EURUSD (Euro vs US Dollar). Exchange rate and online charts.

Currency converter

25 Jul 2025 23:59

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/USD is a currency pair reflecting the current exchange rate of the euro (base currency) versus the US dollar (quote currency). It is one of the most popular currency pairs among traders. EUR/USD enjoys a very high liquidity level. Both currencies of this trading instrument are the world’s major reserve currencies. On top of that, EUR/USD is the most heavily traded instrument in the forex market.

Main features

The euro is a relatively young currency. It was introduced as a noncash monetary unit in 1999. EUR/USD appeared in the foreign exchange market at the same time. In the first years after its introduction, the euro prospects could hardly be evaluated. With time, the currency gathered strength and became the world’s second most commonly held reserve currency after the US dollar.

There is a direct correlation between the pair’s dynamics and the state of the EU and the US economies. So, its movement should be interpreted as follows: when the American economy expands and the EU economy goes through tough times, EUR/USD falls. Conversely, the trading instrument strengthens when the US economy slows down and the EU reports strong economic results.

Factors affecting EUR/USD. Aspects of trading

The pair’s main trading features can cast light on the essence of EUR/USD.

Firstly, this instrument is heavily traded during the European and North American sessions.

Secondly, the pair’s volatility (price change) is at a medium level. Of course, amid the release of important data, EUR/USD can fluctuate sharply (over 100 pips). However, the pair’s average daily volatility is usually about 80 pips.

Lastly, EUR/USD’s main advantage is the lowest spread (the difference between the bid and the ask price). The pair boasts the minimum spread owing to the highest liquidity level.

Both fundamental and technical factors can affect EUR/USD’s exchange rate.

As for fundamental factors, the price is influenced by important economic indicators in the US and the EU, including changes in the interest rate by the US Fed or the ECB, employment, GDP, policymakers’ speeches, force-major, etc.

Meanwhile, technical factors include the current trend (upward trend - long positions; downward trend - short positions; sideways trend - both), important support and resistance levels, as well as price patterns.

Market players trade the currency pair differently. Thus, they can choose to trade EUR/USD based on fundamental analysis, technical analysis, or even indicator analysis. In addition, they can trade using several approaches at once.

See Also

- Technical analysis / Video analytics

Forex forecast 24/07/2025: EUR/USD, GBP/USD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

12:02 2025-07-24 UTC+2

4453

Technical analysis / Video analyticsForex forecast 25/07/2025: EUR/USD, AUD/USD, USD/JPY, GBP/USD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, AUD/USD, USD/JPY, GBP/USD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

11:02 2025-07-25 UTC+2

3028

Euro's Growth Driven by Uncertainty. Now Comes a ReassessmentAuthor: Laurie Bailey

05:06 2025-07-25 UTC+2

2308

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

13:20 2025-07-25 UTC+2

2248

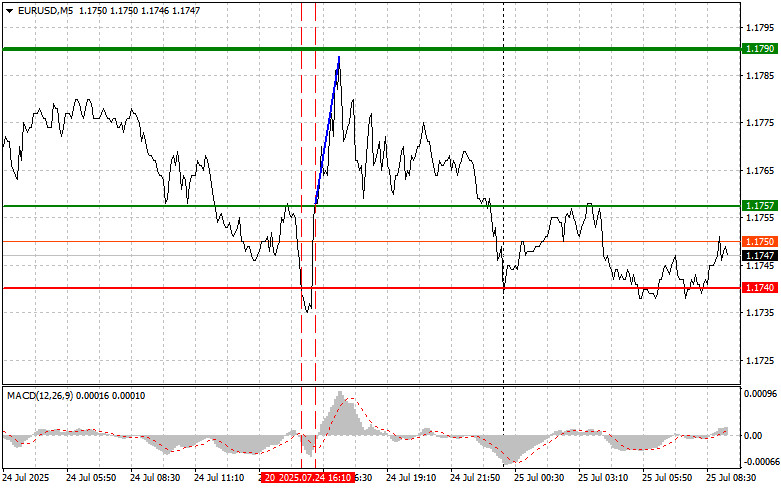

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on July 25. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 25. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

08:52 2025-07-25 UTC+2

2113

Fundamental analysisEUR/USD Overview – July 25: The ECB Meeting Did Not Change the Balance of Power Between the Dollar and the Euro

The EUR/USD currency pair continued to move upward on ThursdayAuthor: Paolo Greco

04:17 2025-07-25 UTC+2

2113

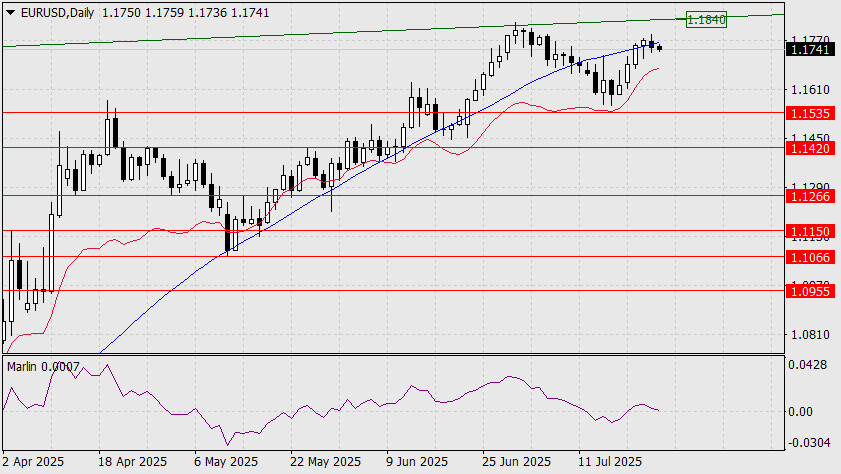

- The Euro Will Attempt a Retest of the Price Channel Boundary

Author: Laurie Bailey

05:18 2025-07-24 UTC+2

1993

On Wednesday, the EUR/USD currency pair continued its upward movementAuthor: Paolo Greco

