CHFSGD (Swiss Franc vs Singapore Dollar). Exchange rate and online charts.

Currency converter

04 Aug 2025 19:32

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/SGD currency pair is not actively traded on the Forex market. The CHF/SGD is the cross currency pair as it does not include the U.S. dollar. However, the U.S. currency has a significant influence on it. This can be seen if you combine two price charts: CHF/USD and USD/SGD. Thus, you can get an approximate CHF/SGD chart.

The U.S. dollar influences both currencies much. So, a CHF/SGD trader should allow for the major U.S. economic indicators in order to make a correct projection of a future trend of this financial asset. The indicators which are important to keep track of: the Federal Reserve discount rate, GDP, unemployment rate, new jobs, etc. It is also worth noting that the currencies comprising the pair can respond at a different rate on changes in the U.S. economy. Therefore, the CHF/SGD may be considered as a specific indicator reflecting these currencies’ changes.

The Swiss economy remains strong for several centuries. For this reason, its national currency enjoys a great confidence all over the world as one of the most reliable and stable currencies. The Swiss franc is also a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this financial asset.

The CHF/SGD is an exotic-cross. As a rule, the pair witnesses slow movements in its exchange rate. Currently, the Singapore dollar is one of the most stable currencies worldwide. The economic situation is marked by fairly low inflation rates and the predominance of exports over imports with high level of foreign exchange reserves.

Singapore is said to be a developed industrial country with high living standards and robust economy. The country is so highly developed by virtue of its favorable geographical position at the crossroads of main global shipping routes, which opened doors for Singapore to actively trade with all the major economies in the world. Currently, Singapore’s chief exports include consumer electronics, information technologies, pharmaceuticals, shipbuilding products and financial services. The economic situation of the country and the national currency is strongly dependent on exports.

Singapore has a highly developed economy included in the group known as the Asian Tigers. This is due to its economy standing on a level with such major nations as the U.S., Germany, France, Great Britain, etc.

This trading instrument is relatively illiquid compared with major currency pairs such as the EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast its further movement, you should primarily focus on the pairs quoted against the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for crosses than for more popular currency pairs, so you should carefully read the conditions the broker offers for trading this type of currency pairs.

See Also

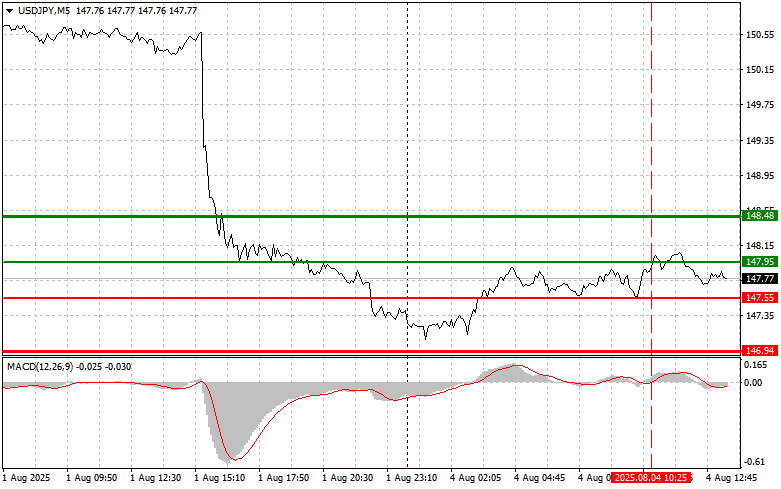

- USD/JPY: Simple Trading Tips for Beginner Traders – August 4th (U.S. Session)

