EURCZK (Euro vs Czech Koruna). Exchange rate and online charts.

Currency converter

15 Jul 2025 00:48

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The EUR/CZK currency pair is a popular one on Forex market. Since the Czech Republic has an active trade with the European Union, the experienced traders choose this trading instrument because of high stability and predictability of the eurozone and the Czech Republic's economies. The most intense EUR/CZK bidding is observed during the european session.

This pair is the cross rate against the U.S. dollar. There is no U.S. dollar in this currency pair, but the euro and the Czech koruna are under its great influence. To see it graphically, just combine the EUR/USD and USD/CHK charts in the same price chart, and you will get the approximate chart of EUR/CZK.

The U.S. dollar extends an enormous influence over both currencies. Therefore, for a better prediction of the future rate movement of this currency pair you should consider the main economic indicators of the U.S.A., such as interest rate, GDP, unemployment, new created workplaces indicator and many others. Remember that the currencies listed above can react differently react to the changes in the economic situation in the United States.

The economy of the Czech Republic is considered as prosperous and stable and it puts this country among the most advanced and industrial countries of the Central Europe. Its economic development is provided by the high rate of personal income.

Machinery, iron and steel production, chemical industry, electronics, beer production, as well as agriculture are the main economic sectors of the Czech Republic. The most developed industry sector is the automotive. This automobile sector's output, which mostly goes on export, has one of the highest rates of car production in the world. Moreover, the Czech Republic is one of the largest exporters of beer and shoes. The Czechs also export a variety of chemical products like tires, synthetic fibers, etc. The Czech Republic has an active trade with Germany, Russia, Slovakia, and Austria. A wide rage of possibilities to produce the electric power(nuclear, thermal, hydro, and solar and wind power) makes it one of the European leaders of the electricity production.

If you trade cross rates, pay your attention to the spread that can be higher than for more popular currency pairs. Thus, before you start dealing with cross currency pairs, read and understand the broker's conditions for this specified trade instrument.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1093

