#ILMN (Illumina, Inc.). Exchange rate and online charts.

Currency converter

14 Jul 2025 22:27

(-0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Illumina Inc. (ILMN) was established in 1998. Having 20-year experience, it develops, creates and introduces the systems for analysis of genetic diversity and biological functions. Illumina specializes in manufacturing products and providing services for sequencing, genotyping and studying genes. Clients of Illumina are centers for genome research, pharmaceutical and biotechnological companies as well as clinical research organizations. Illumina Inc. produces instruments which help to conduct important genetic studies.

One of the latest company’s solutions is the Illumina BeadLab system. It includes various products for gene expression and genetic analysis which involves the DNA microarrays. According to Illumina, sales of the next generation NovaSeq DNA sequencer were high in the first quarter. Illumina develops dynamically in a high-potential biotechnological sphere. DNA sequencing is applied in both scientific field and personalized medicine.

Experts anticipate that this market will expand, and currently the NovaSeq technology is the most advanced one. As the gene therapy is widely used, demand for genome sequencing may increase significantly. In 2014 the company introduced the platform for whole genome sequencing with chemical reagents worth nearly $1,000.

The financial statement of Illumina Inc. for the first quarter of this year revealed rather good results. The company’s performance exceeded expectations due to increasing demand for the DNA sequencing technologies. For the reported period Illumina earned $595 billion. The sale of services rose by 20% and brought a profit of $107 million. The revenue from sales of sequencers, the main product of Illumina, grew by 1.7% to $491 million.

The Illumina shares were placed for the first time 17 years ago, and it was rather successful. Currently, this biotechnological giant develops rapidly on the back of positive news which improves the outlook for the company’s growth. Besides, Illumina NovaSeq, the latest innovative technology of the company, contributes to the business expansion strongly. This technology makes it possible to reduce the cost of genome sequencing by ten times – to $100. In the first quarter of 2017 Illumina has already received 135 orders for NovaSeq.

Experts are sure that Illumina will be able to multiply its revenue with the help of NovaSeq in the longer term, as the DNA sequencing technology will be widely used.

The introduction of non-invasive prenatal testing based on the VeriSeq technology in Europe may boost sales of Illumina products. An expansion of oncology markers database CIViC may also contribute to a rise in sales. Furthermore, the company launched the iHope project which enables low-income families to use the service of genome sequencing.

Some experts estimate that by the end of this year Illumina Inc. may increase its revenue by 10-12% while the GAAP share profit may rise to $5.26-$5.36 for a year. The non-GAAP profit is expected to come in at $3.6-$3.7. Year to date, one share of Illumina appreciated by over 42% to $181.5. The market capitalization of Illumina Inc. reached as high as $26.68 billion. The specifics of the company's operation among other things is that it pursues the razor-razorblade sales strategy which involves selling of both upfront and ongoing products. This method can yield profits on the second-hand market as well.

