EURMXN (Euro vs Mexican Peso). Exchange rate and online charts.

Currency converter

15 Jul 2025 04:45

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/MXN is not in a great demand on Forex, however, it represents a cross rate against the U.S. dollar. Despite the U.S. dollar is not obviously presented in this currency pair, it still has a significant influence on it. Thus, an approximate EUR/MXN price chart can be generated by combining EUR/USD and USD/MXN price charts.

The U.S. dollar has a significant influence on both currencies. Thus, to analyze EUR/MXN correctly, one should keep a close eye on such U.S. economic indicators as the discount rate, GDP, unemployment, new created workplaces and the others. However, it should be noted that the currencies can respond differently to changes in the U.S. economy, therefore, EUR/MXN currency pair may be a specific indicator of changes within the given currencies.

Nowadays, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector due to mass privatization of state enterprises happened in the 80s of last century as a measure to overcome the economic crisis. The greater part of the former state owned enterprises are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country is involved in active trading with its rich neighbors - the United States and Canada, which results in a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. To date, oil sector generates most of the country's revenues . However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government of the country to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to forecasts, with such a policy, Mexico will soon be forced to import oil from abroad to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed on global financial markets. In addition, the Mexican peso exchange rate is highly dependent on the international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

It is necessary to remember that brokers usually set a higher spread on the cross rates rather than on the more popular currency pairs. So before you start working with the cross rates, read carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

