#TSLA (Tesla Motors, Inc.). Exchange rate and online charts.

Currency converter

14 Jul 2025 19:44

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Tesla, Inc. (formerly named Tesla Motors) is an American corporation mainly specialized in car making. The company was established in 2003. It is managed by Elon Musk.

Tesla, Inc. specializes in construction, development and sales of high-quality electric autos and parts for electric cars. The firm has founded Supercharger, its own network of fast-charging stations all over the world. The company’s business is organized in a way that allowed it to quickly develop and start producing innovative electric cars and technologies. The Tesla Roadster BEV sports car and the Tesla Model S premium all-electric five-door liftback are among the most popular technological novelties of the carmaker.

As of June 2017, #TSLA share price is $369.9 with the daily change of 0.42%. Trading this instrument is rather promising. Experts point out that despite a slight decline in the quotes, one can enter the market at the current levels quite successfully.

See Also

- Type of analysis

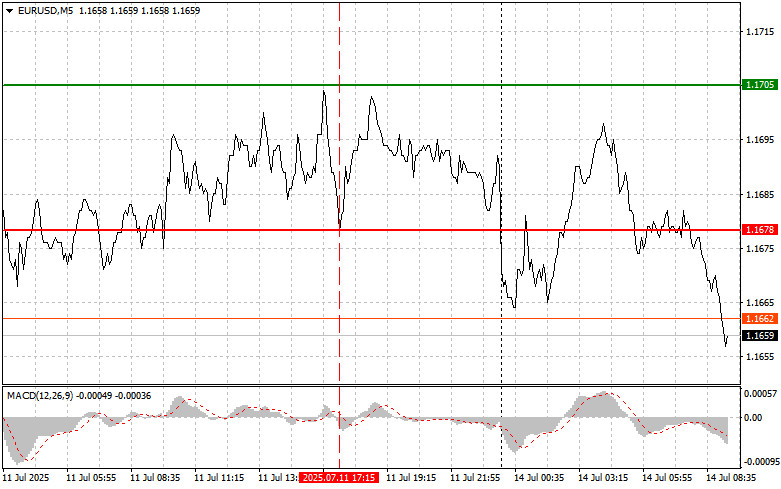

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

1063

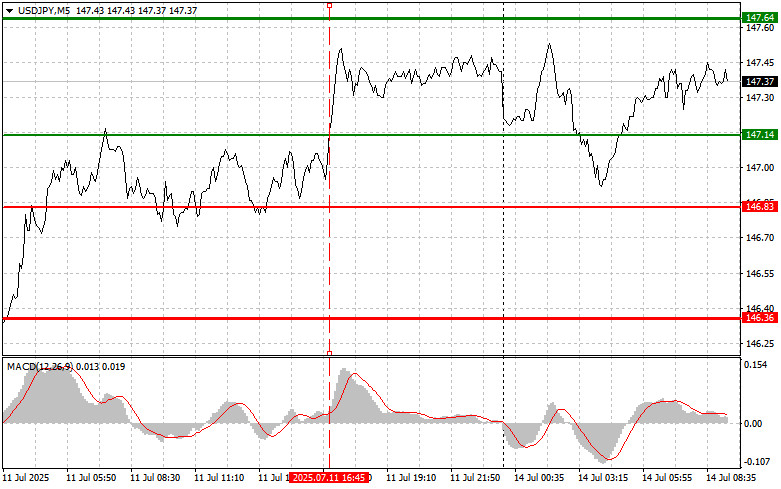

The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signalsAuthor: Irina Yanina

