AUDJPY (Australian Dollar vs Japanese Yen). Exchange rate and online charts.

Currency converter

13 Jun 2025 23:59

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/JPY is a cross rate of the Australian dollar to the Japanese yen. While dealing with this instrument, the influence of the American dollar on each currency through their quotations with USD should be noted.

The currency pair AUD/JPY is quite stable as it consists of the high-yielding commodity currency and the save haven currency. The pair dynamics is mostly influenced by several factors such as the refinance rate differential between Australia and Japan, the purchasing capacity of importing countries, the state of world financial system and weather conditions.

The basis of the Australian economy is the export of minerals, energy products and agricultural products. Japan is one of the main Australian trading partners along with the USA and China. The rate of AUD, and of the currency pair accordingly, depends on gold prices.

Traditionally, the high-yielding Aussie rises against the low-yielding yen; and it makes a quite stable AUD/JPY trend for carry trade. Due to its high volatility and its sensitivity to world events, AUD/JPY is popular among aggressive trading strategists.

See Also

- Technical analysis

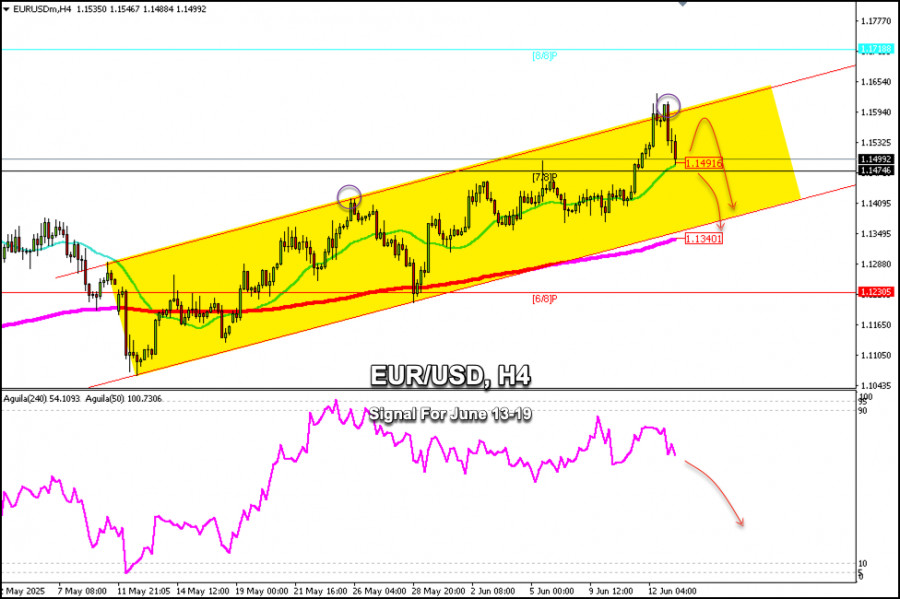

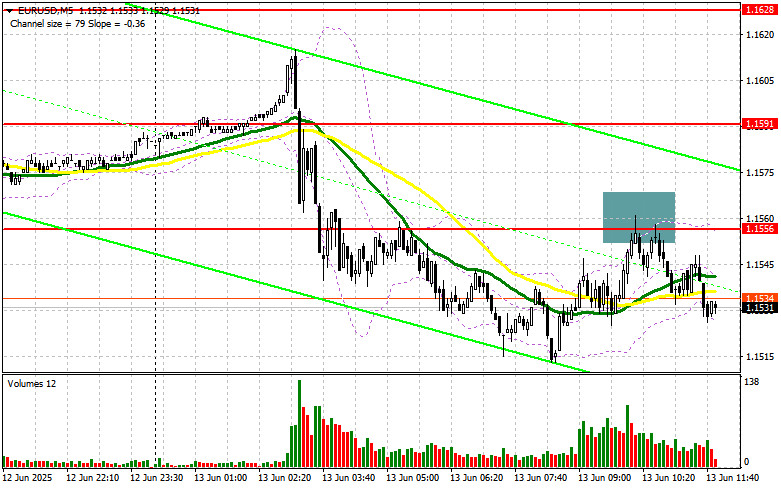

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

2563

GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:44 2025-06-13 UTC+2

2263

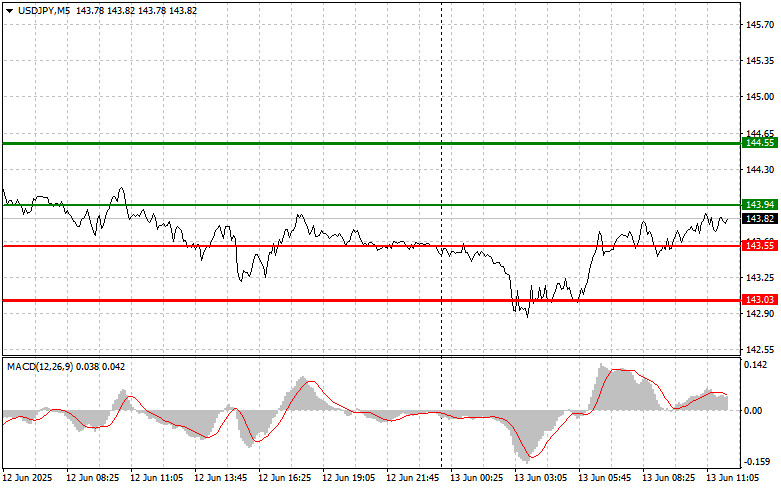

USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:49 2025-06-13 UTC+2