Author: Jakub Novak

12:59 2025-08-04 UTC+2

988

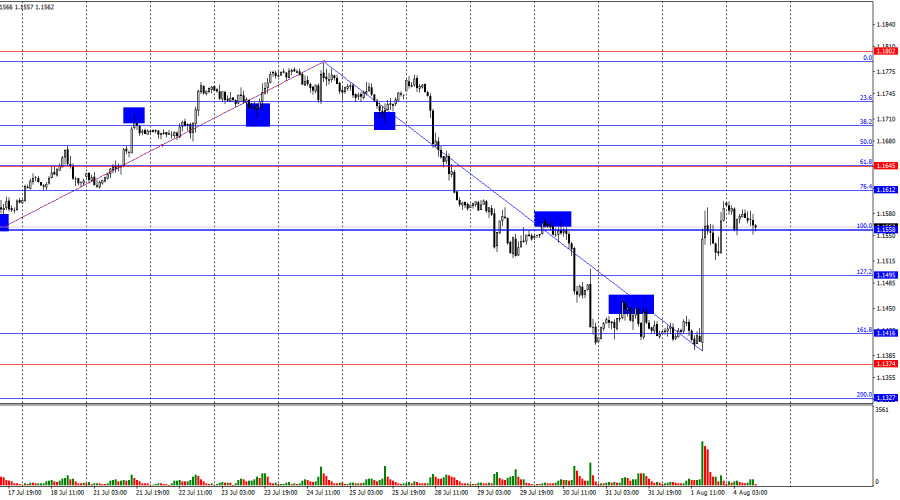

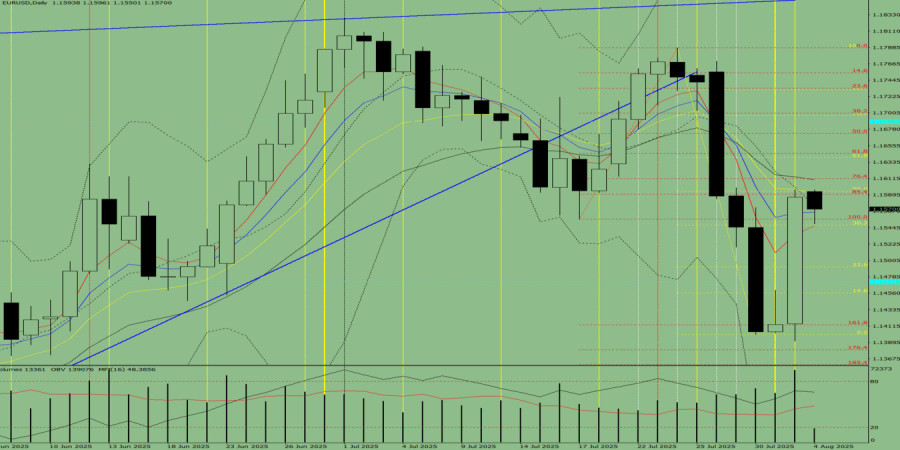

Forecast for EUR/USD on August 4, 2025Author: Samir Klishi

11:49 2025-08-04 UTC+2

988

Gold Resumes Its RallyAuthor: Jakub Novak

11:10 2025-08-04 UTC+2

973

- On Friday, the pair moved downward, tested the historical support level of 1.3148 (blue dotted line), and then rebounded upward (following news releases), closing the daily candlestick at 1.3278. Today, the price may attempt to continue its upward movement. No significant economic events are.

Author: Stefan Doll

10:21 2025-08-04 UTC+2

958

USD/JPY – Analysis and ForecastAuthor: Irina Yanina

12:44 2025-08-04 UTC+2

958

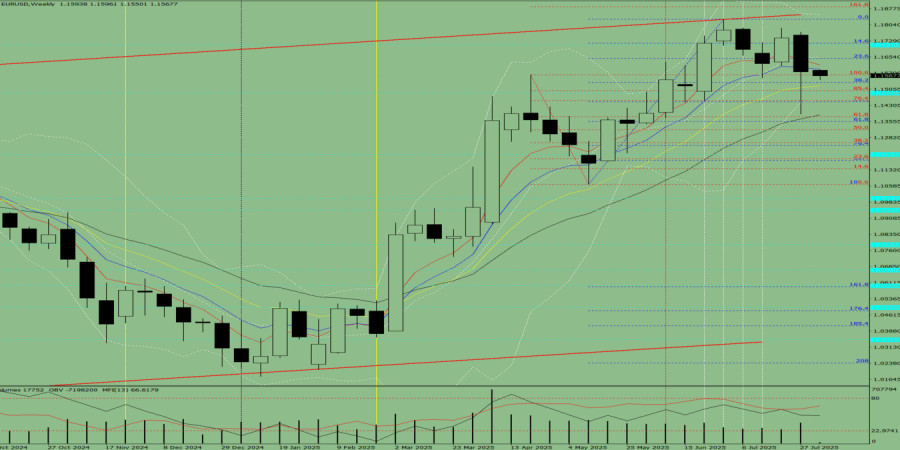

Last week, the pair moved downward and nearly tested the 61.8% retracement level at 1.1378 (red dotted line), before reversing upward and closing the weekly candle at 1.1586. In the upcoming week, the price may begin an upward movement.Author: Stefan Doll

