EURZAR (Euro vs South African Rand). Exchange rate and online charts.

Currency converter

30 Jun 2025 06:47

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/ZAR is quite popular on Forex. South Africa is an active European Union trading partner. Thus, EUR/ZAR attracts experienced traders who choose this instrument for high stability and predictability of the euro area and South Africa economies. Most of operations on this currency pair are carried out during the European session.

EUR/ZAR is greatly affected by the U.S. dollar as it represents a cross rate against the greenback. Hence, by combining the EUR/USD and USD/ZAR price charts, we can get an approximate EUR/ZAR chart.

The U.S. dollar has a significant influence on both currencies represented in EUR/ZAR. To correctly predict the further currency pair movement, it is necessary to take heed of such U.S. indicators as the discount rate, GDP, unemployment, new created workplaces, and many others. However, the currencies can respond differently towards the changes in the U.S. economy, therefore, EUR/ZAR currency pair may serve as a specific indicator for these currencies.

South Africa is the richest country in mineral deposits in Africa. It has one of the largest stock exchanges, which is among the ten largest world stock exchanges. South African's economy is based on the extraction and export of minerals.

South Africa has produced a large number of precious stones and metals, including gold and diamonds. In addition, the country is the largest car manufacturer in Africa. South Africa has all the necessary raw materials for production. For this reason, prices for precious stones and metals, and car manufacturing can greatly affect the South African Rand exchange rate.

If you trade cross rates, it is necessary to remember that brokers , usually, set a higher spread on crosses than on majors. So before you start working with the cross rates, familiarize yourself with the terms and conditions offered by the broker to trade with the specified instrument.

See Also

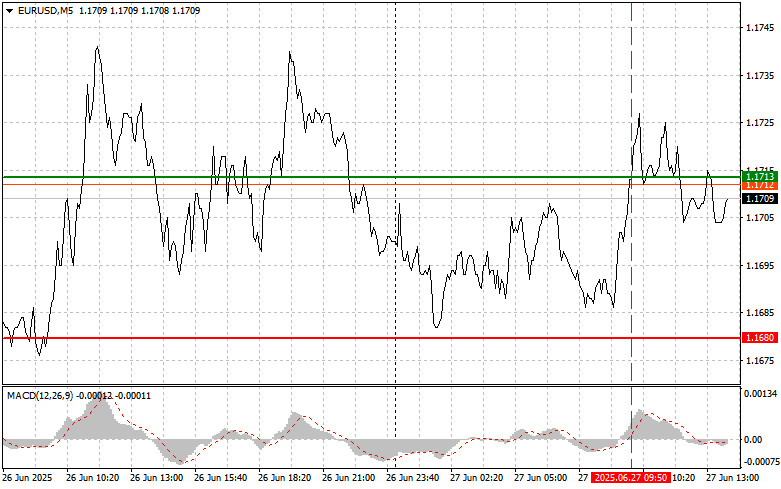

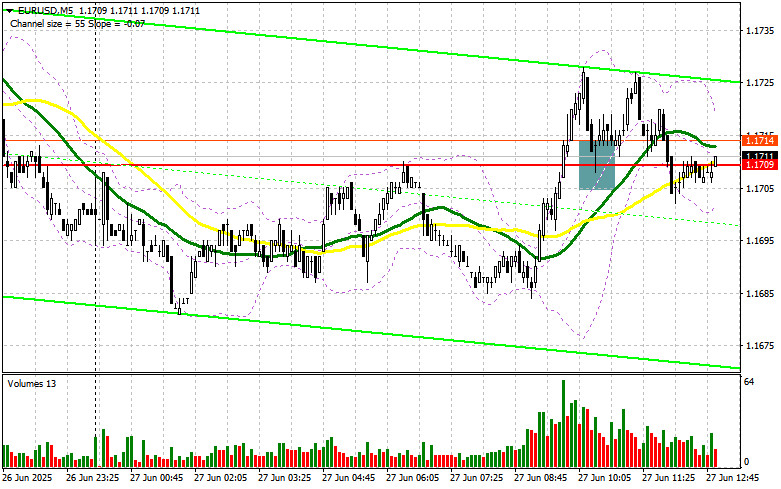

- EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)

