Veja também

09.04.2025 08:44 AM

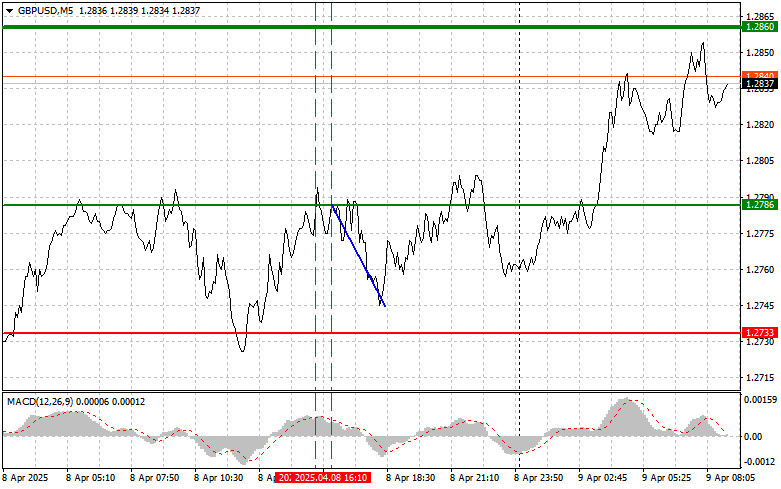

09.04.2025 08:44 AMThe test of the 1.2786 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. The second test of 1.2786, when the MACD was in the overbought area, allowed scenario #2 for a sell trade to be executed, resulting in a decline of over 40 pips.

Following news that the UK Chancellor would hold talks with senior officials regarding the tariff crisis, the pound strengthened. However, the GBP/USD pair's growth was mainly driven by renewed speculation that the U.S. economy could soon begin showing signs of a recession, weakening the dollar's position.

Today, during the first half of the day, the summary and minutes of the Bank of England's Financial Policy Committee meeting will be published. Close attention must be paid to the details of the vote on interest rates and any indications regarding future policy. Markets will analyze the tone of the statements for signs of how confident committee members are in reducing inflation to the 2% target. Discussions around the impact of global economic factors and the potential effects of U.S. tariffs will also be reviewed. Investors are hoping for clarity on the timing of possible monetary policy easing. Any signals suggesting the Bank of England is ready to act independently of the Federal Reserve or the European Central Bank will have significant implications for the pound's exchange rate.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1:

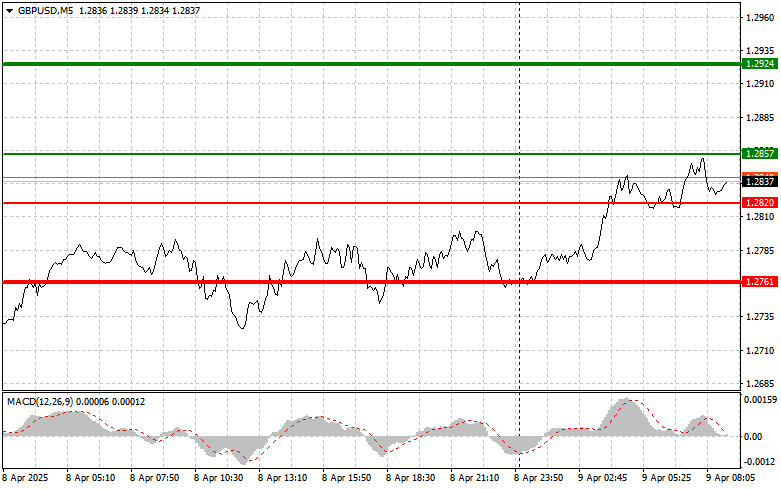

Today, I plan to buy the pound upon reaching the entry point around 1.2857 (green line on the chart), targeting a rise to 1.2924 (thicker green line). Around 1.2924, I plan to exit the buy trades and open sell trades in the opposite direction (expecting a 30–35 pip pullback). Today's rise in the pound could continue as part of the morning correction.

Important: Before buying, ensure that the MACD indicator is above the zero line and beginning to rise.

Scenario #2:

I also plan to buy the pound today if there are two consecutive tests of the 1.2820 level while the MACD is in the oversold area. This will limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 1.2857 and 1.2924 can be expected.

Scenario #1:

I plan to sell the pound after the price breaks below the 1.2820 level (red line on the chart), which could lead to a rapid decline. The key target for sellers will be 1.2761, where I plan to exit the sell trades and immediately open buys in the opposite direction (expecting a 20–25 pip move in the opposite direction). Caution is advised when selling the pound—enter as high as possible.

Important: Before selling, ensure that the MACD is below the zero line and just beginning to fall from it.

Scenario #2:

I also plan to sell the pound today if there are two consecutive tests of the 1.2857 level while the MACD is in the overbought area. This will limit the upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.2820 and 1.2761 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das operações e dicas para negociar o iene japonês Nenhum dos níveis que marquei foi testado na primeira metade do dia, portanto não fiz operações. Dado o breve momento

Análise das operações e dicas para negociar a Libra Esterlina O teste do preço 1,3526 na primeira metade do dia ocorreu quando o indicador MACD estava em território de sobrevenda

Análise das operações e Dicas para negociar o Euro Não houve oportunidades de negociação na primeira metade do dia, pois os níveis-chave que eu havia identificado não foram testados. Após

O teste do nível de preço em 143,75 na primeira metade do dia ocorreu justamente quando o indicador MACD já havia se afastado significativamente da linha zero, o que limitou

O teste de preço em 1,1441 coincidiu com o momento em que o indicador MACD começou a subir a partir da linha zero, confirmando o ponto de entrada ideal para

Petróleo de volta aos holofotes Os contratos futuros do Brent ultrapassaram a marca de US$ 67,5 por barril nesta quarta-feira, atingindo o maior nível em oito semanas. Vários fatores contribuíram

O teste do nível de 1,1440 ocorreu quando o indicador MACD já havia subido significativamente acima da linha zero, limitando o potencial de alta do par. Por esse motivo

O teste do nível de 144,21 ocorreu quando o indicador MACD começou a subir a partir da linha zero. Isso confirmou um ponto de entrada válido para a compra

Indicador de

padrões gráficos.

Percebe coisas

que você nunca perceberia!

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.