Veja também

17.01.2025 09:13 AM

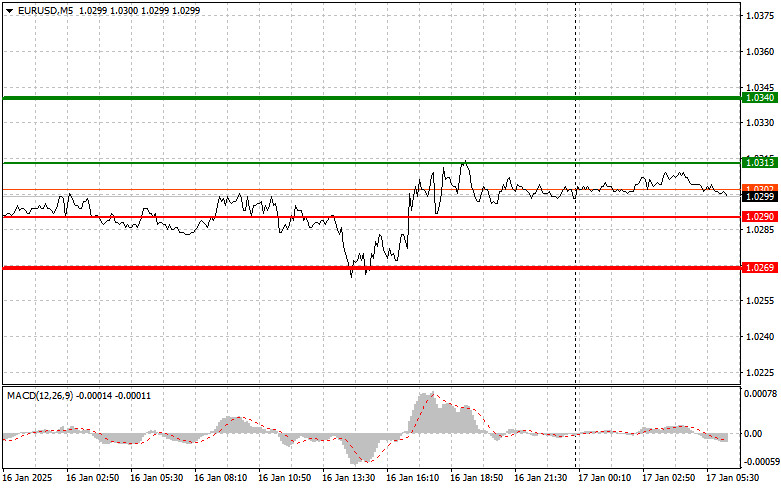

17.01.2025 09:13 AMThe test of the 1.0282 price level in the afternoon coincided with the MACD indicator beginning its downward movement from the zero mark, confirming this as a valid entry point. As a result, the pair dropped about 15 points before the pressure on the dollar eased.

One key factor likely to influence market reactions today is the Eurozone inflation rate, particularly core inflation. If the data comes in below expectations, it could signal a slowdown in economic activity, which would negatively impact the euro's exchange rate. Investors focused on these metrics may adjust their positions, potentially leading to a weakening of the euro against the dollar.

Conversely, if inflation exceeds expectations, it might heighten economic tensions. In this scenario, the European Central Bank may need to reconsider its plans for further rate cuts, possibly delaying the easing process. This situation would support the euro as market participants factor in tighter monetary policy into their forecasts.

Additionally, the Eurozone's current account balance figures released by the ECB will also influence the markets. An increase in the balance could indicate a healthy trade surplus, strengthening the euro against other currencies. Conversely, negative balance data could suggest a deficit in external payments, weakening the euro.

For intraday strategy, I will rely more on implementing Scenario #1 and Scenario #2.

Scenario #1: Buy the euro today if the price reaches 1.0313 (green line on the chart), targeting 1.0340. At the 1.0340 level, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30–35 pips from the entry point. Expect euro growth in the first half of the day only after favorable data. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0290 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Growth to 1.0313 and 1.0340 can be expected.

Scenario #1: Plan to sell the euro after it reaches the 1.0290 level (red line on the chart), targeting 1.0269. At this level, I plan to exit the market and immediately buy in the opposite direction, aiming for a movement of 20–25 pips in the opposite direction from the level. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0313 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a downward market reversal. A decline to the 1.0290 and 1.0269 levels can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das operações e dicas para negociar com a libra esterlina O teste do nível de preços de 1,3322 durante a primeira metade do dia ocorreu quando o indicador MACD

Perspectiva das operações e dicas para negociar o euro Os níveis designados não foram testados na primeira metade do dia. Na ausência de dados fundamentais importantes, a volatilidade do EUR/USD

Análise das operações e dicas para negociar a Libra Esterlina O teste do nível 1,3294 na primeira metade do dia ocorreu quando o indicador MACD já havia se movido significativamente

Análise das operações e dicas para negociar o Iene Japonês O teste do nível 145,05 ocorreu quando o indicador MACD já havia se movido significativamente abaixo da linha zero

O teste do nível de 142,54 na segunda metade do dia coincidiu com o indicador MACD começando a se mover para baixo a partir da linha zero, confirmando um ponto

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.