2128

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2113

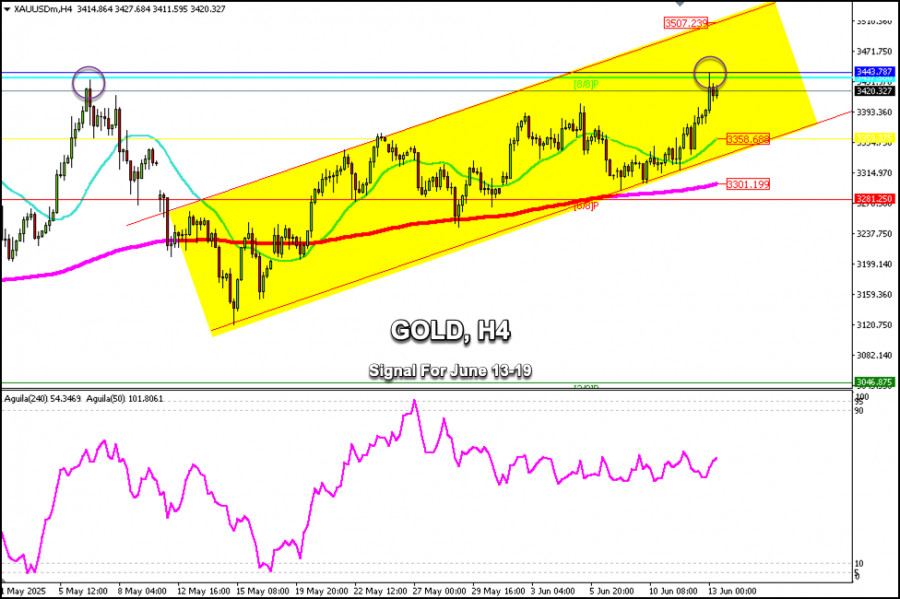

Technical analysisTrading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2008

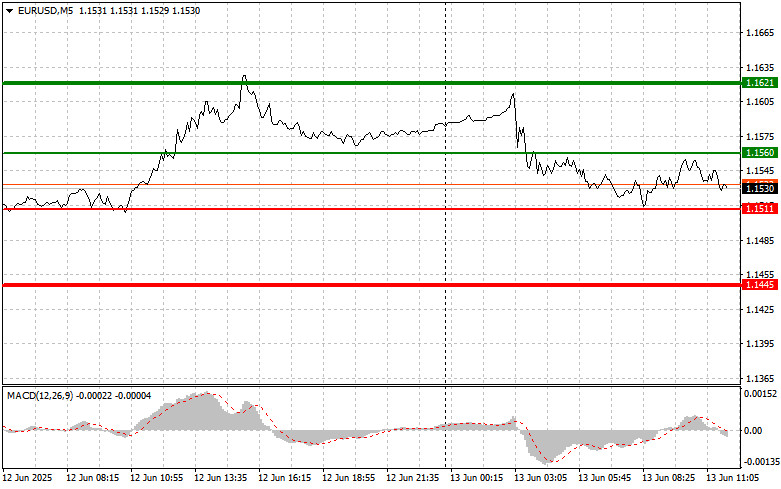

EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)Author: Jakub Novak

12:41 2025-06-13 UTC+2

1858

- EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)

Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1738

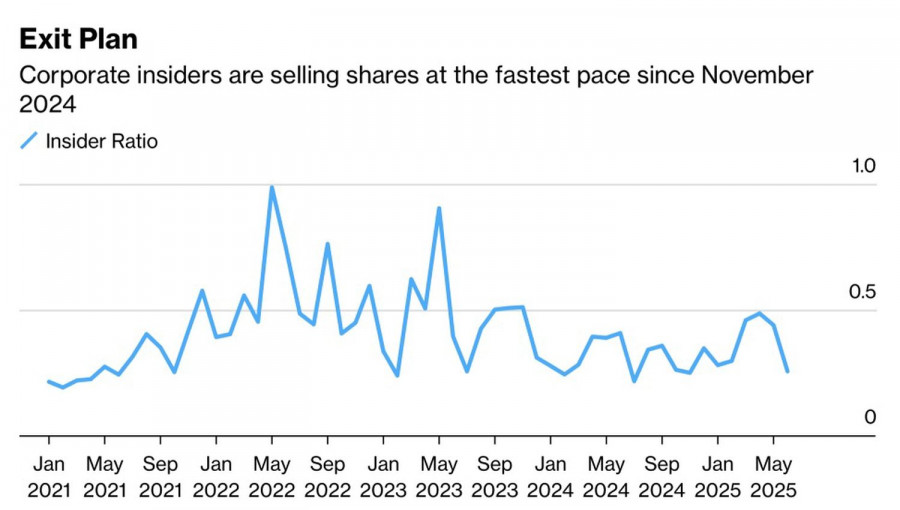

The crowd will be punished for its overconfidence in buying the S&P 500 dipAuthor: Marek Petkovich

09:35 2025-06-13 UTC+2

1738

Pressure persists despite short-term reboundAuthor: Irina Yanina

12:53 2025-06-13 UTC+2

1663

- Technical analysis

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

2563

- GBP/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:44 2025-06-13 UTC+2

2263

- USD/JPY: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2128

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

2113

- Technical analysis

Trading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

2008

- EUR/USD: Simple Trading Tips for Beginner Traders – June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

1858

- EUR/USD: Trading Plan for the U.S. Session on June 13th (Review of Morning Trades)

Author: Miroslaw Bawulski

12:31 2025-06-13 UTC+2

1738

- The crowd will be punished for its overconfidence in buying the S&P 500 dip

Author: Marek Petkovich

09:35 2025-06-13 UTC+2

1738

- Pressure persists despite short-term rebound

Author: Irina Yanina

12:53 2025-06-13 UTC+2

1663