Double Bottom

was formed on 18.04 at 11:05:30 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDJPY M5; the upper boundary is 84.39; the lower boundary is 84.32. The width of the pattern is 8 points. In case of a break of the upper boundary 84.39, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

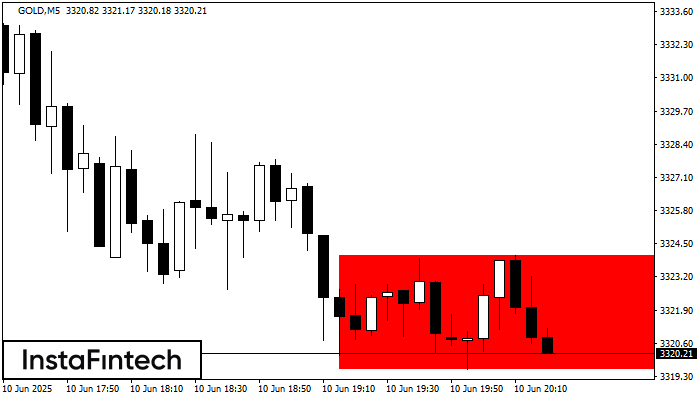

Bearish Rectangle

was formed on 10.06 at 19:22:18 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURCAD formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 1.5634 - 0.0000

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Rectangle

was formed on 10.06 at 19:22:15 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GOLD formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 3324.05, the lower border is 3319.56. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 10.06 at 19:20:48 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on GBPAUD M5. It has the following characteristics: resistance level 2.0732/2.0725; support level 2.0689/2.0693; the width is 43 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window