CADCZK (Canadian Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

16 Jun 2025 21:38

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CAD/CZK is one of the most popular currency pairs among traders. The US dollar has a significant impact on this pair. We can see this by combining the charts of CAD/USD and USD/CZK. As a result, the approximate chart of CAD/CZK will be shown.

Features of CAD/CZK

Canada is one of the leading global exporters of oil. Therefore, its national currency is affected by world oil prices. As a result, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. For this reason, the CAD/CZK pair is vulnerable to oil prices.

The Czech Republic is one of the most industrialized countries in Central Europe. Its economy is characterized by prosperity and sustainability. The population of the Czech Republic has a consistently high level of personal income. This could be explained by well-balanced economic development.

The main sectors of the country's economy are car manufacturing, iron and steel production, and agriculture. The Czech Republic is one of the world's leading car manufacturers. In addition, it is the main exporter of beer and shoes.

How to trade CAD/CZK

If you want to start trading cross-currency pairs, please be aware that the spread in such trades is often higher than for the main currency pairs. Before you start trading, read the trading conditions for each type of financial instrument carefully.

As mentioned above, the US dollar has a strong influence on each of the currencies of the CAD/CZK pair. Therefore, in order to make the most accurate forecast about the movement of this trading instrument, it is necessary to take into account such indicators of the US economy as interest rate changes, GDP, unemployment rate, new job creation, and so on. Notably, the Canadian dollar and the Czech Koruna react to any changes in the US economy. This is why the movement of the CAD/CZK pair is a specific indicator of the exchange rate fluctuations.

See Also

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

4198

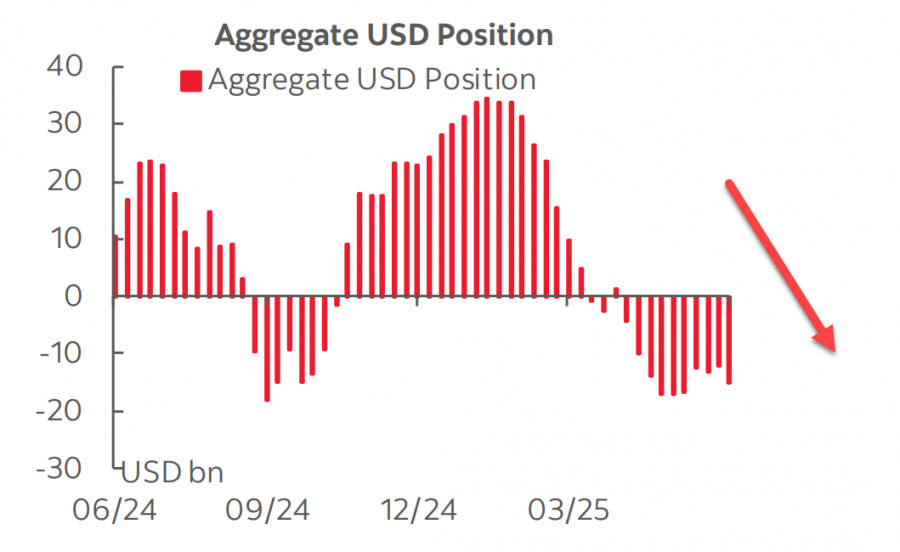

Fundamental analysisCFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1618

Fundamental analysisThe Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1558

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1543

Bears still struggling to find supportAuthor: Samir Klishi

12:02 2025-06-16 UTC+2

1468

Stock Market on May 16th: S&P 500 and NASDAQ Closed LowerAuthor: Jakub Novak

10:43 2025-06-16 UTC+2

1453

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1423

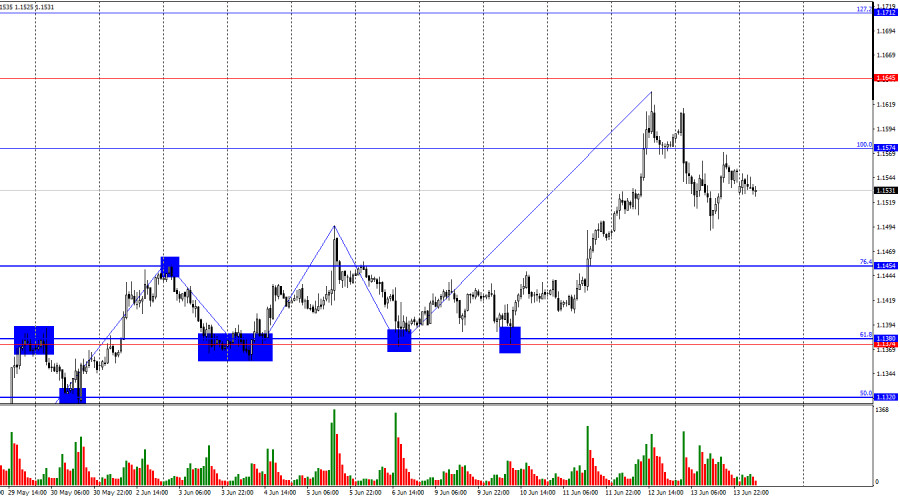

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

12:08 2025-06-16 UTC+2

1303

Bitcoin pauses above $105,000, but breakout occursAuthor: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

928

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

4198

- Fundamental analysis

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1618

- Fundamental analysis

The Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1558

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1543

- Bears still struggling to find support

Author: Samir Klishi

12:02 2025-06-16 UTC+2

1468

- Stock Market on May 16th: S&P 500 and NASDAQ Closed Lower

Author: Jakub Novak

10:43 2025-06-16 UTC+2

1453

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1423

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

12:08 2025-06-16 UTC+2

1303

- Bitcoin pauses above $105,000, but breakout occurs

Author: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

928