Veja também

02.01.2023 12:20 PM

02.01.2023 12:20 PMTrend-following analysis

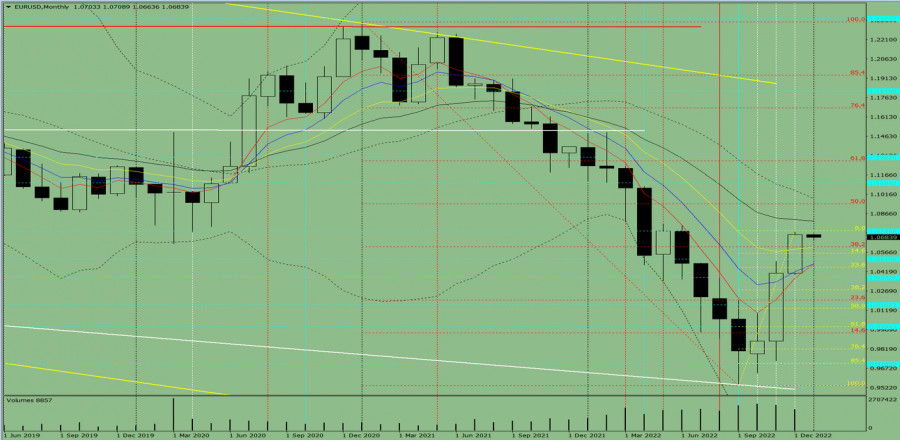

In January, EUR/USD is expected to move higher from 1.0706, the level of closing the December one-month high, to the target at 1.0941, which is the 50.0% Fibonacci retracement level plotted by the red dotted line. Once this level is tested, the instrument will continue its rise to 1.1104, the historic resistance level plotted by the blue dotted line. After this level is tested, we could expect a downward retracement.

Picture 1, one-month chart

Indicator analysis

The conclusion from the complex analysis is that EUR/USD is likely to trade higher.

The one-month chart of EUR/USD draws traders to the conclusion that the overall trend is going to be bullish. The one-month white candlestick lacks the first lower shadow in the first week. The second upper shadow is also missing on the final week.

The basic scenario. EUR/USD is expected to move higher from 1.0706, the level of closing the December one-month candlestick, to the target at 1.0941, which is the 50.0% Fibonacci retracement level plotted by the red dotted line. Once this level is tested, the instrument will continue its rise to 1.1104, the historic resistance level plotted by the blue dotted line. After this level is tested, we could expect a downward retracement.

Alternative scenario. EUR/USD might also move higher from 1.0706, the level of closing the December one-month candlestick, towards the target of 1.0941, which is the 50.0% Fibonacci retracement level plotted by the red dotted line. After this level is tested, the price will retrace downwards. 1.0809 serves as a 21-period moving average plotted by the black thin line.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Se observarmos o gráfico diário do Petróleo Bruto (#CL), é possível identificar uma divergência entre o movimento dos preços do ativo e o indicador Estocástico. Isso sugere a possibilidade

No gráfico de 4 horas do índice Nasdaq 100, podemos observar uma divergência entre o movimento dos preços e o indicador Estocástico, especialmente com a confirmação atual

Se o preço do euro cair abaixo de 1,1500 nas próximas horas, isso pode ser visto como uma oportunidade de venda. Tecnicamente, ele parece estar sobrecomprado no gráfico

A tendência do XAU/USD permanece de alta enquanto o preço se consolidar acima de 3.331. Portanto, seria prudente comprar ouro enquanto o preço se consolidar acima de 3.359, onde está

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.