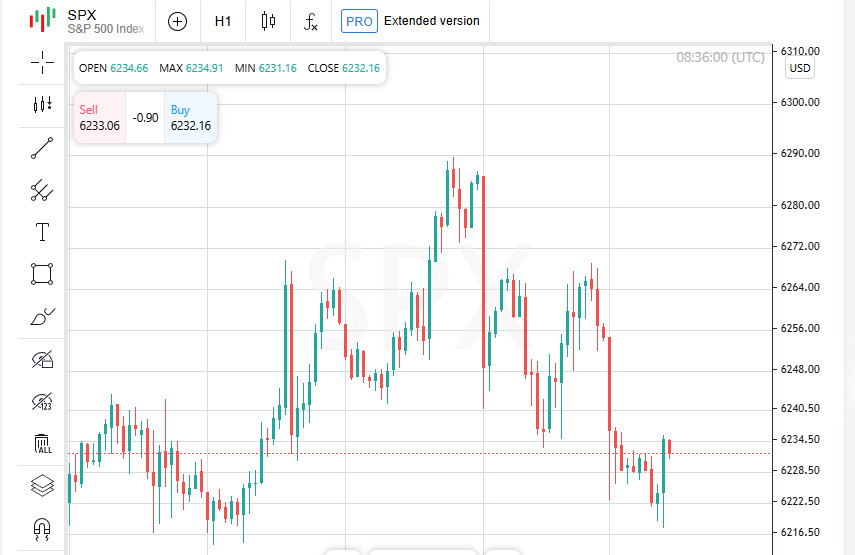

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

943

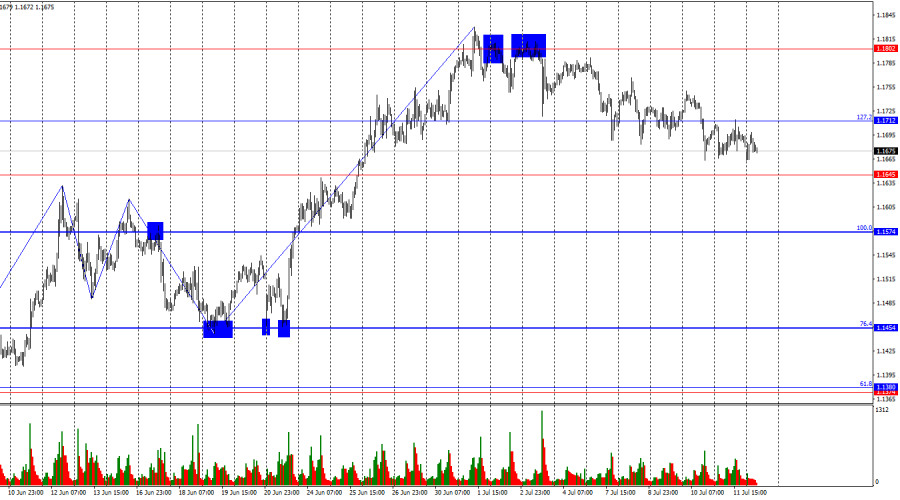

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

793

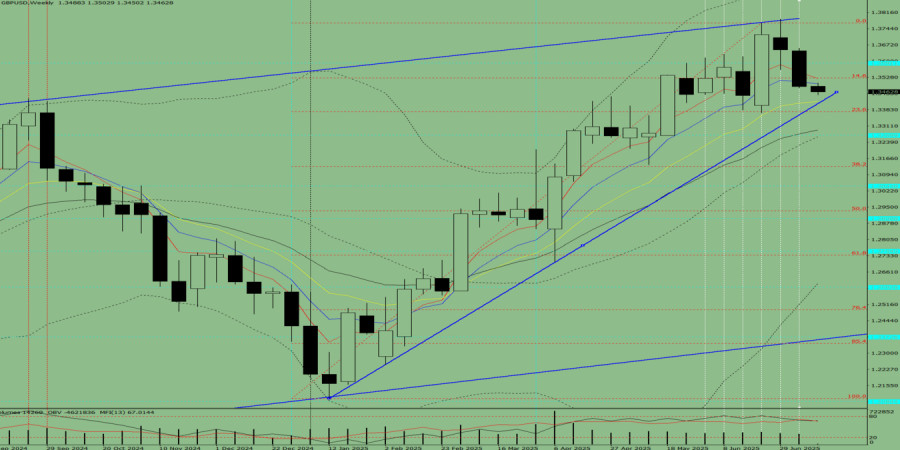

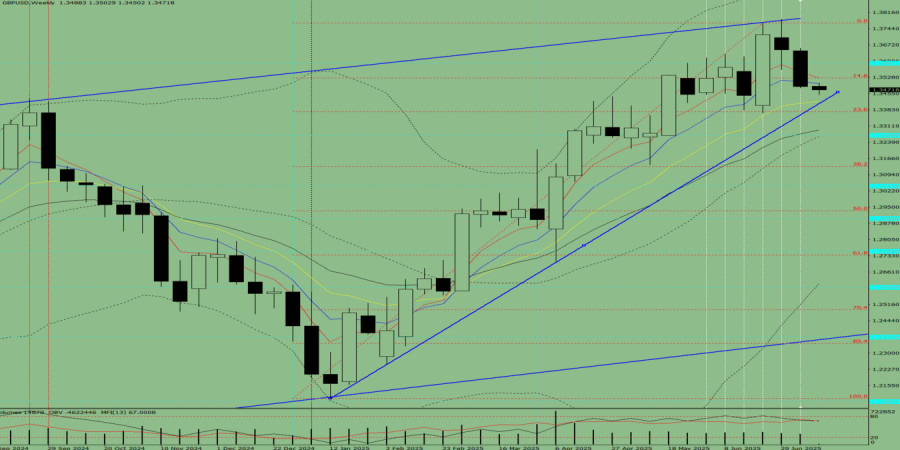

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

763

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciationAuthor: Irina Yanina

19:05 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1093

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

943

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

763

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

- Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciation

Author: Irina Yanina

19:05 2025-07-14 UTC+2

703