12:17 2025-07-14 UTC+2

1003

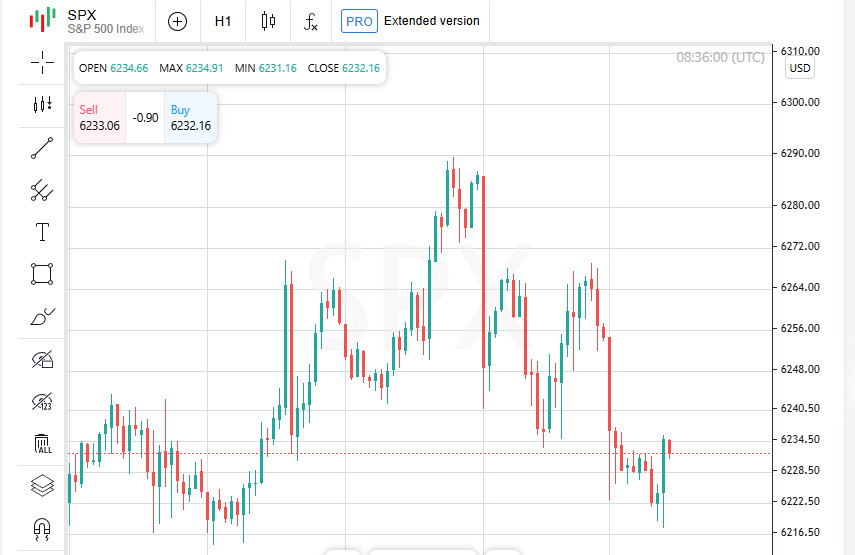

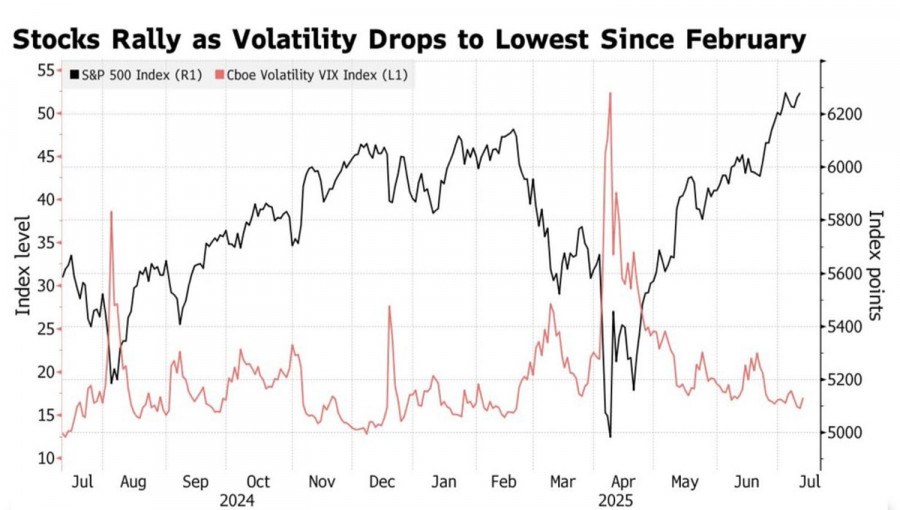

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

913

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

868

Wave analysisWeekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

823

The White House is convinced that S&P 500 records are the result of its protectionist policiesAuthor: Marek Petkovich

09:06 2025-07-14 UTC+2

778

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

778

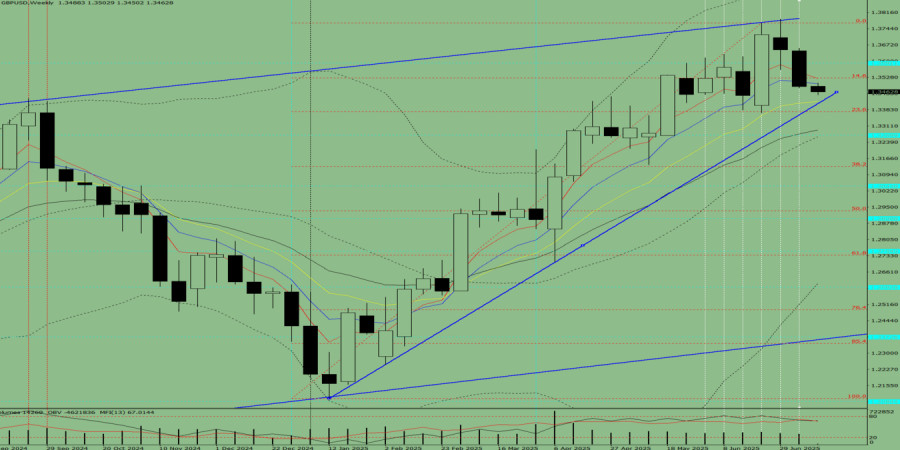

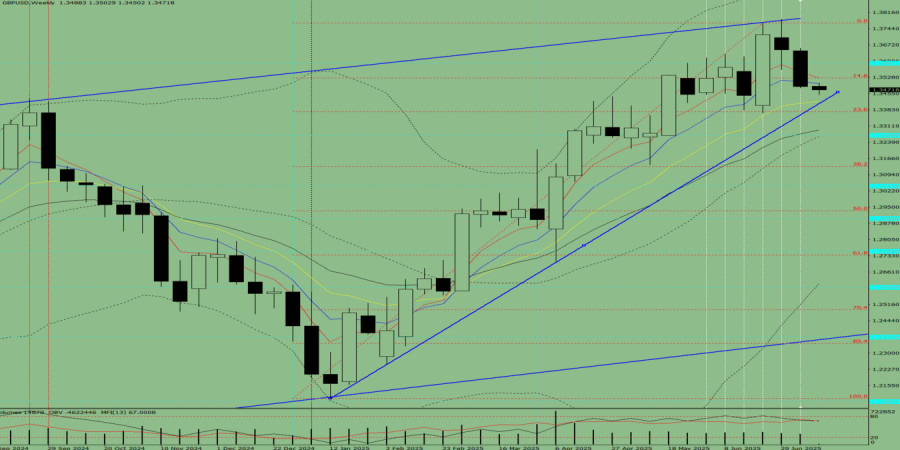

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

718

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:02 2025-07-14 UTC+2

703

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

1063

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1003

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

913

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

868

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

823

- The White House is convinced that S&P 500 records are the result of its protectionist policies

Author: Marek Petkovich

09:06 2025-07-14 UTC+2

778

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

778

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

718

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:02 2025-07-14 UTC+2

703