Author: Jakub Novak

13:11 2025-06-27 UTC+2

3073

Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

3058

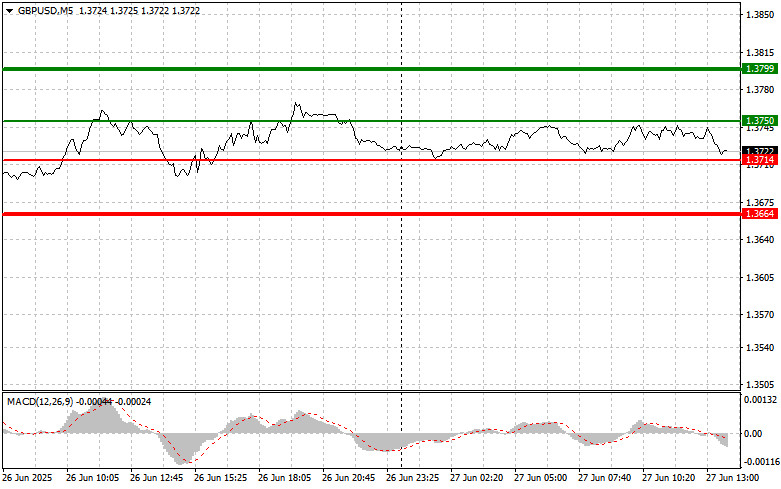

GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)Author: Jakub Novak

13:16 2025-06-27 UTC+2

2983

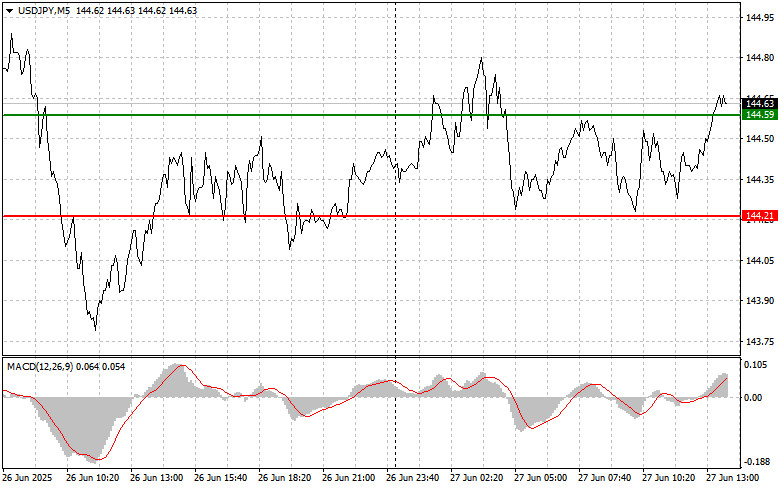

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2908

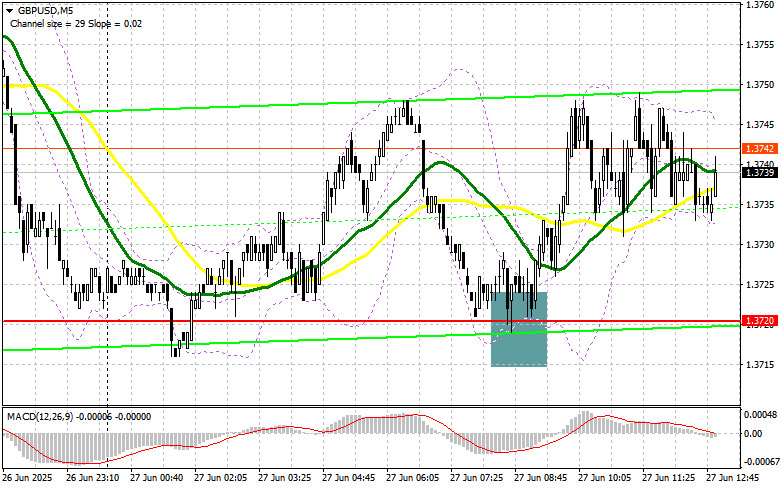

GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2848

EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2833

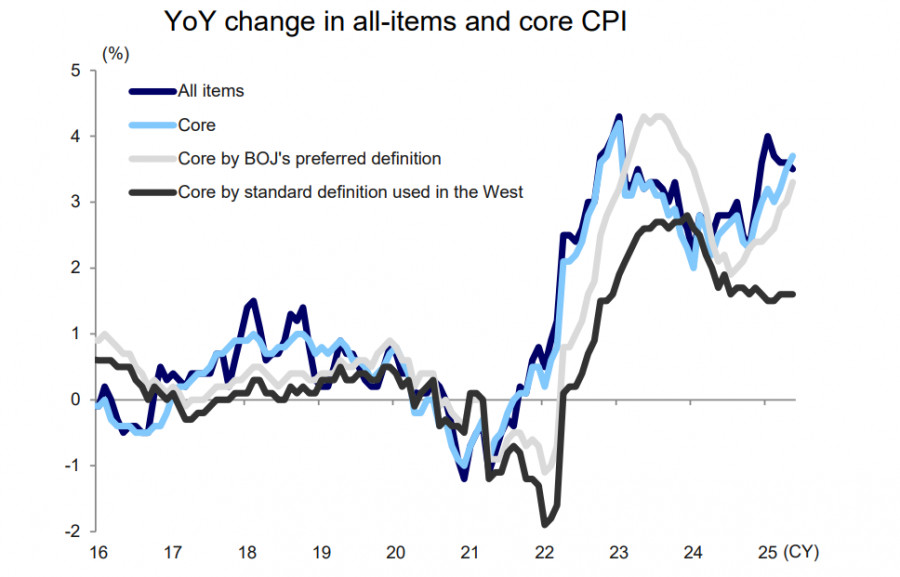

- The Yen Has Lost Its Bullish Momentum

Author: Kuvat Raharjo

12:21 2025-06-27 UTC+2

2773

The EUR/JPY pair is regaining positive momentum during today's trading session, reversing its recent decline.Author: Irina Yanina

12:17 2025-06-27 UTC+2

2668

Technical analysisTrading Signals for GOLD (XAU/USD) for June 27-30, 2025: buy above $3,250 or sell below $3,320 (rebound - 6/8 Murray)

Technically, we believe that in the short term, gold could continue its fall and expect it to reach the 5/8 Murray level support around 3,203. The instrument might even cover the gap around 3,188 it created in May.Author: Dimitrios Zappas

18:12 2025-06-27 UTC+2

2548

- EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)

Author: Jakub Novak

13:11 2025-06-27 UTC+2

3073

- Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...

Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

3058

- GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:16 2025-06-27 UTC+2

2983

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2908

- GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2848

- EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2833

- The Yen Has Lost Its Bullish Momentum

Author: Kuvat Raharjo

12:21 2025-06-27 UTC+2

2773

- The EUR/JPY pair is regaining positive momentum during today's trading session, reversing its recent decline.

Author: Irina Yanina

12:17 2025-06-27 UTC+2

2668

- Technical analysis

Trading Signals for GOLD (XAU/USD) for June 27-30, 2025: buy above $3,250 or sell below $3,320 (rebound - 6/8 Murray)

Technically, we believe that in the short term, gold could continue its fall and expect it to reach the 5/8 Murray level support around 3,203. The instrument might even cover the gap around 3,188 it created in May.Author: Dimitrios Zappas

18:12 2025-06-27 UTC+2

2548