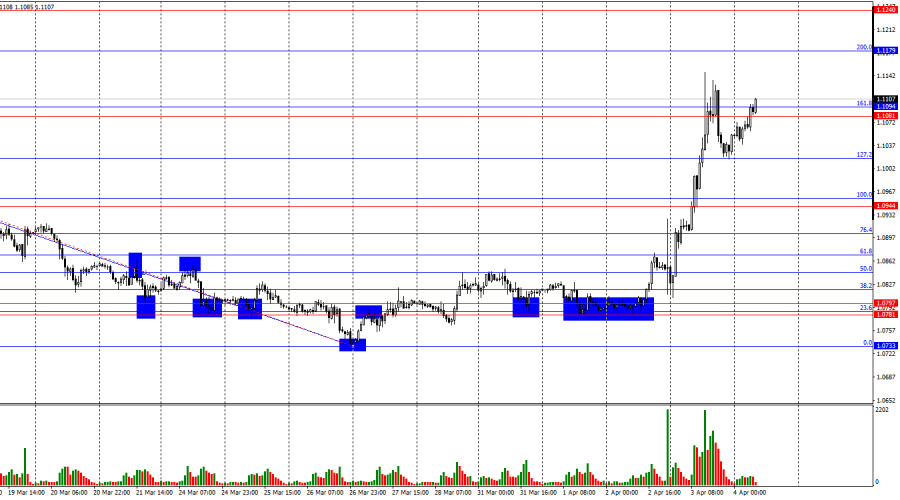

04.04.2025 10:32 AMOn Thursday, the EUR/USD pair continued its upward movement. At the moment, the decline in the U.S. dollar has paused, but the market could "explode" again at any moment. A bounce from the 161.8% Fibonacci retracement level at 1.1094 may signal a reversal in favor of the U.S. dollar and a decline toward the 127.2% and 100.0% levels. A breakout and consolidation above 1.1094 would increase the chances of continued growth toward the next Fibonacci level at 200.0% – 1.1179.

The last completed downward wave broke the low of the previous wave, but the latest upward wave also broke the prior high. This currently points to a bullish trend reversal. Donald Trump imposed new tariffs last week, and this week he extended tariffs to all goods from all countries globally. Bulls had been showing weakness recently, but as it turned out yesterday, that weakness was simply a period of waiting.

The news background on Thursday revolved solely around Trump's global tariffs. The generosity of the U.S. president is, indeed, striking. If tariffs against Nicaragua or Serbia are of little concern to traders, a 54% duty on Chinese imports is a major issue, given the enormous trade volume between the U.S. and China. Trump also hasn't forgotten the European Union. Previous tariffs on EU cars, steel, and aluminum were considered "general" tariffs. Now, an additional 10% has been added, meaning EU imports will now face a total "tax" of 20%. In both Beijing and Brussels, retaliatory measures are being prepared—which could further enrage Trump. He has repeatedly warned that any country daring to retaliate will face even greater tariff pressure. As such, next week may bring a flood of new information that could shake the charts in highly unexpected ways.

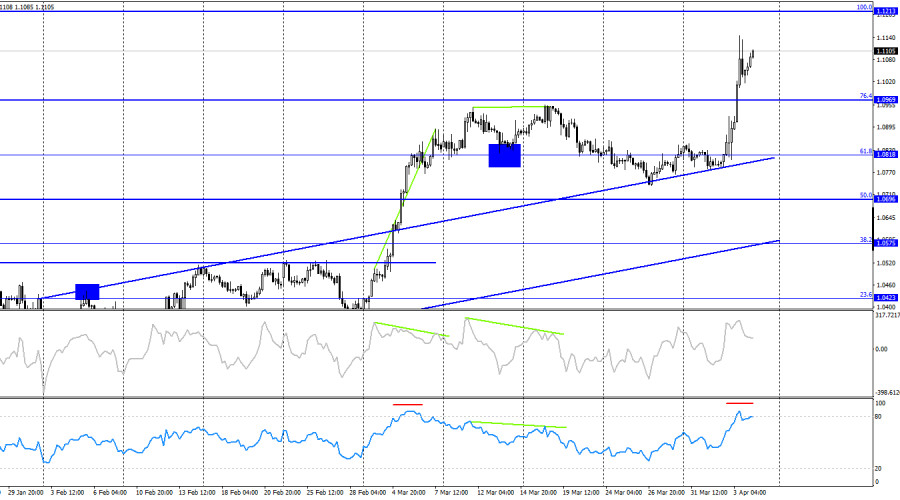

On the 4-hour chart, the pair has made a new upward reversal in favor of the euro and consolidated above the 76.4% Fibonacci retracement level at 1.0969. The euro's growth, unsupported by EU economic data, should have ended long ago—but Trump continues to exert intense pressure on the dollar. A close above 1.0969 supports a continuation of the rally toward the 100.0% Fibonacci level at 1.1213. The RSI is overbought, but right now, the fundamental background outweighs technicals.

