Veja também

02.01.2025 01:13 PM

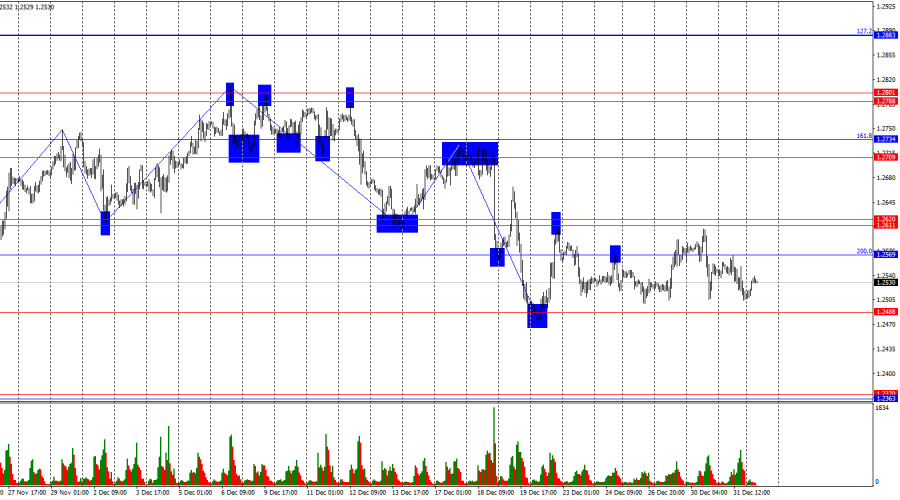

02.01.2025 01:13 PMThe wave situation poses no questions. The last completed wave upward did not break the peak of the previous wave, while the last completed wave downward broke the previous low. Thus, a new bearish trend is currently forming. For this trend to conclude, the pound must rise to at least the 1.2709–1.2734 zone.

On Tuesday, the economic calendar did not include any significant events. Therefore, neither bears nor bulls have reasons to open new positions. As a result, the pair remains in the range and is unable or unwilling to break out. The chances of the range breaking today are very slim, given the weak information background. In any case, we must first wait for the breakout of the horizontal channel before assessing the situation. Until the breakout, the optimal strategy remains trading on the rebound from the range boundaries. Currently, the pound is near the lower boundary of the range—a rebound is possible. However, this is already the sixth attempt by bears to break below the range and continue forming the trend. The chances of a new pound decline are increasing.

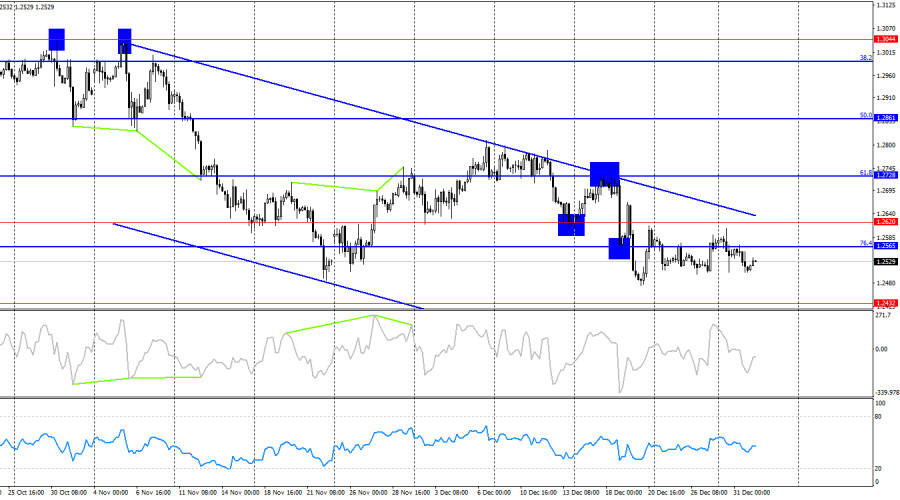

On the 4-hour chart, the pair returned to the 76.4% corrective level at 1.2565. However, the range on the hourly chart is more important than the chart pattern on the 4-hour timeframe. The downward trend channel indicates the dominance of bears, who are unlikely to lose their edge anytime soon. Only a close above the channel would suggest a strong rise for the pound.

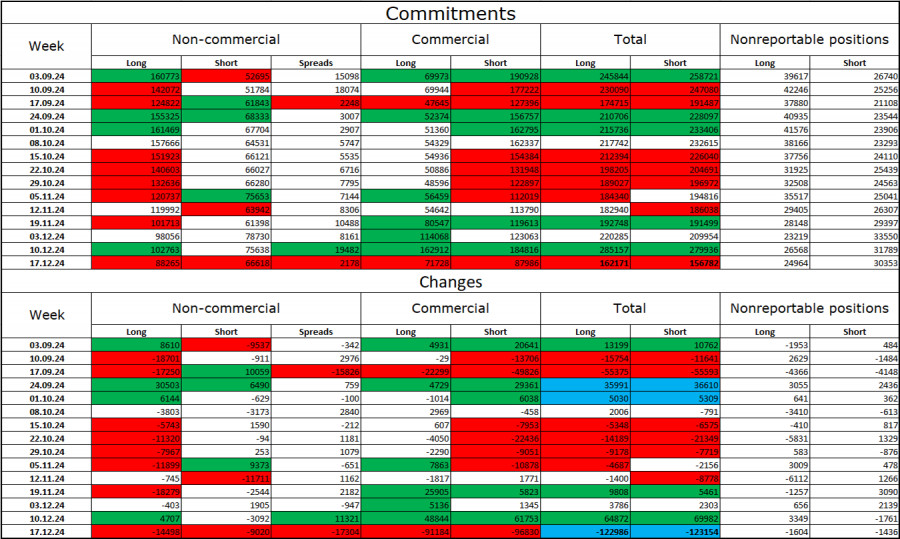

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders has hardly changed over the last reporting week. The number of long positions held by speculators increased by 4,707, while short positions decreased by 3,092. Bulls still have the advantage, but this has been fading in recent months. The gap between the number of long and short positions is now just 27,000: 102,000 versus 75,000.

In my view, the pound's prospects for a decline remain intact, and the COT reports signal growing bearish positions almost every week. Over the past three months, the number of long positions has dropped from 160,000 to 102,000, while short positions have risen from 52,000 to 75,000. I believe professional players will continue to reduce long positions or increase shorts over time, as all possible factors for buying the British pound have already been priced in. Technical analysis also supports the pound's decline.

Economic Calendar for the UK and the US:

On Thursday, the economic calendar includes several entries, but none are particularly significant. The impact of the informational background on trader sentiment today may be very weak.

Forecast for GBP/USD and Trading Tips:

Fibonacci Levels:

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

No início da sessão americana, o par EUR/USD está sendo negociado próximo de 1,1327, mostrando uma força de alta que está desaparecendo. Tendo atingido o topo do canal de tendência

No início da sessão americana, o ouro está sendo negociado em torno de 3.304, acima do nível Murray de 6/8, e dentro do canal de tendência de alta formado

Embora no gráfico de 4 horas o par AUD/JPY esteja mostrando sinais de enfraquecimento, tudo indica que esse movimento representa apenas uma correção momentânea. Desde que o preço não rompa

No gráfico de 4 horas, a Prata apresenta sinais de convergência entre o movimento de preço e o indicador Oscilador Estocástico, o que sugere um potencial de fortalecimento no curto

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.