Veja também

28.03.2025 12:44 AM

28.03.2025 12:44 AMThe EUR/USD pair is experiencing a correction following Donald Trump's latest statements, as he has once again reignited the tariff war. Interestingly, the greenback initially reacted positively to the president's remarks — the U.S. dollar index returned to the 104.00 area and reached a three-week high. However, after the market digested the news flow, the developments were ultimately interpreted against the American currency. The dollar index reversed south again, and EUR/USD buyers tested the 1.08 area (Thursday's high was 1.0822). Market participants concluded that the new round of the tariff war could also hit the U.S. economy, increasing the risk of recession.

Trump announced that the United States will introduce 25% tariffs on all cars assembled abroad. According to him, the new tariffs will be implemented from April 2 and are expected to generate $100 billion in annual revenue while stimulating the growth of the domestic auto industry.

According to economists surveyed by Bloomberg, the countries most affected by the "automotive" tariffs will be Germany (last year, the U.S. accounted for 13% of all German auto exports), Japan, South Korea, Mexico, and Canada.

These tariffs could significantly harm the American auto industry since nearly 60% of auto parts used in U.S.-assembled vehicles come from abroad. Giants like General Motors, Stellantis, and Ford will be particularly affected. For instance, GM and Ford assemble many of their models in Canada and Mexico, which are considered "foreign" vehicles under U.S. law. Consequently, when these cars cross the border, they will be subject to an additional 25% tax. Furthermore, Trump announced that the tariffs would apply to parts manufactured outside the United States starting in May. Naturally, the increased cost of parts will ultimately impact the final price of vehicles. Mexico alone supplies almost 40% of all auto parts imported to the U.S. Analysts have already calculated that 25% tariffs on components from just Canada and Mexico would raise the cost of American cars by $5,000–$10,000 depending on the model.

It's also evident that U.S. automakers will not be able to relocate production to the States in the short term — such changes take time — not to mention that American labor is significantly more expensive than Mexican labor. It's also clear that manufacturers will pass additional costs onto the end consumer and/or compensate for losses by cutting production, which would mean job losses.

Moreover, one shouldn't forget about potential retaliatory measures. Japanese Prime Minister Shigeru Ishiba has already stated that Japan will consider "all possible responses to U.S. tariffs." European Commission President Ursula von der Leyen echoed this sentiment, noting that Brussels would examine the impact of the new tariffs and explore possible countermeasures.

It's worth recalling that following the March Federal Reserve meeting, Chair Jerome Powell spoke of rising uncertainty "mainly due to developments surrounding foreign trade tariffs." He stressed that the Fed would not rush to cut interest rates in this context, as "greater clarity is needed."

As we can see, the U.S. president has only complicated an already tricky puzzle — against the backdrop of looming "reciprocal" tariffs, Trump also announced new duties on auto imports.

It is reasonable to assume that, in the context of growing trade tensions, the Fed will take a wait-and-see approach not only in May but also in June. Theoretically, such "patience" from the Fed should support the greenback by weakening dovish expectations. But in reality, we are witnessing the opposite: the dollar index is actively declining, as fears of a potential U.S. recession have again taken hold in the market.

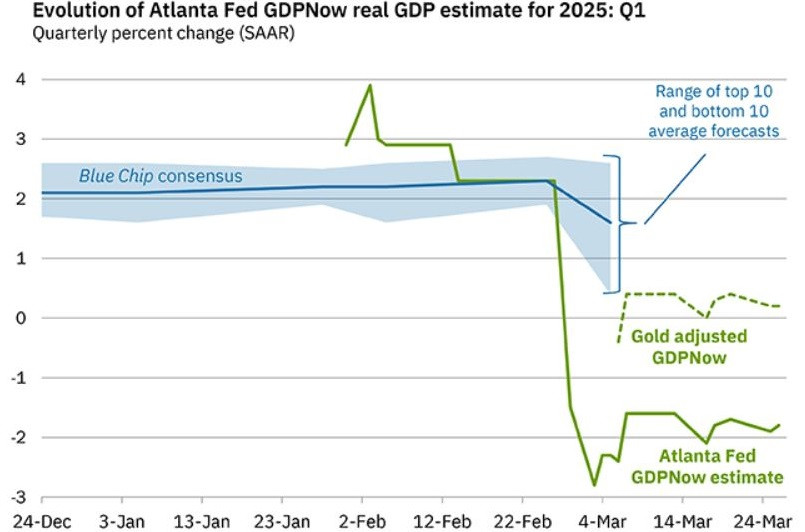

Incidentally, the Atlanta Fed's GDPNow tracker confirmed a gloomy outlook, estimating annual growth in the current quarter at -1.8% (earlier this month, the forecast was -2.8%). This bleak preview puts additional pressure on the dollar. The market ignored the final Q4 GDP data from the U.S. despite the headline figure being revised upward from 2.3% to 2.4%. Despite this positive release, the dollar continues to lose ground as the uncertain outlook for 2025 matters more to traders than last year's achievements.

Thus, Donald Trump has once again sent the dollar into a knockdown by announcing a tightening tariff policy. Markets are again talking about the negative consequences of another trade confrontation, and the greenback is under pressure, allowing EUR/USD buyers to stage a corrective rebound. However, it is too early to speak of a sustainable rally in the pair as the market continues to digest the U.S. president's statements and assess the consequences of his decisions. A wait-and-see approach in EUR/USD is advisable in such an environment. The market is agitated, and the current pullback appears more emotional than trend-driven — it is too early to speak of a reversal. Meanwhile, the dollar has yet to find solid ground. Therefore, staying out of the market remains the safest option for now.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Israel e Irã seguem trocando ataques com mísseis, mas os mercados parecem adotar seu próprio roteiro, operando sob a suposição de que o conflito não ultrapassará o limite nuclear. Enquanto

Há cinco semanas, a posição vendida total do dólar americano em relação às principais moedas parou de aumentar, o que deu motivos para acreditar que o dólar poderia iniciar

Vários relatórios macroeconômicos estão programados para sexta-feira, mas duvidamos que os dados tenham um impacto significativo sobre os traders hoje — especialmente hoje. Como lembrete, Donald Trump pretende aumentar

Indicador de

padrões gráficos.

Percebe coisas

que você nunca perceberia!

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.