Veja também

06.01.2025 12:23 AM

06.01.2025 12:23 AMOn Friday, the EUR/USD currency pair rebounded after the sharp decline observed on Thursday. It's important to note that there were no significant reasons for the euro's drop at the start of the new year. However, the medium-term decline of the euro is justified. For novice traders, it's essential to understand that price declines don't solely occur due to macroeconomic reports or major fundamental events. When a trend is established, price movements can happen at any time in the trend's direction, even overnight, since the Forex market operates 24/7.

On Friday, market volatility was low, and there was little reaction to the important US ISM Manufacturing PMI report. This report could have led to a renewed strengthening of the US dollar, but it did not. Nonetheless, it remains another positive indicator for the dollar.

In the 5-minute time frame, trading movements on Friday were relatively weak, but two trading signals were formed. First, the price broke above the 1.0269–1.0277 range and then rebounded from it. In both instances, the price moved only 15–20 pips in the desired direction after the signals were generated. As a result, these buy trades did not yield significant profits. However, the buy signals remain valid, suggesting that the euro may continue to grow on Monday or Tuesday.

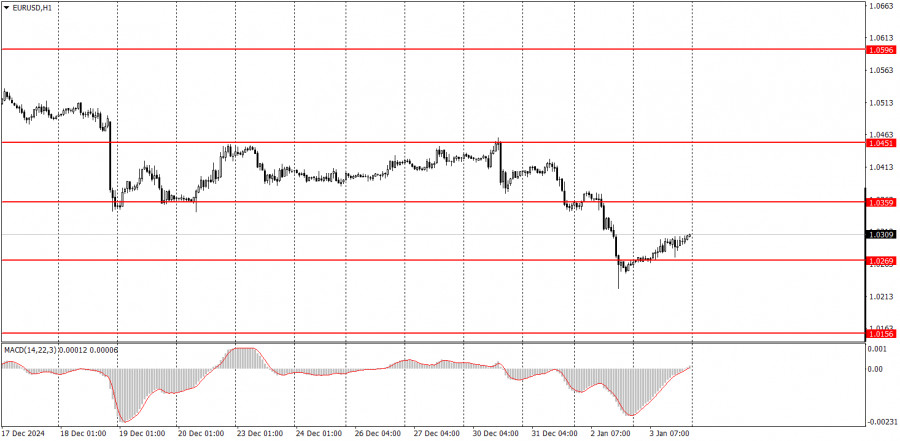

On the hourly chart, the EUR/USD pair has exited its "holiday flat" phase, concluding it with a fresh decline. We believe that the euro's downtrend has resumed in the medium term, with little distance remaining to parity. Further declines in the euro are expected, supported by fundamental and macroeconomic factors that favor the US dollar.

Nevertheless, the pair may experience upward movement on Monday, as two buy signals formed in the 1.0269–1.0277 range.

On the 5-minute time frame, the following levels should be considered: 1.0156, 1.0221, 1.0269–1.0277, 1.0334–1.0359, 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0845–1.0851.

On Monday, the US, Germany, and the EU will release second estimates for their services PMI. These are unlikely to cause any significant market reaction. Additionally, Germany will publish its December inflation figures, which are of greater interest but need to deviate significantly from expectations in order to provoke a notable market response.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das negociações de sexta-feira Gráfico 1H do EUR/USD Na sexta-feira, o par EUR/USD registrou uma queda significativa, apesar da ausência de fatores macroeconômicos ou fundamentais claros. Ainda assim

Na minha previsão matinal, destaquei o nível 1,1378 e planejei basear as decisões de entrada no mercado nele. Vamos dar uma olhada no gráfico de 5 minutos e analisar

Na minha previsão matinal, concentrei-me no nível 1,1358 e planejei tomar decisões de negociação com base nele. Vamos dar uma olhada no gráfico de 5 minutos para entender

Análise das operações de segunda-feira Gráfico 1H do EUR/USD O par EUR/USD iniciou a segunda-feira com uma forte recuperação. Durante a madrugada, o euro avançou entre 100 e 120 pips

Análise das operações de quinta-feira Gráfico 1H do GBP/USD Nas últimas 24 horas, o par GBP/USD avançou 170 pips, e a valorização da libra esterlina continuou durante a madrugada desta

Análise das operações de sexta-feira Gráfico 1H do GBP/USD O par GBP/USD registrou uma forte correção na sexta-feira, um movimento difícil de justificar — mesmo com a vantagem da retrospectiva

Análise das operações de sexta-feira Gráfico 1H de EUR/USD O par EUR/USD permaneceu sob forte instabilidade nesta sexta-feira. Desta vez, o movimento de baixa predominou — mas isso não tornou

Na minha previsão matinal, destaquei o nível 1,0994 e planejei basear minhas decisões de entrada no mercado nele. Vamos dar uma olhada no gráfico de 5 minutos e analisar

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.