CADMXN (Canadian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

26 Mar 2025 13:36

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/MXN currency pair is rather popular on Forex market. This pair is the cross rate against the U.S. dollar. There is no U.S. Dollar in this currency pair, however CAD/MXN is under its great influence. You can see that graphically: just combine two charts (CAD/USD and USD/MXN) in the same price chart, and you will get the approximate CAD/MXN chart.

The U.S. dollar affects both currencies profoundly. So for a better forecasting the future rate of this currency pair you need to consider the main indicators of the U.S. economy. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Remember that the CAD/MXN currency pair can react in a different way to the U.S. economic changes.

Since Canada has been one of the largest world oil exporters, the world oil prices significantly influence the Canadian dollar. That is why the value of the Canadian dollar varies in direct proportion to the oil prices.

Mexico has the highest income per capita in Latin America that put this country among the most developed countries of that region. In the 80s to overcome the economic crisis, most of the Mexican state enterprises got privatized. Therefore, private sector comprises the bigger part of the Mexican economy. A great part of the former state-owned enterprises now belongs to the foreign companies.

Thanks to Mexican membership in the North American Free Trade Agreement (NAFTA), it has an active trade with United States and Canada, which, so to speak, generates considerable part of government revenue of Mexico.

Moreover, Mexico is the largest exporter of oil in Latin America, so the oil sector provides most of the country’s revenues. But the service sector stays the main source of Mexican income.

Despite of its huge oil and gas reserves, Mexican natural hydrocarbons are getting depleted. In order to avoid new economical problems, the Mexican government has to reduce the amount of extracted oil and natural gas. According to the experts, such restrictive policy can soon make Mexico to import oil from abroad to meet the needs of its economy. So you can see that the Mexican peso is dependent on the world oil prices. Furthermore, its exchange rate is closely dependent on the international ranking of Mexico, which is based on complex economic analysis and published by the most authoritative rating agencies.

Please note that the spread for cross currency pairs is usually higher than for more popular ones. So before you start dealing with the cross rates, study properly the broker’s conditions of trading with the specified trade instrument.

See Also

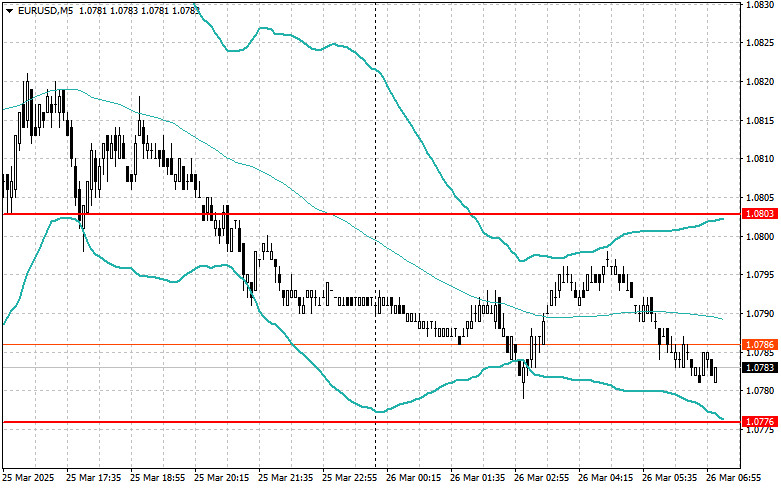

- Intraday Strategies for Beginner Traders on March 26

Author: Miroslaw Bawulski

08:00 2025-03-26 UTC+2

1258

Gold maintains a positive tone today, but lacks strong bullish momentumAuthor: Irina Yanina

11:54 2025-03-26 UTC+2

1183

Bulls pushed for two weeks, but now it's time for a pauseAuthor: Samir Klishi

11:32 2025-03-26 UTC+2

1078

- Fundamental analysis

Looks Like It's Time to Focus on the Euro and Yen (EUR/USD May Fall, USD/JPY May Rise)

Since mid-month, financial markets have been trying to recover while frantically analyzing all possible developments surrounding the trade war the U.S. launched against its largest trading partnersAuthor: Pati Gani

09:52 2025-03-26 UTC+2

1078

The S&P 500 is likely to wait for America's "Liberation Day" on April 2, increasing the likelihood of consolidationAuthor: Marek Petkovich

08:00 2025-03-26 UTC+2

1063

KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%Author: Thomas Frank

10:02 2025-03-26 UTC+2

1063

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1048

Trading Recommendations for the Cryptocurrency Market on March 26Author: Miroslaw Bawulski