See Also

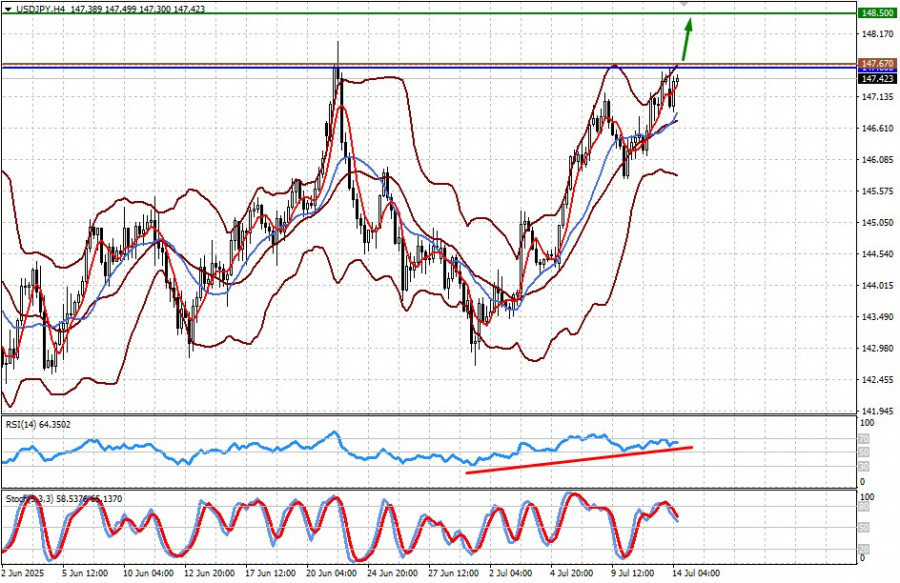

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1063

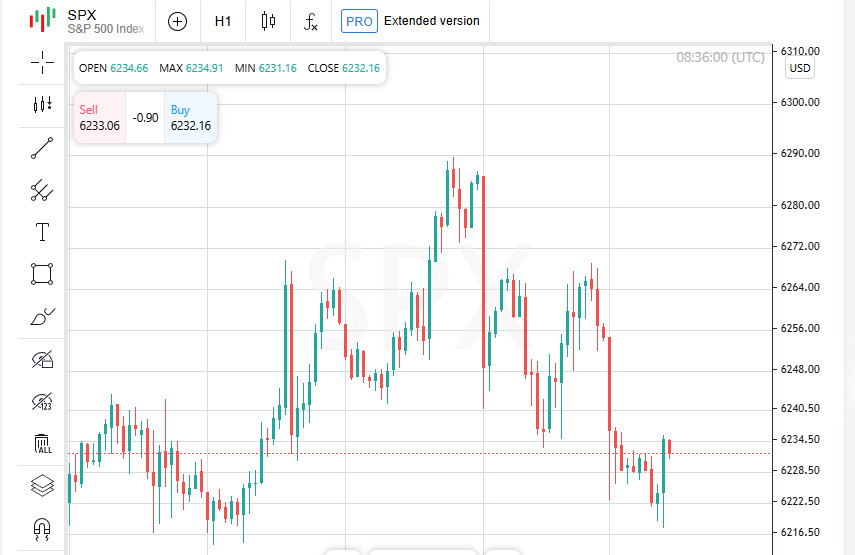

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

928

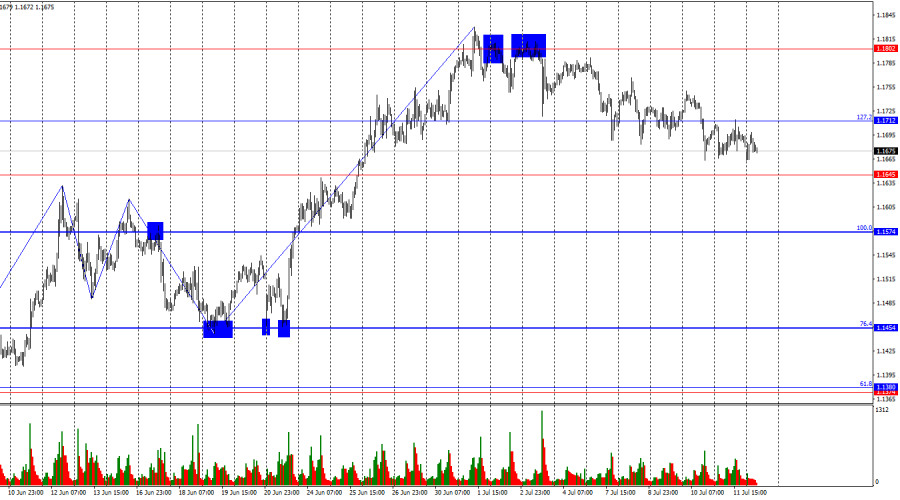

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

838

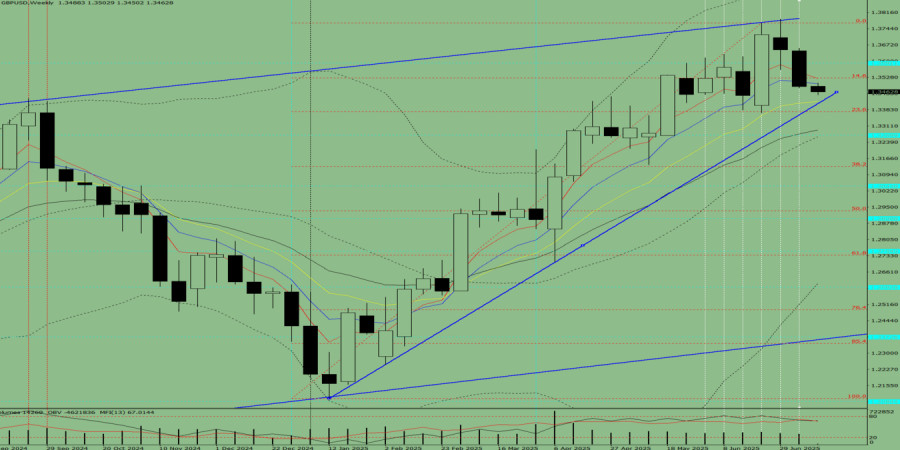

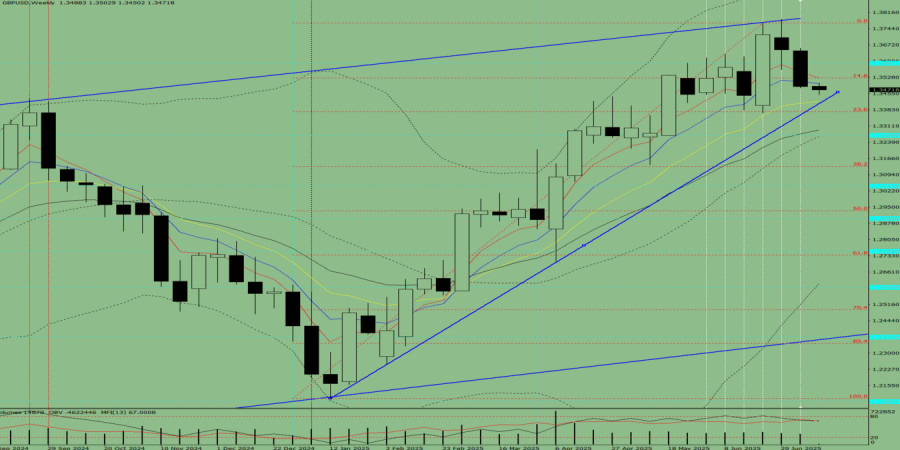

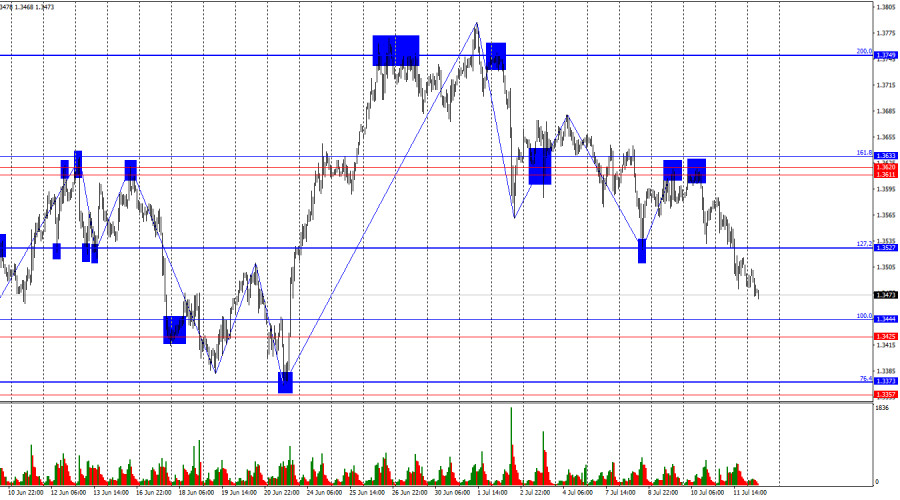

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

748

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

Bears are attacking, but this is a temporary phenomenon.Author: Samir Klishi

11:25 2025-07-14 UTC+2

703

Fundamental analysisTrump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1063

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

928

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

838

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

748

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

703

- Fundamental analysis

Trump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

703