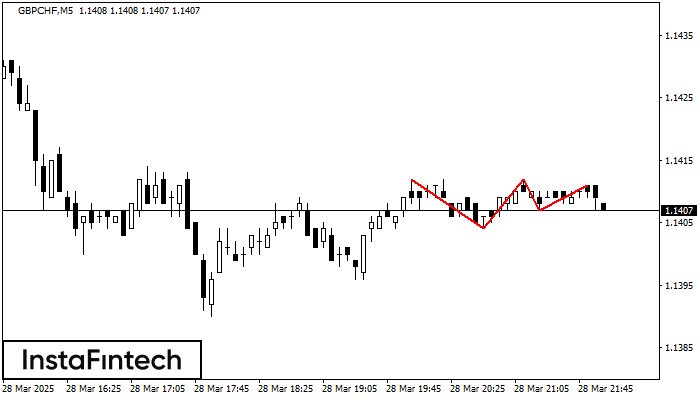

Triple Top

was formed on 28.03 at 22:01:13 (UTC+0)

signal strength 1 of 5

On the chart of the GBPCHF M5 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 1.1404, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 8 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

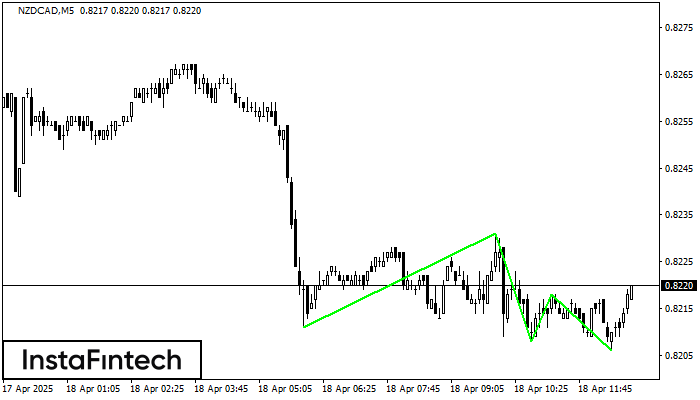

Triple Bottom

was formed on 18.04 at 11:50:33 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of the NZDCAD M5 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Bottom

was formed on 18.04 at 11:45:33 (UTC+0)

signal strength 2 of 5

The Triple Bottom pattern has been formed on NZDJPY M15. It has the following characteristics: resistance level 84.49/84.47; support level 84.31/84.32; the width is 18 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

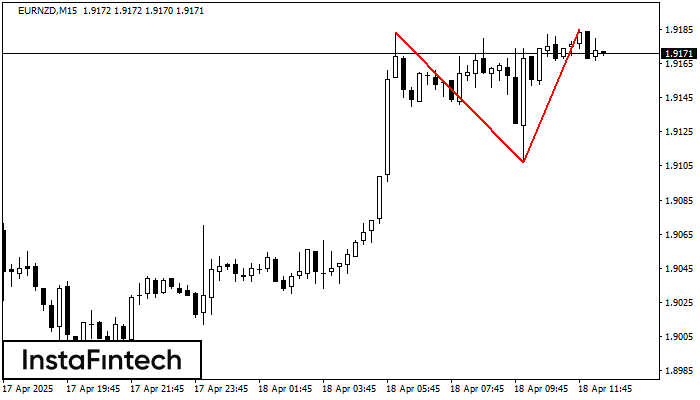

Double Top

was formed on 18.04 at 11:30:37 (UTC+0)

signal strength 2 of 5

The Double Top reversal pattern has been formed on EURNZD M15. Characteristics: the upper boundary 1.9183; the lower boundary 1.9107; the width of the pattern is 78 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window