Vea también

25.11.2024 04:35 PM

25.11.2024 04:35 PMLast week, market sentiment continued to shift toward a potential strengthening of the dollar and increased demand for US assets amidst geopolitical and economic challenges in Europe and beyond.

Throughout the previous week, the market remained focused on the dollar's potential strength, driven by growing interest in US assets amidst geopolitical and economic turmoil in Europe and globally. Investors analyzed Donald Trump's government nominations, assessing their implications for future economic policy. However, this week, attention shifts to inflation data releases and the minutes from the latest Federal Reserve meeting, which will offer insights into the central bank's monetary policy outlook.

Despite today's temporary weakening of the dollar—following Scott Bessent's appointment as Treasury Secretary in Trump's administration—it is too early to conclude that the recent dollar rally has ended.

Bessent's statement about prioritizing financial stability over radical economic changes has unsettled investors. As a result, the dollar weakened against major currencies, with the euro, pound, Australian dollar, and yen posting notable gains. Gold prices, often viewed as a safe-haven asset during geopolitical uncertainty, also faced downward pressure.

After digesting this news, market participants are turning their focus to upcoming key US economic reports. Notable releases include data on the Personal Consumption Expenditures (PCE) Price Index and its core reading, as well as figures on Americans' incomes and expenditures. Additionally, the Federal Reserve's latest monetary policy meeting minutes will draw significant attention. These releases are expected to influence expectations regarding future rate decisions.

Last week, the dollar reached two-year highs, buoyed by speculation that Trump's policies could drive inflation higher and restrict the Federal Reserve's ability to lower borrowing costs. On this backdrop, the US Dollar Index tested the 108-point level on the ICE index. Although it has since retreated slightly below 107.00, further declines are unlikely. Much will depend on the upcoming PCE Price Index report, which is expected to show consistent growth. If consumer inflation aligns with or exceeds forecasts and nonfarm payrolls remain strong, the Federal Reserve may pause rate cuts at its December meeting.

Today's dollar weakness appears to result from localized profit-taking ahead of significant US economic data. Observing broader trends, gold prices are unlikely to decline sharply, as ongoing geopolitical tensions support demand for it as a safe-haven asset. Meanwhile, the dollar is expected to resume strengthening, particularly against the euro and pound, amidst Europe's recessionary pressures. For the yuan, a localized pullback against the dollar is anticipated, driven by the People's Bank of China's monetary policy.

Daily Forecasts

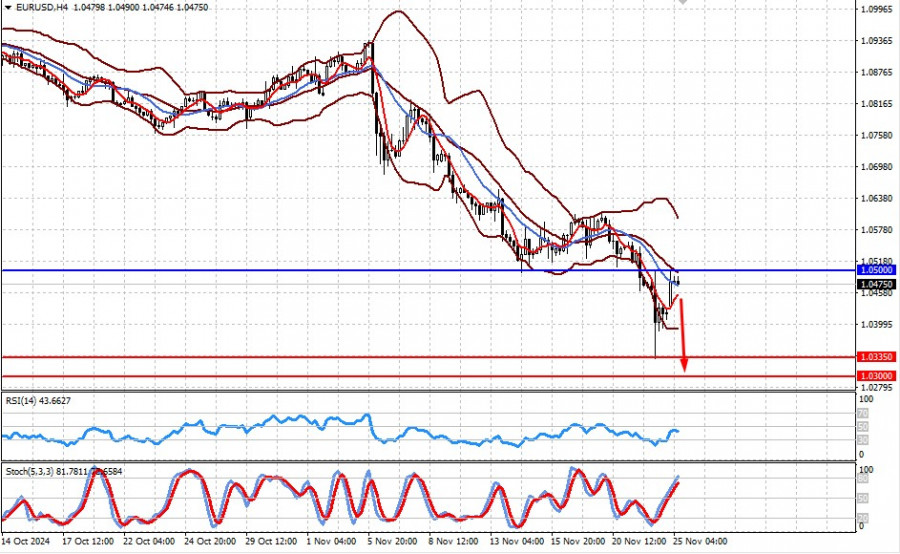

EUR/USDThe pair has corrected upward to 1.0500. If it fails to break this level, a resumption of the decline toward 1.0335 and subsequently 1.0300 is expected.

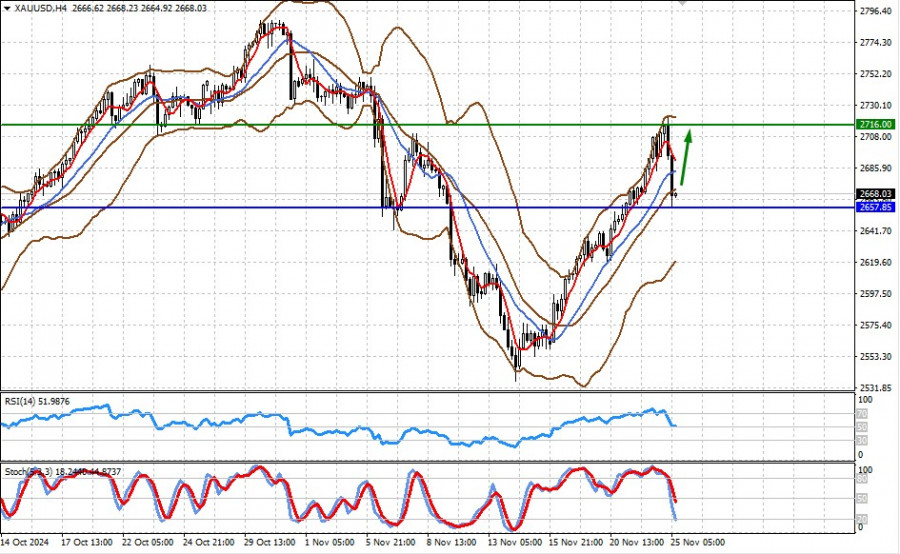

XAU/USDGold prices have found support at 2657.85. Strong demand for gold as a safe-haven asset suggests that prices could recover to the 2716.00 level.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas EUR/USD continuó el viernes con un movimiento descendente suave y débil. Como ya hemos mencionado muchas veces, el movimiento actual es una corrección en estado puro

El par de divisas EUR/USD durante el martes mantuvo un ánimo de corrección. No hubo eventos macroeconómicos en este día, sin embargo, Donald Trump "leyó toda la lista" de países

El par de divisas GBP/USD durante el lunes descendió ligeramente, pero todavía no se puede hablar de una tendencia bajista. Desde el punto de vista técnico, el par permanece

El par de divisas EUR/USD se negoció durante el lunes con una inclinación bajista, aunque probablemente no hubo motivos de peso para el fortalecimiento del dólar. Recordemos que durante

El par de divisas GBP/USD también se mantuvo en el mismo lugar durante el viernes, ya que en ese día la sesión comercial estadounidense, en esencia, no funcionaba. No hubo

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.