USDHKD (US Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

18 Jun 2025 03:07

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

«US Dollar vs Hong Kong Dollar» or «USDHKD»

USD/HKD is a popular currency pair on Forex. The rate of this financial instrument depends considerably on the US economic situation. For this reason, a trader should primarily focus on the economic indicators of the United States of America. At the moment the rate of the Hong Kong dollar is pegged to the US dollar. This financial instrument trading is carried in the range 7.75-7.85 HKD per USD.

Hong Kong has one of the largest stock exchanges. On many indicators Hong Kong Stock Exchange (SEHK) leaves behind a number of major European and American stock exchanges. Nowadays, Hong Kong is one of the world's leading financial centers.

Hong Kong's economy is based on the principle of free market, low taxation, and the policy of neutrality, as the government does not interfere in the region's economy. There are insufficient mineral and food resources in the region, for this reason its economy is heavily dependent on these factors. The majority of Hong Kong's income is received from service industries, as well as re-exports from China. In addition, the tourism sector is well developed.

If you trade with currency pair USD/HKD, you need to pay attention to the behavior of the other most important trading instruments such as: EUR/USD, GBP/USD, and USD/JPY. These trading instruments are indicators of price movement of USD/HKD, since they greatly influence on the rate of national currency of Hong Kong Special Administrative Region.

See Also

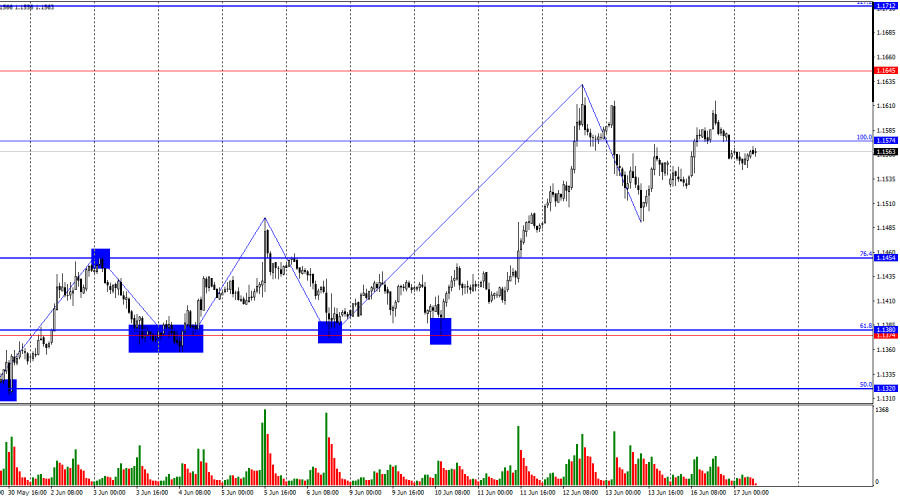

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1663

The Kiwi Doesn't Give Up Despite New Zealand's Weak EconomyAuthor: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1363

Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1168

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1168

Stock Market on May 17th: S&P 500 and NASDAQAuthor: Jakub Novak

11:56 2025-06-17 UTC+2

1108

JPMorgan Chase & Co. is planning to launch its own stablecoinAuthor: Jakub Novak

11:25 2025-06-17 UTC+2

1093

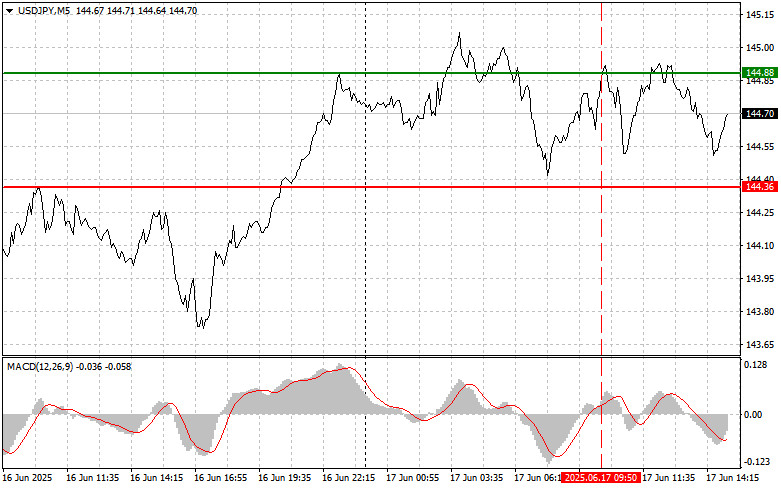

- USD/JPY: Simple Trading Tips for Beginner Traders – June 17 (U.S. Session)