09:22 2025-03-26 UTC+2

1018

Bulls and bears remain in balanceAuthor: Samir Klishi

11:29 2025-03-26 UTC+2

1003

- Intraday Strategies for Beginner Traders on March 26

Author: Miroslaw Bawulski

08:00 2025-03-26 UTC+2

1258

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1183

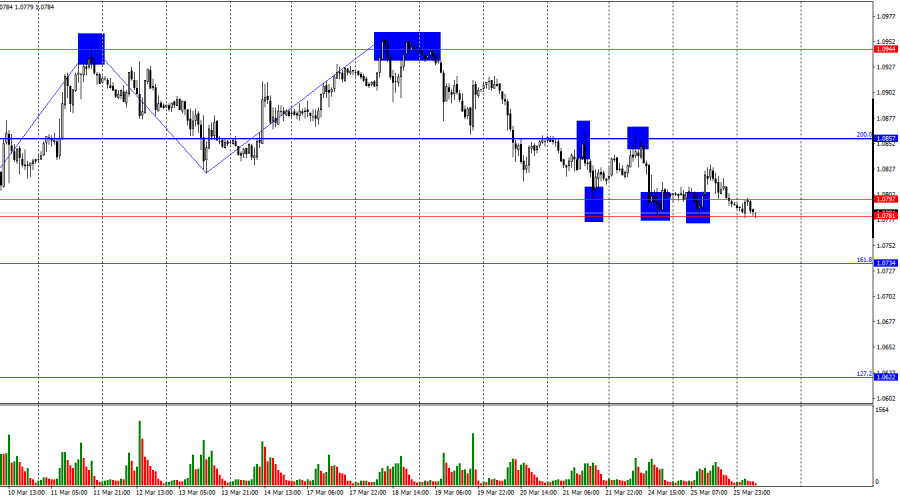

- Bulls pushed for two weeks, but now it's time for a pause

Author: Samir Klishi

11:32 2025-03-26 UTC+2

1078

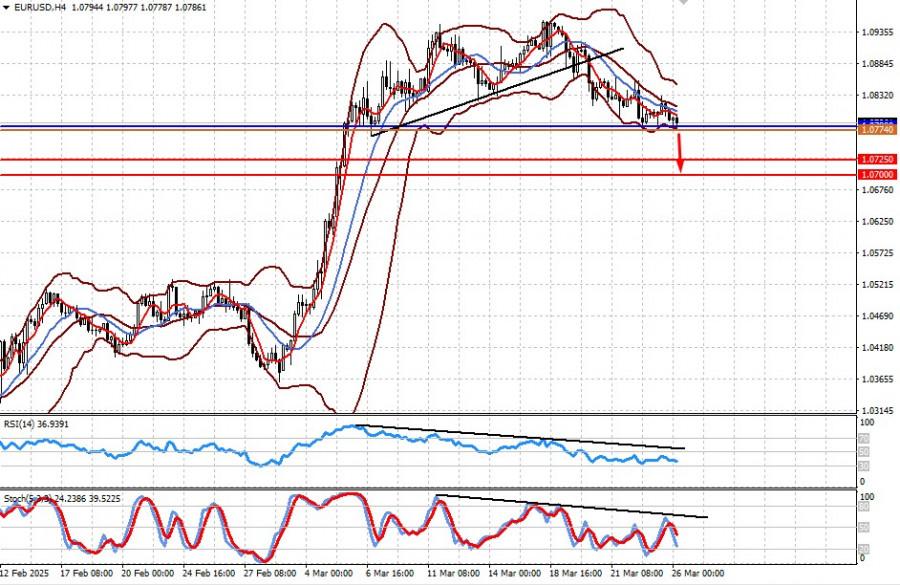

- Fundamental analysis

Looks Like It's Time to Focus on the Euro and Yen (EUR/USD May Fall, USD/JPY May Rise)

Since mid-month, financial markets have been trying to recover while frantically analyzing all possible developments surrounding the trade war the U.S. launched against its largest trading partnersAuthor: Pati Gani

09:52 2025-03-26 UTC+2

1078

- The S&P 500 is likely to wait for America's "Liberation Day" on April 2, increasing the likelihood of consolidation

Author: Marek Petkovich

08:00 2025-03-26 UTC+2

1063

- KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%

Author: Thomas Frank

10:02 2025-03-26 UTC+2

1063

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1048

- Trading Recommendations for the Cryptocurrency Market on March 26

Author: Miroslaw Bawulski

09:22 2025-03-26 UTC+2

1018

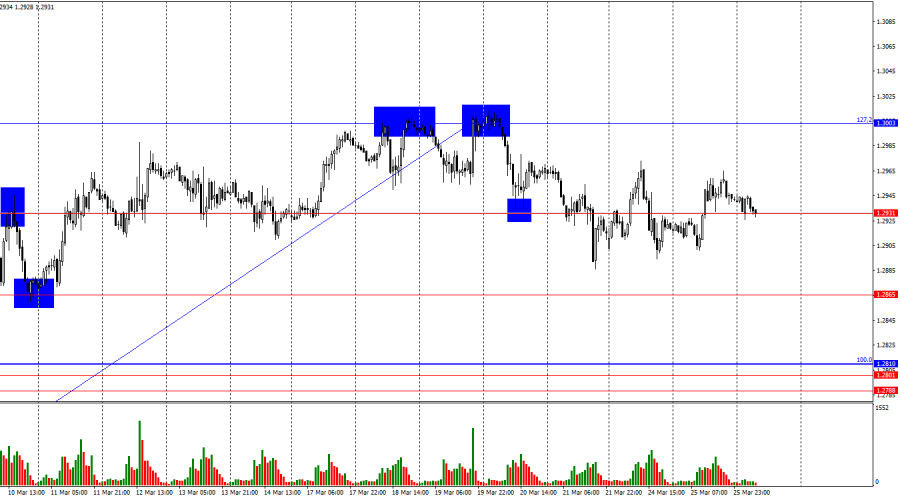

- Bulls and bears remain in balance

Author: Samir Klishi

11:29 2025-03-26 UTC+2

1003