10:38 2025-08-04 UTC+2

958

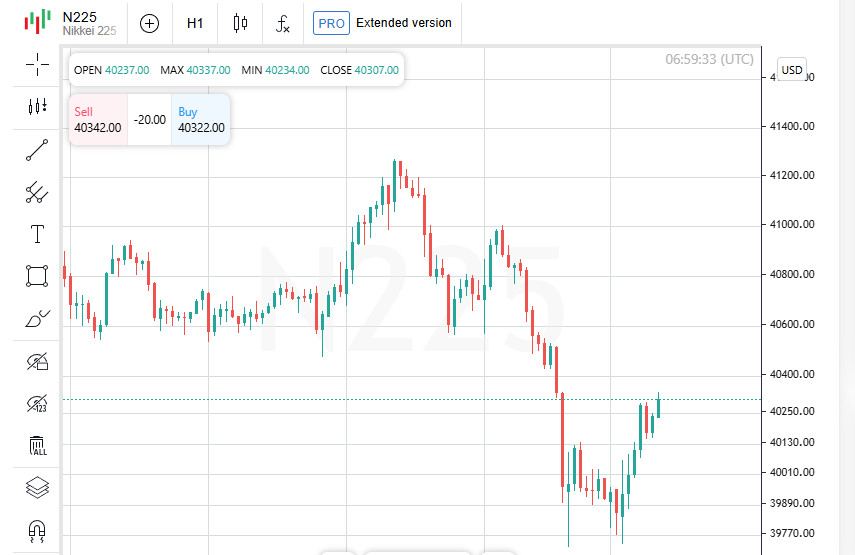

- S&P 500 futures and European indices surged, while the Nikkei dropped. A surprise result of the US employment report prompted markets to price in further rate cuts. Investors await earnings reports from Disney, McDonald's, and Caterpillar. The dollar held steady. Oil dipped

Author: Gleb Frank

11:12 2025-08-04 UTC+2

943

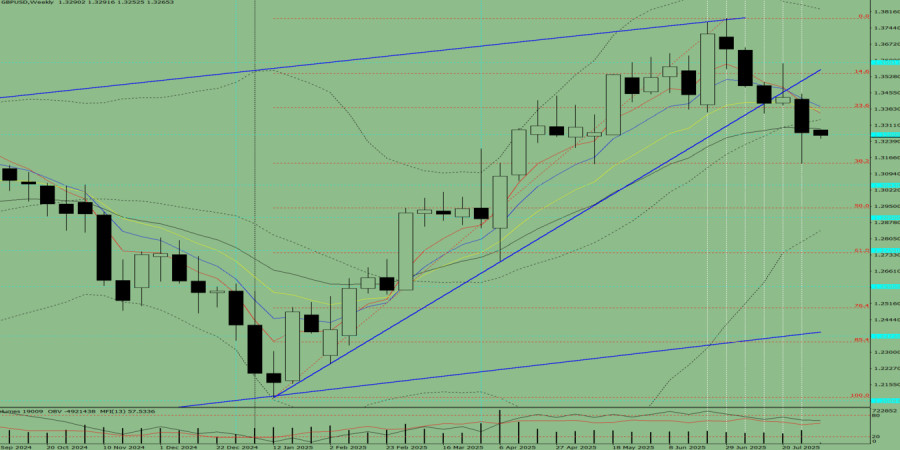

Last week, the pair moved downward and tested the 38.2% retracement level at 1.3141 (red dashed line), after which the price moved upward and closed the weekly candle at 1.3278. In the upcoming week, the price may start moving upward.Author: Stefan Doll

11:38 2025-08-04 UTC+2

928

Bad Economic News Leads to Negative ConsequencesAuthor: Jakub Novak

10:42 2025-08-04 UTC+2

928

- USD/JPY: Simple Trading Tips for Beginner Traders – August 4th (U.S. Session)

Author: Jakub Novak

12:59 2025-08-04 UTC+2

988

- Forecast for EUR/USD on August 4, 2025

Author: Samir Klishi

11:49 2025-08-04 UTC+2

988

- Gold Resumes Its Rally

Author: Jakub Novak

11:10 2025-08-04 UTC+2

973

- On Friday, the pair moved downward, tested the historical support level of 1.3148 (blue dotted line), and then rebounded upward (following news releases), closing the daily candlestick at 1.3278. Today, the price may attempt to continue its upward movement. No significant economic events are.

Author: Stefan Doll

10:21 2025-08-04 UTC+2

958

- USD/JPY – Analysis and Forecast

Author: Irina Yanina

12:44 2025-08-04 UTC+2

958

- Last week, the pair moved downward and nearly tested the 61.8% retracement level at 1.1378 (red dotted line), before reversing upward and closing the weekly candle at 1.1586. In the upcoming week, the price may begin an upward movement.

Author: Stefan Doll

10:38 2025-08-04 UTC+2

958

- S&P 500 futures and European indices surged, while the Nikkei dropped. A surprise result of the US employment report prompted markets to price in further rate cuts. Investors await earnings reports from Disney, McDonald's, and Caterpillar. The dollar held steady. Oil dipped

Author: Gleb Frank

11:12 2025-08-04 UTC+2

943

- Last week, the pair moved downward and tested the 38.2% retracement level at 1.3141 (red dashed line), after which the price moved upward and closed the weekly candle at 1.3278. In the upcoming week, the price may start moving upward.

Author: Stefan Doll

11:38 2025-08-04 UTC+2

928

- Bad Economic News Leads to Negative Consequences

Author: Jakub Novak

10:42 2025-08-04 UTC+2

928