Author: Jakub Novak

21:11 2025-06-17 UTC+2

928

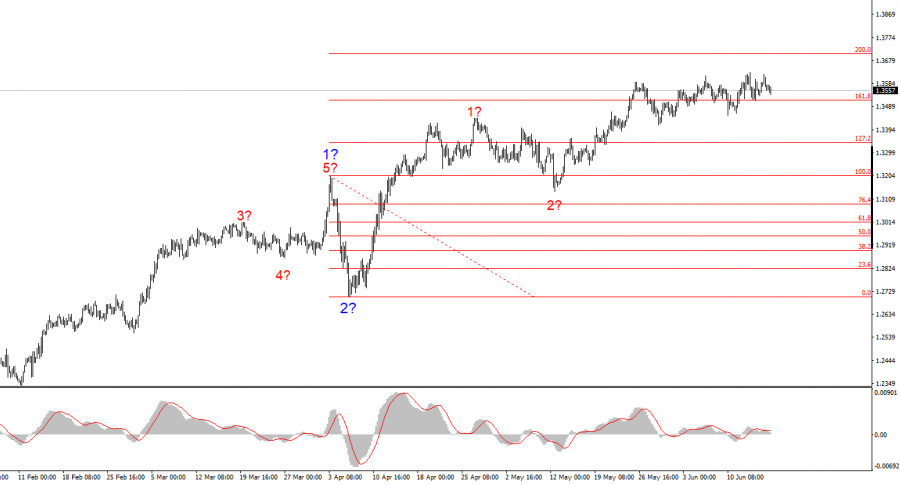

GBP/USD. Analysis and ForecastAuthor: Irina Yanina

20:24 2025-06-17 UTC+2

883

GBP/USD lost 100 basis points in the second half of TuesdayAuthor: Chin Zhao

21:24 2025-06-17 UTC+2

838

- Bears still can't find support

Author: Samir Klishi

12:00 2025-06-17 UTC+2

1663

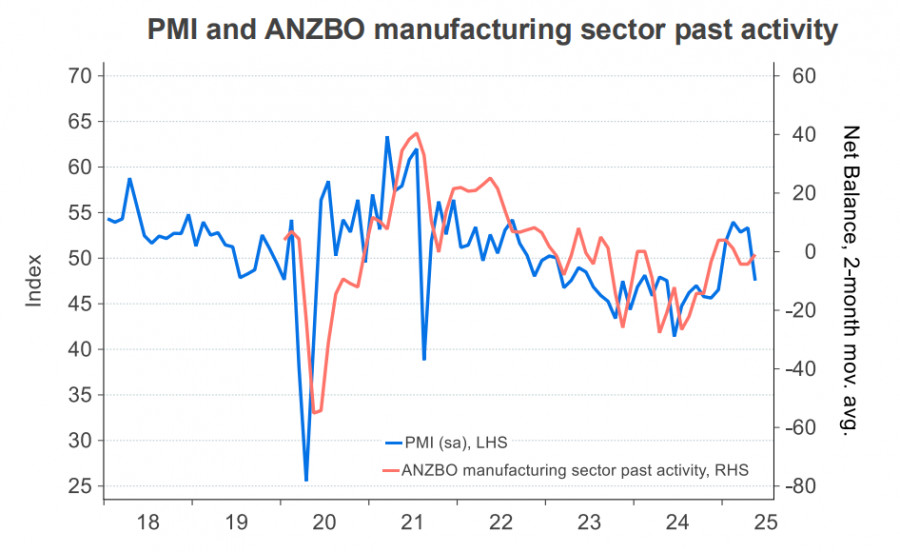

- The Kiwi Doesn't Give Up Despite New Zealand's Weak Economy

Author: Kuvat Raharjo

12:10 2025-06-17 UTC+2

1363

- Tensions in the US stock market are rising as the conflict between Israel and Iran intensifies. Analysts warn that a potential full-scale war could trigger a 20% drop in the S&P 500

Author: Ekaterina Kiseleva

13:25 2025-06-17 UTC+2

1168

- The US stock market continues to disregard geopolitical realities. Indices have approached key levels and are ready for a breakout. The only question is, in which direction? If upcoming events (PPI, Fed, retail sales) do not disappoint

Author: Natalya Andreeva

13:27 2025-06-17 UTC+2

1168

- Stock Market on May 17th: S&P 500 and NASDAQ

Author: Jakub Novak

11:56 2025-06-17 UTC+2

1108

- JPMorgan Chase & Co. is planning to launch its own stablecoin

Author: Jakub Novak

11:25 2025-06-17 UTC+2

1093

- USD/JPY: Simple Trading Tips for Beginner Traders – June 17 (U.S. Session)

Author: Jakub Novak

21:11 2025-06-17 UTC+2

928

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

20:24 2025-06-17 UTC+2

883

- GBP/USD lost 100 basis points in the second half of Tuesday

Author: Chin Zhao

21:24 2025-06-17 UTC+2

838