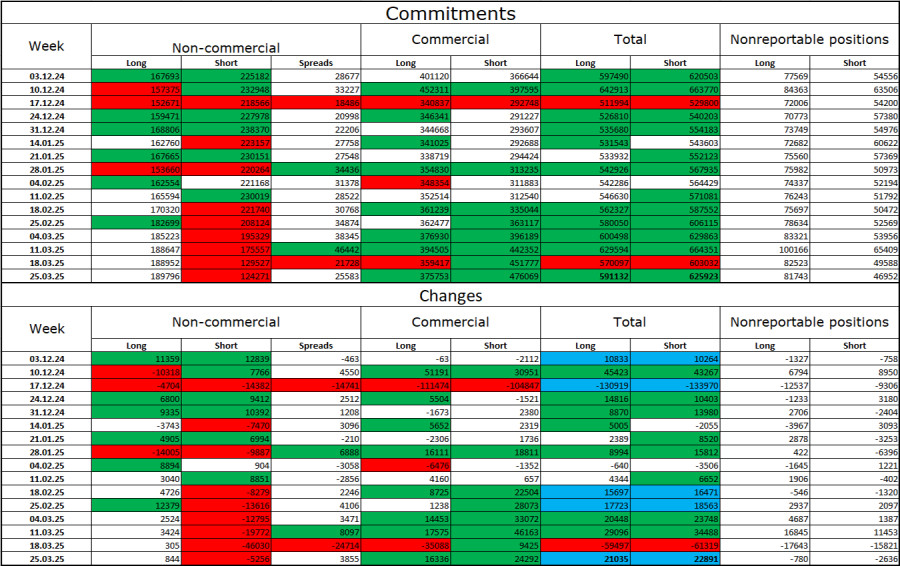

Commitments of Traders (COT) Report:

In the most recent reporting week, professional traders opened 844 long positions and closed 5,256 short positions. The sentiment of the "Non-commercial" group has once again turned bullish—thanks to Donald Trump. The total number of long positions held by speculators now stands at 190,000, while short positions total 124,000.

For twenty consecutive weeks, large players had been selling off the euro, but for the last seven weeks, they've been reducing short positions and building up longs. Despite the interest rate differential still favoring the U.S. dollar due to divergent monetary policies between the ECB and the Fed, Trump's trade policy has become the dominant factor. It could pressure the FOMC into a more dovish stance and potentially trigger a U.S. recession.

Economic Calendar for the U.S. and Eurozone (April 4):

April 4 features three key events on the economic calendar, but whether the market even cares about them right now is questionable. Market sentiment on Friday is expected to be driven more by Trump's policies than by hard U.S. data.

EUR/USD Forecast and Trading Tips:

Selling the pair is possible today if there is a confirmed rebound from the 1.1094 level on the hourly chart, with a target of 1.1017.

Buying opportunities will open if the pair closes above 1.1094 on the hourly chart, targeting 1.1179.

Fibonacci levels are drawn from 1.0957–1.0733 on the hourly chart and 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Semalam, seperti yang dijangkakan, ECB menurunkan kadar faedah utama sebanyak suku mata, menjadikan kadar pembiayaan semula kepada 2.15%. Dalam sidang akhbar, Presiden ECB Christine Lagarde menyatakan bahawa kadar telah kembali

Di sebalik sedikit optimisme semalam berikutan keputusan ECB untuk menurunkan kadar faedah dan hampir melengkapkan kitaran pelonggaran, pound hampir mencecah paras sasaran 1.3635. Hari ini bermula secara neutral, nampaknya dalam

Sehingga pagi ini, pasangan USD/JPY berada dalam situasi yang benar-benar maksud berganda — dengan kebarangkalian yang seimbang antara pertumbuhan dan penurunan. Petunjuk yang mencadangkan potensi pertumbuhan termasuk harga yang kekal

Pada awal sesi Eropah, euro didagangkan sekitar paras 1.1440, mengalami pembetulan teknikal selepas mencapai paras psikologi 1.15. Data Senarai Gaji Bukan Ladang AS akan diterbitkan dalam sesi dagangan Amerika

Di sisi lain, emas dijangka akan mengalami pembetulan teknikal. Pada 30 Mei, ia meninggalkan jurang sekitar 3,284, dan jika ia mengukuh di bawah 3,350, ia berkemungkinan besar boleh mencapai sasaran

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.