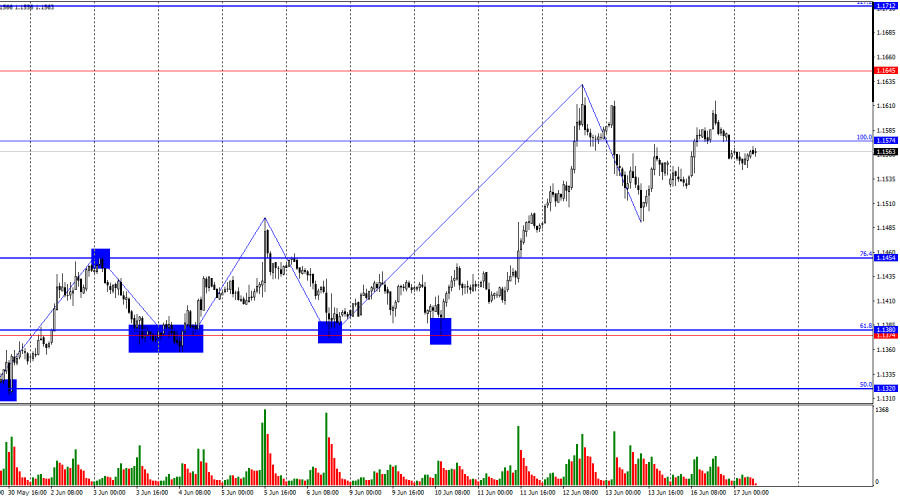

EURHUF (Euro vs Hungarian Forint). Exchange rate and online charts.

Currency converter

18 Jun 2025 05:03

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/HUF is a common currency pair in the forex market. The instrument proves to be vastly popular among savvy traders owing to its great stability and the predictability of the eurozone and the Hungarian economies.

At the same time, EUR/HUF is a cross currency pair against the US dollar. The pair does not contain USD, but its exchange rate is significantly affected by it. This tendency could be traced if we compare the EUR/USD and USD/HUF charts.

Main features

EUR/HUF is suitable for both novice and professional traders. It involves low risks. The pair’s exchange rate is influenced by the correlation between the eurozone economy and the Hungarian one. Although Hungary is part of the European Union, it has preserved its national currency – the forint. That is why the Hungarian currency often repeats the euro’s dynamics.

Hungary is heavily dependent on the organizations and countries that operate in its territory. Hungary enjoys a high share of foreign investments in its economy.

A large portion of Hungary's income comes from tourism. The country’s other well-developed economic sectors are mechanical engineering, metallurgy, chemical, and agriculture (products are mainly exported abroad). Hungary’s main trade partners are the EU countries and Russia. Therefore, when evaluating the forint’s exchange rate, the economic indicators of these regions should be taken into consideration.

Aspects of trading EUR/HUF

When trading cross currency pairs, traders should bear in mind that brokers set a higher spread for them than for major currency pairs. For that reason, before working with cross currency pairs, it is important to explore the broker’s trading conditions for a specific instrument.

EUR/HUF is usually heavily traded in the European session and is coolly traded the rest of the time.

Above all else, the US dollar has a significant impact on both the euro and the Hungarian forint. That is why traders should focus on the main US economic indicators when making forecasts for EUR/HUF (interest rates, GDP, unemployment, Nonfarm Payrolls, etc.).

See Also

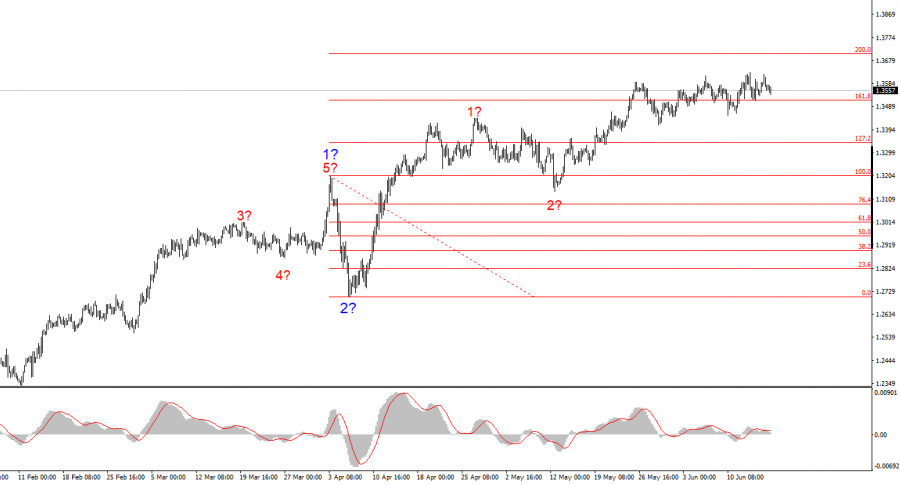

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1663

The Kiwi Doesn't Give Up Despite New Zealand's Weak EconomyAuthor: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1363

Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1168

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1168

Stock Market on May 17th: S&P 500 and NASDAQAuthor: Jakub Novak

11:56 2025-06-17 UTC+2

1108

JPMorgan Chase & Co. is planning to launch its own stablecoinAuthor: Jakub Novak

11:25 2025-06-17 UTC+2

1093

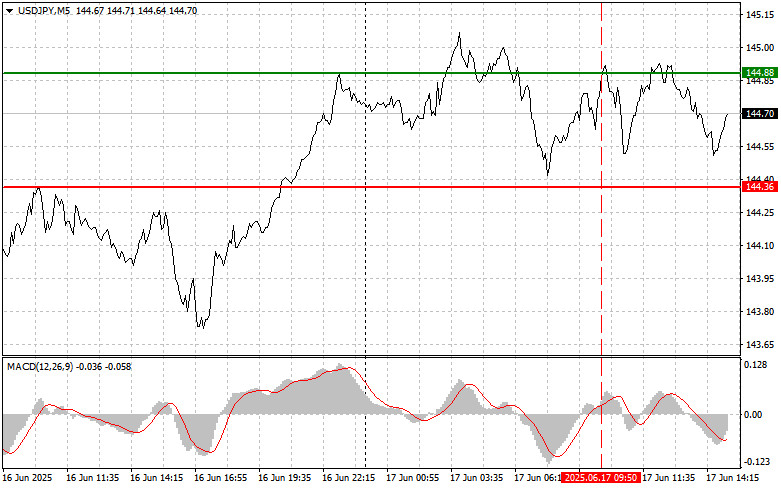

- USD/JPY: Simple Trading Tips for Beginner Traders – June 17 (U.S. Session)

Author: Jakub Novak

21:11 2025-06-17 UTC+2

973

GBP/USD lost 100 basis points in the second half of TuesdayAuthor: Chin Zhao

21:24 2025-06-17 UTC+2

898

GBP/USD. Analysis and ForecastAuthor: Irina Yanina

20:24 2025-06-17 UTC+2

883

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1663

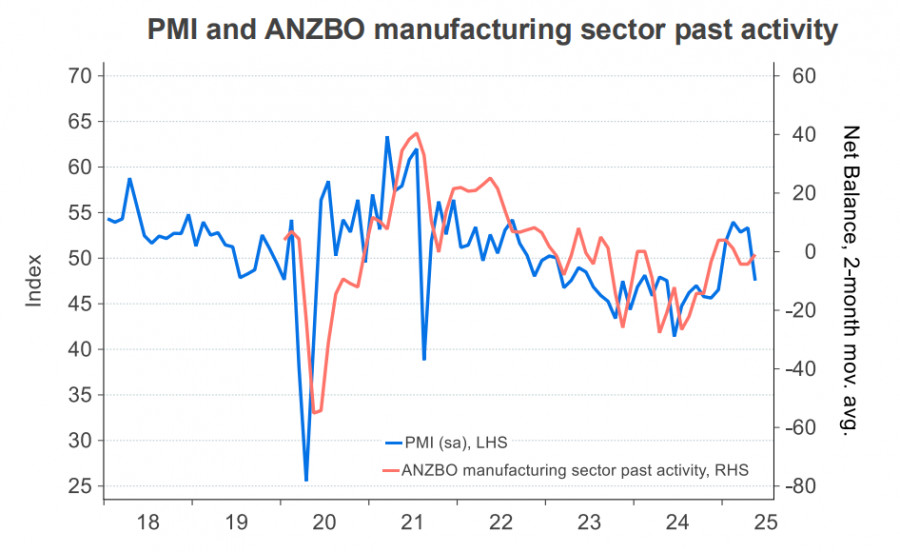

- The Kiwi Doesn't Give Up Despite New Zealand's Weak Economy

Author: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1363

- Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500

Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1168

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1168

- Stock Market on May 17th: S&P 500 and NASDAQ

Author: Jakub Novak

11:56 2025-06-17 UTC+2

1108

- JPMorgan Chase & Co. is planning to launch its own stablecoin

Author: Jakub Novak

11:25 2025-06-17 UTC+2

1093

- USD/JPY: Simple Trading Tips for Beginner Traders – June 17 (U.S. Session)

Author: Jakub Novak

21:11 2025-06-17 UTC+2

973

- GBP/USD lost 100 basis points in the second half of Tuesday

Author: Chin Zhao

21:24 2025-06-17 UTC+2

898

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

20:24 2025-06-17 UTC+2

883