Vea también

17.02.2025 09:58 AM

17.02.2025 09:58 AMAsian financial markets started the new week with strong gains. Investors continue to reorient themselves away from US assets and towards global markets, reacting to the weakening dollar and the recovery of the Chinese economy. Last year, the strategy based on "US exceptionalism" brought good results, but now the focus is shifting towards global opportunities.

The key event of the week will be the publication of Japanese GDP data for the fourth quarter. According to analysts, the country's economy will show growth of 1.0% year-on-year. This is slightly below the revised July-September figure (1.2%), but business investment is a compensating factor, while consumer activity remains weak.

The American currency continues to weaken, reaching a two-month low. The main reason for the weakening was the delay in introducing tariff measures by the Donald Trump administration. Although the ultimate goal of the US president's policy remains unchanged, the longer implementation period gives a respite to global markets, putting pressure on the dollar.

The dollar has been declining for four days in a row - this is the longest streak of declines since August last year. Major currencies of developing countries are confidently strengthening, with the only exception being the Indian rupee.

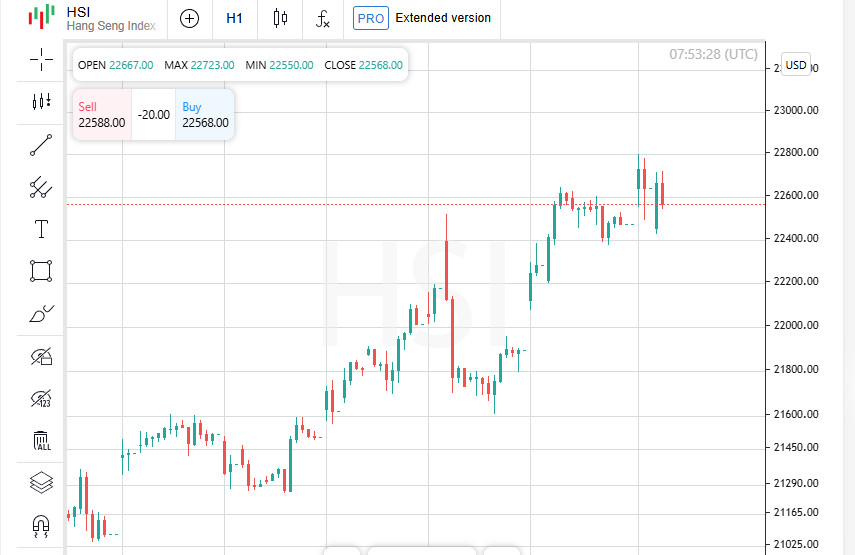

Amid a weakening dollar and capital inflows, Asian stock markets are showing impressive growth. The MSCI Asia ex-Japan index has gained 8% over the past month, but Hong Kong stocks have become the real leaders. The Hang Seng Index has soared 20%, while the Hang Seng Tech Index has soared 30%.

Investors see Asian markets as a promising alternative that can deliver high returns. Given current trends, the region continues to strengthen its position, attracting capital and increasing its role in the global economy.

Since Donald Trump's inauguration on January 20, shares of China's largest tech companies, the BATX group (Baidu, Alibaba, Tencent and Xiaomi), have shown an impressive gain of 22%. By comparison, the US giants from the so-called "Mag Seven" have remained at zero, having not increased in price over the same period.

According to Jeff Weniger, head of equities at WisdomTree, China's "Mag Ten" tech companies are now significantly ahead of their US peers, strengthening their influence in the global market.

The future of Chinese tech stocks may hinge on their advances in artificial intelligence. If the new DeepSeek system confirms China's active participation in the race for AI leadership, the Chinese market's upward trend will continue.

Bank of America analysts note that BATX currently has a market cap of $1 trillion, which is nothing compared to Mag Seven's $17 trillion. However, Chinese tech stocks remain extremely undervalued, leaving room for further gains.

As tech giants battle for AI leadership, a major shift is brewing in the semiconductor sector. According to the Wall Street Journal, Taiwan Semiconductor Manufacturing Co (TSMC) and Broadcom are considering deals that could split Intel, one of the icons of American chip manufacturing, into two separate entities.

This potential restructuring could significantly change the balance of power in the global semiconductor industry and redistribute influence among the largest chip makers.

Amid even weak signs of a possible truce in geopolitical conflicts, global markets are showing significant volatility. Easing tensions are helping to push oil prices and the dollar lower, while pushing up European stock markets.

In addition, analysts note that other risk assets, including Asian markets and emerging markets, should also benefit from this favorable market environment. Investors continue to look for growth opportunities outside traditional U.S. assets, which could help further strengthen global markets.

Goldman Sachs revised its forecasts for the Chinese stock market earlier this week, raising its targets for key indices. According to the bank's analysts, the rapid development of artificial intelligence technologies can significantly accelerate profit growth and attract up to $200 billion in new capital.

Chinese tech stocks are experiencing their best period in the last two years, showing impressive dynamics. The success of the DeepSeek project in the field of AI has become a catalyst for renewed investor interest in Chinese innovative companies.

On Monday, Goldman Sachs raised its 12-month forecast for key Chinese indices:

The CSI300 index is currently at 3954 points, but given the current dynamics, it is expected to strengthen further.

The main growth factor remains the large-scale implementation of artificial intelligence in the Chinese economy. If this trend continues, the Chinese market may continue its upward movement, attracting even more foreign investment.

Chinese companies are gradually restoring the confidence of global investors, and the country's technology sector is once again demonstrating the potential for rapid development.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Según observaciones de analistas, el ciclo actual del Bitcoin es diferente a los anteriores. Los expertos atribuyen esto no solo a la volatilidad actual de la primera criptomoneda

El metal amarillo ha ocupado un lugar de honor entre los activos más demandados y no piensa detenerse en lo logrado. El precio del oro sigue creciendo con seguridad, superando

La primera criptomoneda se encuentra en un estado de "descomposición": no logra encontrar un punto de apoyo. El Bitcoin está experimentando una volatilidad significativa, habiendo mostrado una caída esta semana

Ayer se supo que, a partir de la próxima semana, el presidente de Estados Unidos, Donald Trump, impondrá aranceles del 25% a la importación de automóviles. Esta noticia provocó turbulencias

La sesión de negociación en EE. UU. del martes trajo noticias interesantes para los participantes del mercado: los futuros de gas natural subieron repentinamente, mientras que el petróleo decidió tomarse

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.