Veja também

09.01.2025 12:28 AM

09.01.2025 12:28 AMThe first data release of the year from Australia is primarily neutral, with a slight positive trend. The PMI in the services sector increased from 50.4 to 50.8 in December, while the composite index moved out of contraction territory, rising from 49.9 to 50.2 compared to the previous month.

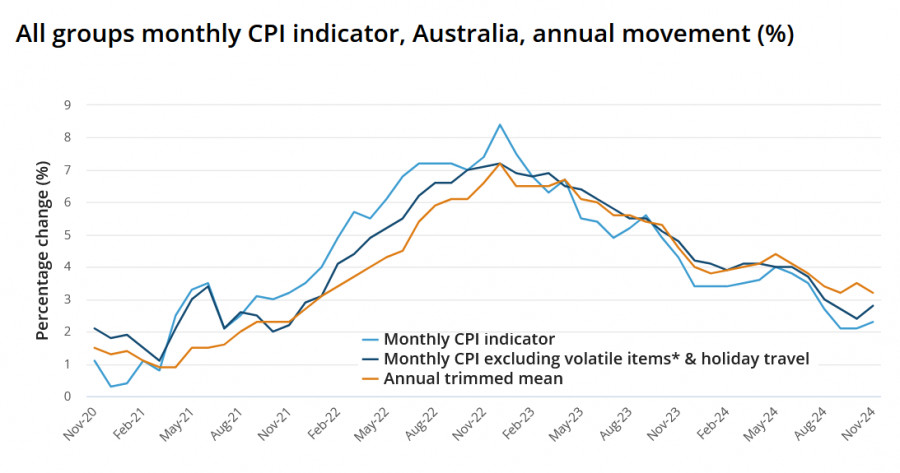

However, the main focus was on the release of the monthly consumer inflation index, which typically influences forecasts regarding the Reserve Bank of Australia's (RBA) intentions. This index increased from 3.2% to 3.3% year-over-year in November, initially suggesting rising inflation that could prompt the RBA to adopt a more hawkish stance. However, the trimmed mean CPI, which removes volatile components and is closely monitored by the RBA, actually slowed from 3.5% to 3.2%.

The recent release has put selling pressure on the Australian dollar, as market expectations for the RBA have shifted. Currently, there is an 80% probability of a rate cut anticipated at the RBA's February meeting, and this is expected to be fully priced in by the April meeting. Although these forecasts may change once the complete Q4 report is released on January 29, a clear trend has emerged: inflation is declining, and the RBA can no longer overlook this reality, especially considering the slow pace of economic recovery. Since November 2023, the RBA has maintained steady interest rates, making it the last major central bank not to begin a rate-cutting cycle. This decision was partly justified by the RBA's lower peak interest rate compared to most other central banks, which allowed it to pause. However, the current economic climate now suggests that the RBA should consider joining the global trend of monetary easing.

Meanwhile, the US dollar has ended its recent decline following the release of the ISM services PMI on Tuesday. The index increased from 52.1 to 54.1, surpassing forecasts. This improvement strengthens the case for the Federal Reserve to postpone rate cuts and maintain higher yields.

Today, market tensions intensified following reports from sources close to President-elect Donald Trump, indicating that he is considering declaring a state of economic emergency. This declaration would enable him to impose broad tariffs on both allies and adversaries. By utilizing the International Emergency Economic Powers Act (IEEPA), Trump would gain the authority to unilaterally regulate imports during emergencies. Unsurprisingly, the markets reacted swiftly: global bond yields surged, the dollar strengthened, and risk assets, particularly in countries likely to be impacted by changes in tariff policies, came under pressure. Australia, as China's largest trading partner and a key target of Trump's tariff plans, is particularly at risk.

Given the current circumstances, there is little reason to expect the Australian dollar to strengthen. Both internal and external factors are working against it. Market expectations of an imminent rate-cutting cycle by the RBA are putting downward pressure on the Aussie dollar due to anticipated declines in yields. This stands in stark contrast to the Fed, which is supported by the strong performance of the US economy.

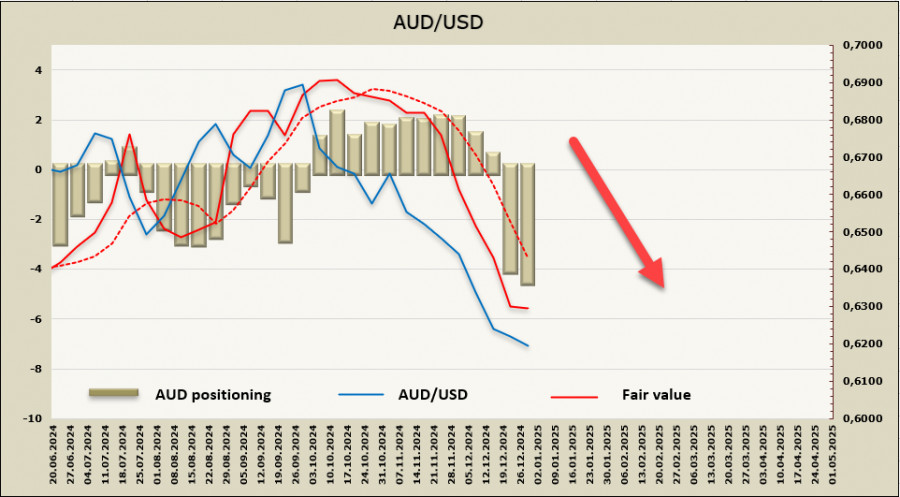

Speculative positioning on the Australian dollar (AUD) remains strongly bearish, with the calculated price below the long-term average and continuing to trend downward. Currently, there are no signs of a reversal.

The AUD/USD pair is approaching the support level of 0.6173, which was identified in previous analysis as a key target. The bearish momentum has not yet been fully exhausted, suggesting that the price may test 0.6173 and subsequently consolidate below this level. Although oversold conditions present an increased risk of a corrective rebound, there are no fundamental factors supporting a correction for the Australian dollar at this time. We expect the downtrend to persist, potentially reaching the long-term target of 0.5513.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O relatório de crescimento econômico do Reino Unido, divulgado hoje, ofereceu suporte aos compradores do GBP/USD, embora a reação do mercado tenha sido silenciosa. Os investidores estão relutantes em abrir

Vídeo de treinamento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.