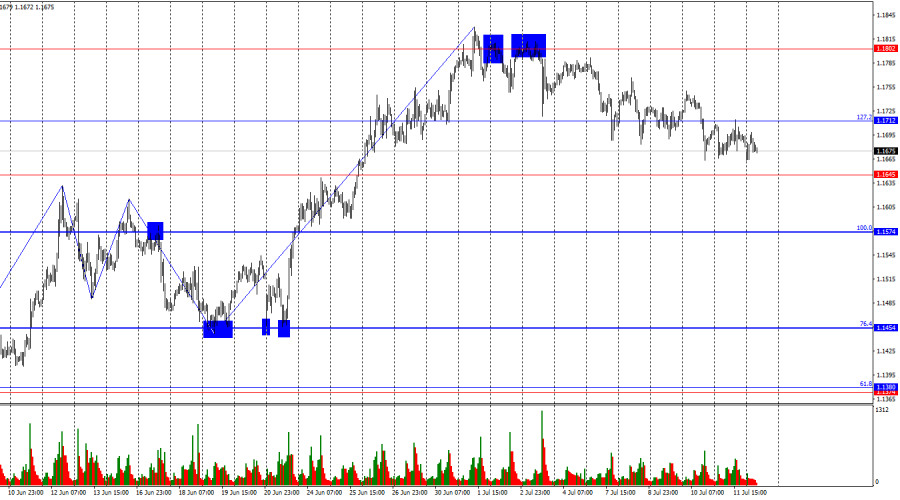

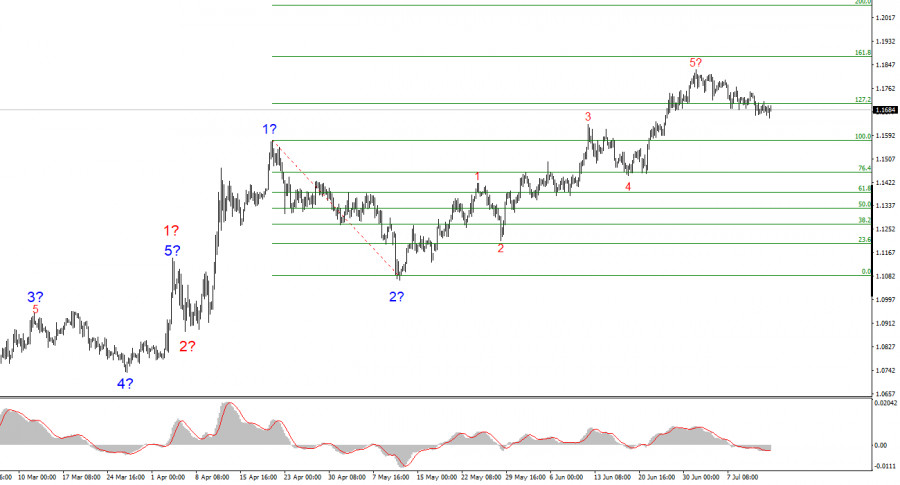

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciationAuthor: Irina Yanina

19:05 2025-07-14 UTC+2

868

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

823

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

823

The EUR/USD rate remained virtually unchanged on MondayAuthor: Chin Zhao

22:19 2025-07-14 UTC+2

793

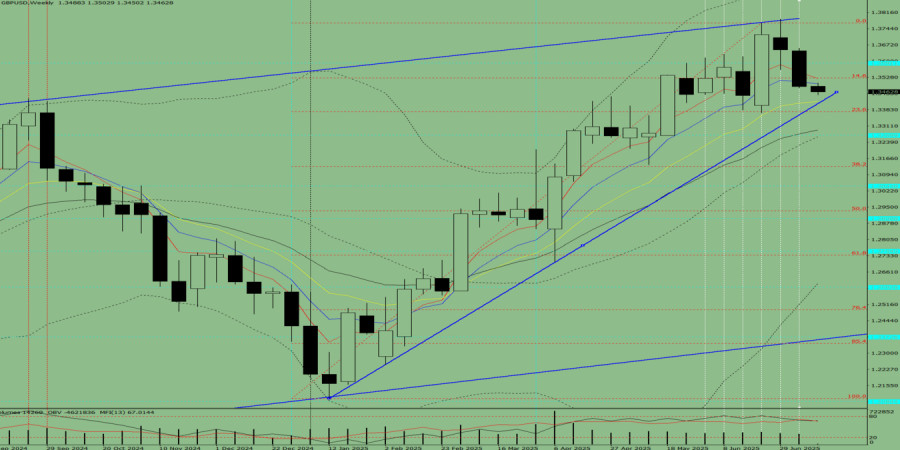

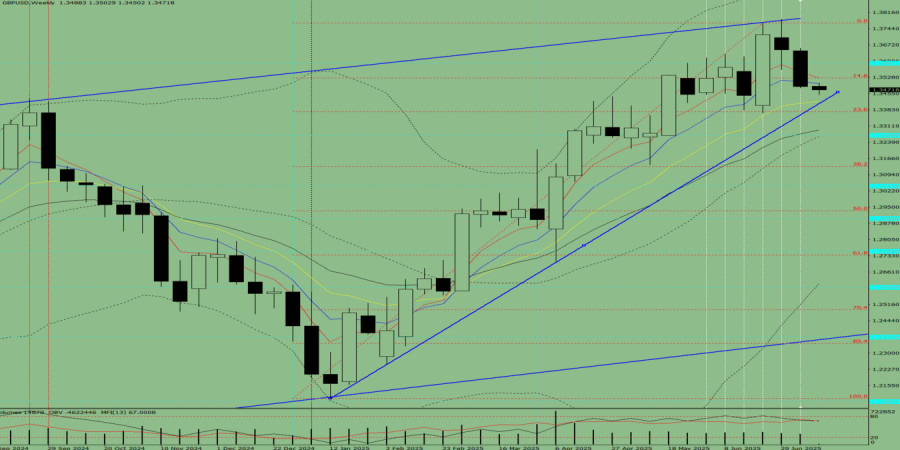

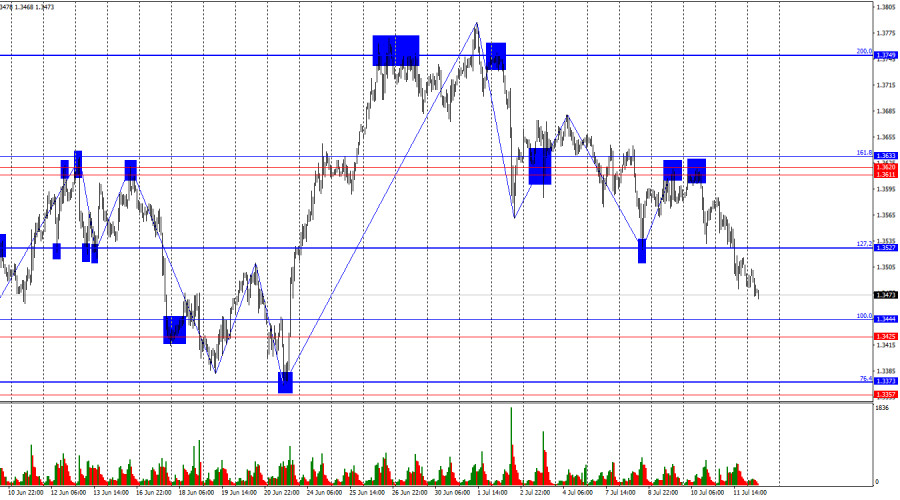

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

Bears are attacking, but this is a temporary phenomenon.Author: Samir Klishi

11:25 2025-07-14 UTC+2

733

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciation

Author: Irina Yanina

19:05 2025-07-14 UTC+2

868

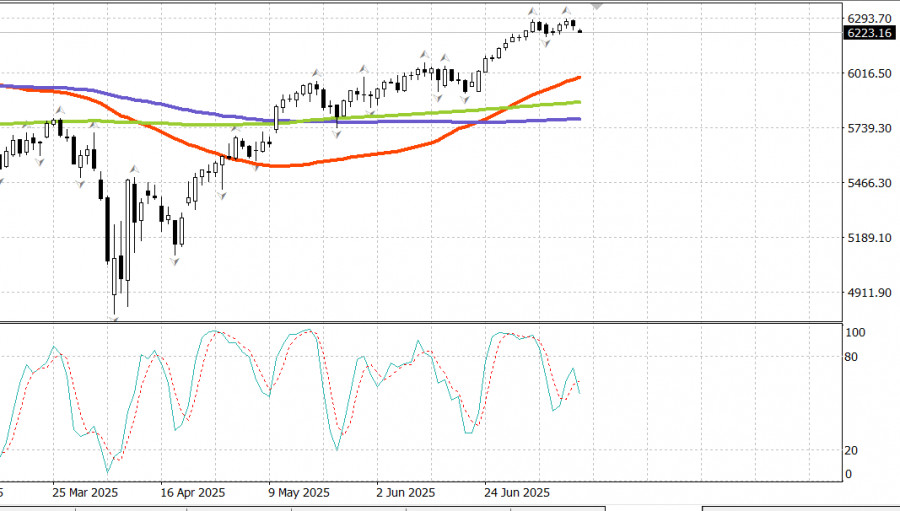

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

823

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

823

- The EUR/USD rate remained virtually unchanged on Monday

Author: Chin Zhao

22:19 2025-07-14 UTC+2

793

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

733