CHFJPY (Swiss Franc vs Japanese Yen). Exchange rate and online charts.

Currency converter

30 Apr 2025 04:47

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

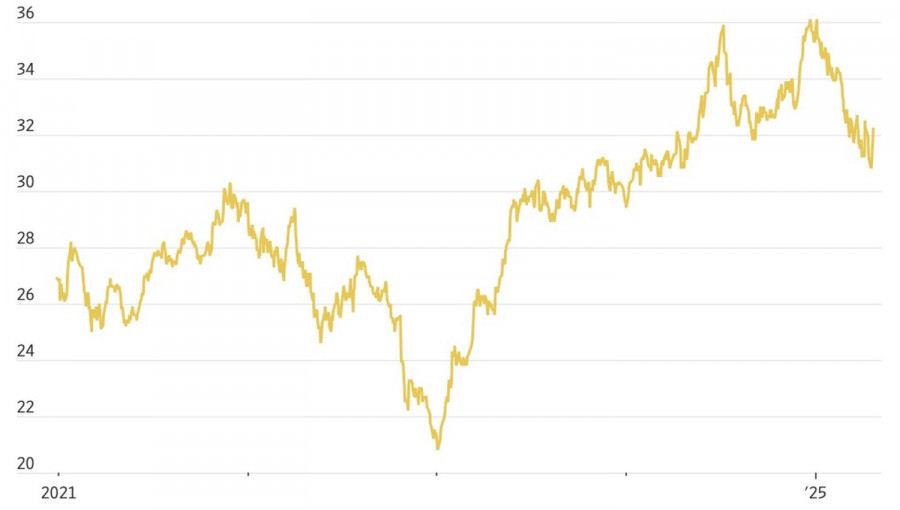

CHF/JPY is a cross rate of the Swiss franc to the Japanese yen. The influence of the American dollar on this currency pair can be measured by combining the charts of USD/JPY and USD/CHF – the result will be an approximate chart of CHF/JPY.

Due to the fact that USD has a considerable impact on each currency of the pair above, such main economic indicators of the USA as discount rate, unemployment rate, the GDP level, jobs growth should be taken into account while dealing with this trading instrument. Besides, it should not be forgotten that the currencies can respond to the change of the USD rate with different pace.

The currency pair CHF/JPY is easy to forecast, and suits for beginner traders. Its movement is often outrun by more dynamic pair EUR/JPY.

Sometimes, professional traders use this situation to make profitable deals.

The yen is one of the main reserve currencies; and the franc is among the most reliable ones.

See Also

- Fundamental analysis

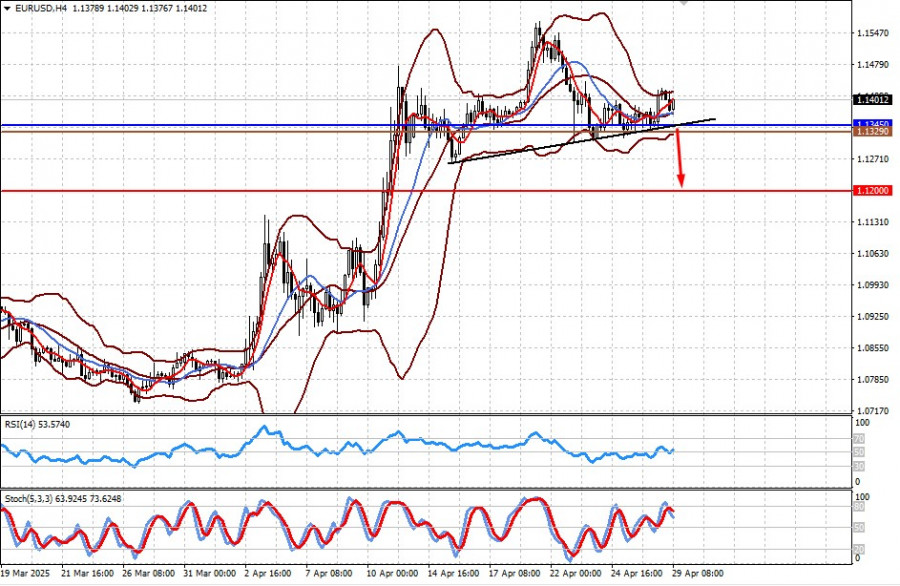

Trade Negotiations Between China and the U.S. Are Ongoing. Markets Await Results (There Is a Risk of Local Declines in EUR/USD and GBP/USD Pairs)

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soonAuthor: Pati Gani

10:04 2025-04-29 UTC+2

1378

GBP/USD: Simple Trading Tips for Beginner Traders for April 29th (U.S. Session)Author: Jakub Novak