07:12 2025-07-24 UTC+2

1918

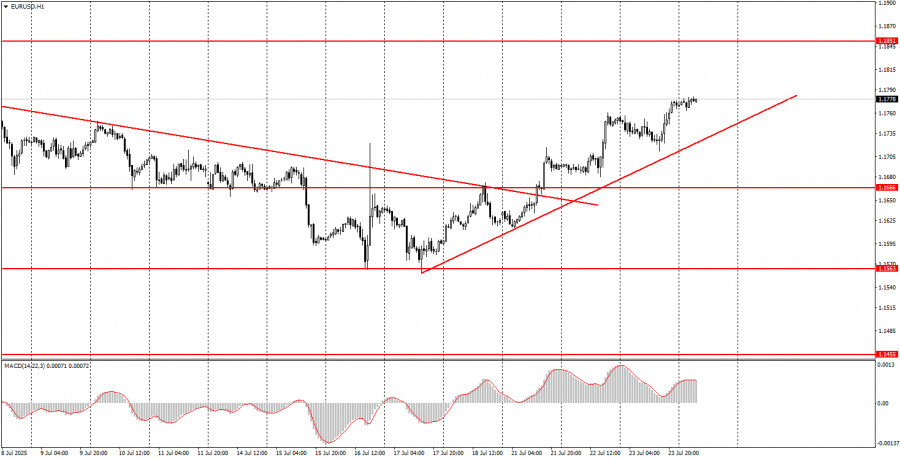

Trading planTrading Recommendations and Trade Breakdown for EUR/USD on July 25: The Market Wanders Aimlessly

On Thursday, the EUR/USD currency pair exhibited astonishingly low volatility and a complete unwillingness to move in any clear directionAuthor: Paolo Greco

04:17 2025-07-25 UTC+2

1888

- Technical analysis / Video analytics

Forex forecast 24/07/2025: EUR/USD, GBP/USD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

12:02 2025-07-24 UTC+2

4453

- Technical analysis / Video analytics

Forex forecast 25/07/2025: EUR/USD, AUD/USD, USD/JPY, GBP/USD, Gold, Ethereum and Bitcoin

Technical analysis of EUR/USD, AUD/USD, USD/JPY, GBP/USD, Gold, Ethereum and BitcoinAuthor: Sebastian Seliga

11:02 2025-07-25 UTC+2

3028

- Euro's Growth Driven by Uncertainty. Now Comes a Reassessment

Author: Laurie Bailey

05:06 2025-07-25 UTC+2

2308

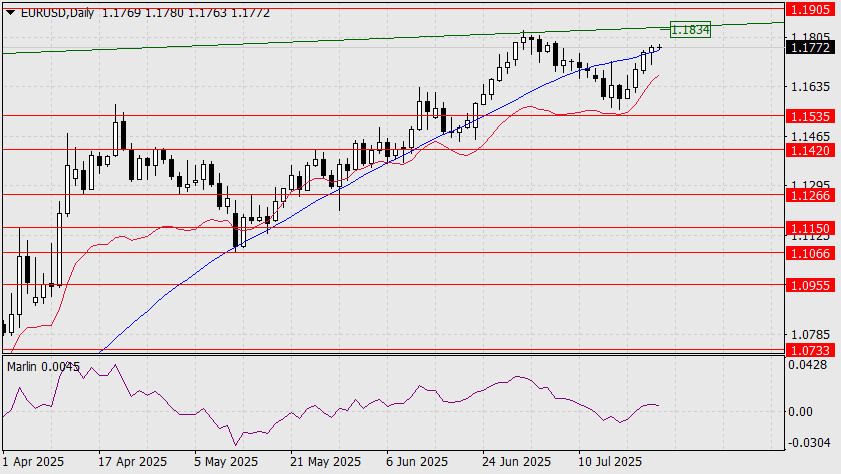

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

13:20 2025-07-25 UTC+2

2248

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on July 25. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 25. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

08:52 2025-07-25 UTC+2

2113

- Fundamental analysis

EUR/USD Overview – July 25: The ECB Meeting Did Not Change the Balance of Power Between the Dollar and the Euro

The EUR/USD currency pair continued to move upward on ThursdayAuthor: Paolo Greco

04:17 2025-07-25 UTC+2

2113

- The Euro Will Attempt a Retest of the Price Channel Boundary

Author: Laurie Bailey

05:18 2025-07-24 UTC+2

1993

- On Wednesday, the EUR/USD currency pair continued its upward movement

Author: Paolo Greco

07:12 2025-07-24 UTC+2

1918

- Trading plan

Trading Recommendations and Trade Breakdown for EUR/USD on July 25: The Market Wanders Aimlessly

On Thursday, the EUR/USD currency pair exhibited astonishingly low volatility and a complete unwillingness to move in any clear directionAuthor: Paolo Greco

04:17 2025-07-25 UTC+2

1888