GBPZAR (British Pound vs South African Rand). Exchange rate and online charts.

Currency converter

13 Jun 2025 23:59

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The GBP/ZAR currency pair is a popular one on Forex market. As South Africa does an active trade with the United Kingdom, the experienced traders choose this trading instrument for the high stability and predictability of the Great Britain and South Africa's economies. The most intense GBP/ZAR bidding is observed during the European sessions.

This pair is the cross rate against the U.S. dollar. There is no the U.S. dollar in this currency pair, nevertheless, it wields an enormous influence over the pound and the rand. To see it graphically, just combine the GBP/USD and USD/ZAR charts in the same price chart, and you will get the approximate GBP/ZAR chart.

The U.S. dollar affects both currencies profoundly. Hence, for a better prognosis on the future rate movement of this currency pair, you should take into account the main indicators of the U.S. economy. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Keep in mind that the aforementioned currencies may respond in a different manner to the changes in the economic situation of the U.S.A.

The South African rand is one of the most widespread currencies, which is used in many trading operations. The huge reserves of the mineral resources allow South Africa to be the richest country of its continent. Its economy is concentrated on mining with a further export of minerals. Moreover, one of the major stock exchanges that is in the top 10 world's largest stock exchanges, is situated in South Africa. South Africa specializes in extraction of precious stones and metals, including gold and diamonds. Since the country is the leading car manufacturer in Africa, the majority of its products goes on export. As you can see, South Africa does not suffer from the shortage in raw materials. Among the factors, which can affect the rand rate, are prices for precious gems and metals, as well as level of engineering production.

Remember that the spread for the cross rates can be higher than for more popular currency pairs. Thus, before you start dealing with the cross currency pair, learn thoroughly the broker's conditions for this specified trading instrument.