19:01 2025-04-29 UTC+2

1033

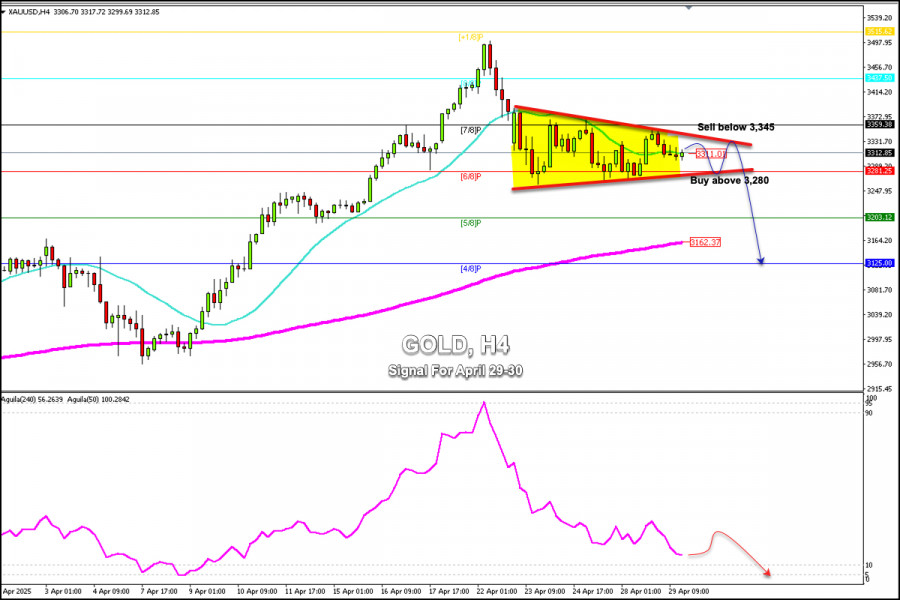

Technical analysisTrading Signals for GOLD (XAU/USD) for April 29-30, 2025: buy above $3,310 (21 SMA - 7/8 Murray)

The Eagle indicator is showing an oversold signal, but there is still a chance of further declines, so any technical rebound will be seen as a signal to sell.Author: Dimitrios Zappas

18:10 2025-04-29 UTC+2

988

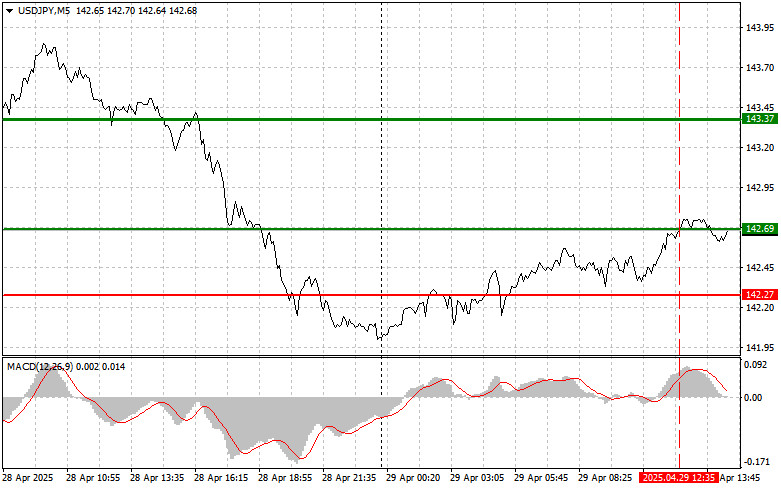

- USD/JPY: Simple Trading Tips for Beginner Traders for April 29th (U.S. Session)

Author: Jakub Novak

19:18 2025-04-29 UTC+2

958

European stocks rise; oil prices decline, mixed performance in US marketsAuthor: Gleb Frank

12:42 2025-04-29 UTC+2

928

Further Tariff Concessions from TrumpAuthor: Jakub Novak

18:48 2025-04-29 UTC+2

898

- The BTC/USD price has significantly increased in recent weeks

Author: Chin Zhao

11:30 2025-04-29 UTC+2

898

Stock Market for April 29th: S&P 500 and NASDAQ Still Have Growth PotentialAuthor: Jakub Novak

10:59 2025-04-29 UTC+2

883

The bearish drivers behind the S&P 500 correction are gradually fading into the backgroundAuthor: Marek Petkovich

09:10 2025-04-29 UTC+2

868

- Fundamental analysis

Trade Negotiations Between China and the U.S. Are Ongoing. Markets Await Results (There Is a Risk of Local Declines in EUR/USD and GBP/USD Pairs)

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soonAuthor: Pati Gani

10:04 2025-04-29 UTC+2

1378

- GBP/USD: Simple Trading Tips for Beginner Traders for April 29th (U.S. Session)

Author: Jakub Novak

19:01 2025-04-29 UTC+2

1033

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 29-30, 2025: buy above $3,310 (21 SMA - 7/8 Murray)

The Eagle indicator is showing an oversold signal, but there is still a chance of further declines, so any technical rebound will be seen as a signal to sell.Author: Dimitrios Zappas

18:10 2025-04-29 UTC+2

988

- USD/JPY: Simple Trading Tips for Beginner Traders for April 29th (U.S. Session)

Author: Jakub Novak

19:18 2025-04-29 UTC+2

958

- European stocks rise; oil prices decline, mixed performance in US markets

Author: Gleb Frank

12:42 2025-04-29 UTC+2

928

- Further Tariff Concessions from Trump

Author: Jakub Novak

18:48 2025-04-29 UTC+2

898

- The BTC/USD price has significantly increased in recent weeks

Author: Chin Zhao

11:30 2025-04-29 UTC+2

898

- Stock Market for April 29th: S&P 500 and NASDAQ Still Have Growth Potential

Author: Jakub Novak

10:59 2025-04-29 UTC+2

883

- The bearish drivers behind the S&P 500 correction are gradually fading into the background

Author: Marek Petkovich

09:10 2025-04-29 UTC+2

868