Veja também

24.03.2025 07:08 AM

24.03.2025 07:08 AMEight macroeconomic events are scheduled for Monday. Preliminary March readings of business activity indices in the manufacturing and services sectors will be published in Germany, the Eurozone, the U.S., and the UK. Individually, these indices may have a relatively weak impact on trading, but with eight releases in total, the market reaction could be significant. A slight increase is expected across all European indices, but it's important to emphasize that what matters is how actual figures compare to forecasts, not just the absolute values. If the actual readings come in higher than the previous ones but below expectations, we will likely see a decline in the corresponding currency.

Bank of England Governor Andrew Bailey's speech stands out among Monday's fundamental events. However, it is hard to expect anything new or noteworthy from Bailey, considering that the BoE just held its policy meeting on Thursday, where he fully expressed his views on the economy, inflation, and monetary policy. We believe Bailey will unlikely provide the markets with any fresh insights on Monday. The BoE has taken a somewhat hawkish stance, which supports the British pound. However, it's worth noting that the pound has been rising steadily for three consecutive weeks without pauses or corrections. The British currency needs a pullback regardless of Bailey's rhetoric or the BoE's stance.

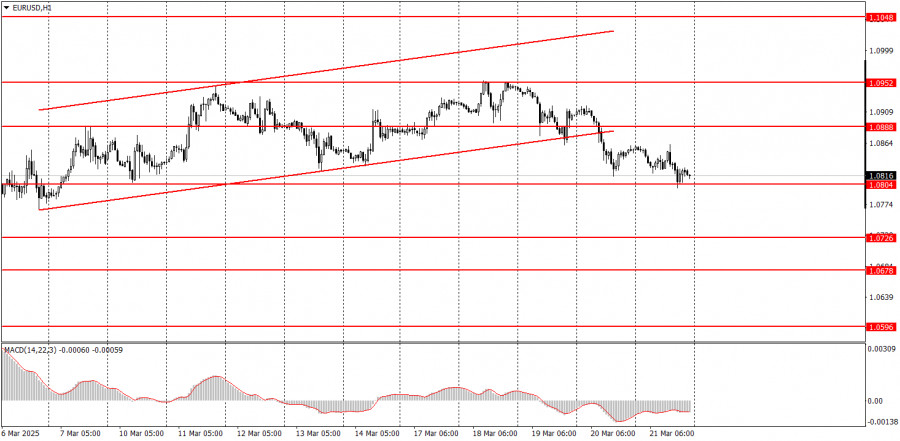

On the first trading day of the new week, both currency pairs may continue their decline, which has been building over recent weeks. Both pairs have broken below their ascending channels, and the Federal Reserve's current position allows the dollar to reclaim some of the ground it lost unfairly. Of course, no one knows when Trump will announce new trade tariffs, but even they cannot trigger an endless decline of the U.S. dollar.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Há poucas publicações macroeconômicas previstas para sexta-feira, mas o volume de negociações ainda deve ser maior do que em qualquer outro dia desta semana. O Reino Unido divulgará dados sobre

Há poucos dados macroeconômicos importantes previstos para esta quinta-feira, e nenhum deles deve ter grande impacto nos mercados. Então, em que os traders podem focar hoje? Na segunda leitura

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.