See Also

- Technical analysis

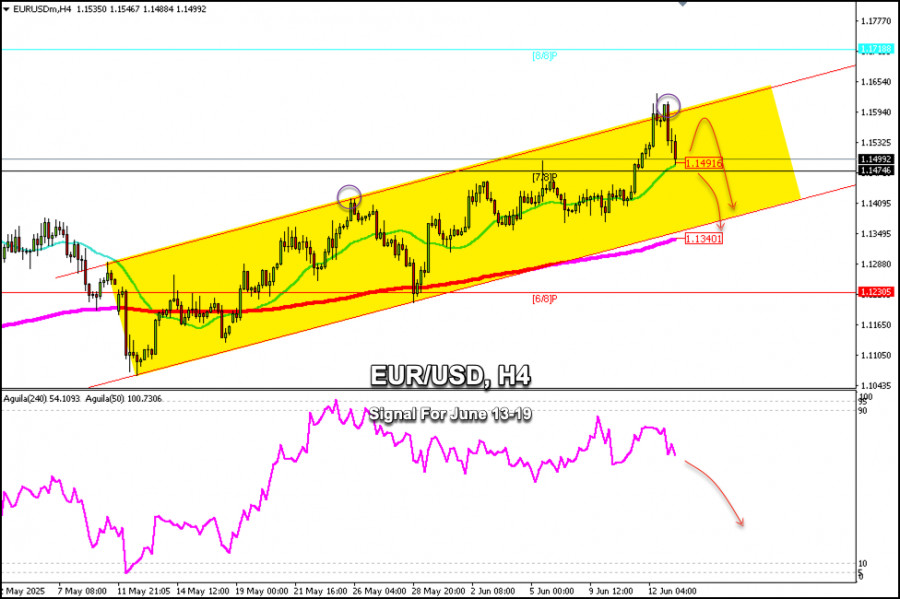

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

4978

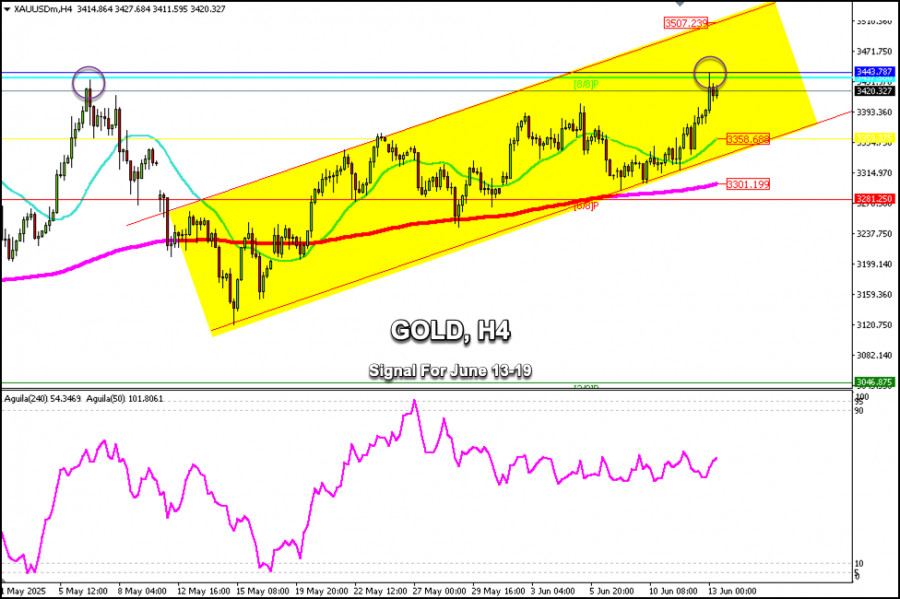

Technical analysisTrading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

3553

Recovery supported by the U.S. dollar reboundAuthor: Irina Yanina

13:09 2025-06-13 UTC+2

3253

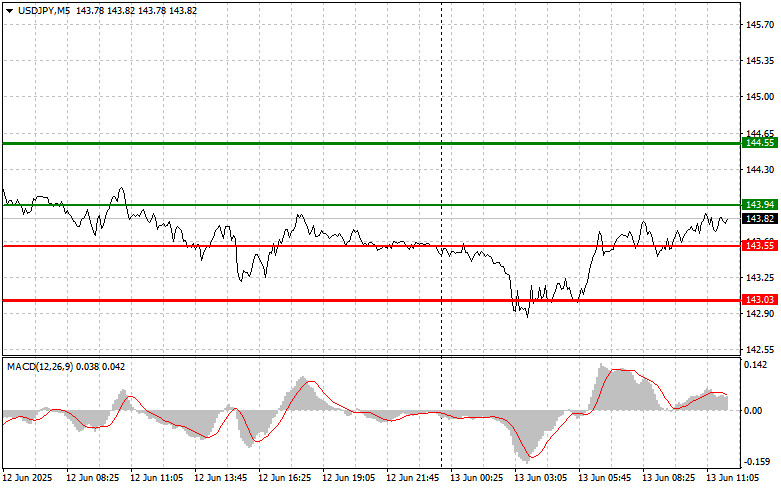

- USD/JPY: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2983

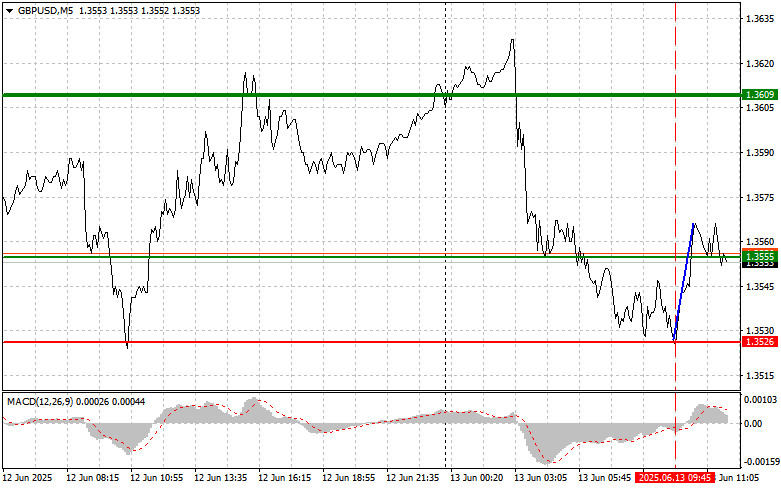

GBP/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)Author: Jakub Novak

12:44 2025-06-13 UTC+2

2803

Pressure persists despite short-term reboundAuthor: Irina Yanina

12:53 2025-06-13 UTC+2

2488

- EUR/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

2428

Fundamental analysisIsraeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2353

- Technical analysis

Trading Signals for EUR/USD for June 13-19, 2025: buy above 1.1500 (21 SMA - 7/8 Murray)

Under the opposite scenario, if the euro falls below 1.1490, it is likely to reach the 200 EMA, which is located at 1.1340 and coincides with the bottom of the uptrend channel. This will be seen as a selling opportunity.Author: Dimitrios Zappas

14:14 2025-06-13 UTC+2

4978

- Technical analysis

Trading Signals for GOLD for June 13-19, 2025: sell below 3,343 (21 SMA - 8/8 Murray)

Gold has left a gap at 3,282 and another around 3,181. So, if the price falls below the psychological level of 3,300, we could expect it to fall to cover these price levels.Author: Dimitrios Zappas

14:12 2025-06-13 UTC+2

3553

- Recovery supported by the U.S. dollar rebound

Author: Irina Yanina

13:09 2025-06-13 UTC+2

3253

- USD/JPY: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:49 2025-06-13 UTC+2

2983

- GBP/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:44 2025-06-13 UTC+2

2803

- Pressure persists despite short-term rebound

Author: Irina Yanina

12:53 2025-06-13 UTC+2

2488

- EUR/USD: Simple Trading Tips for Beginner Traders � June 13th (U.S. Session)

Author: Jakub Novak

12:41 2025-06-13 UTC+2

2428

- Fundamental analysis

Israeli Missile Strike on Iran Will Crash Global Markets (I Expect Bitcoin and #NDX to Resume Their Decline After a Local Upward Correction)

As I anticipated, the lack of a broad positive outcome in negotiations between China and the U.S. and renewed inflationary pressure led to a sharp decline in demand for corporate stocksAuthor: Pati Gani

10:10 2025-06-13 UTC+2

2353