Vea también

06.12.2024 07:31 AM

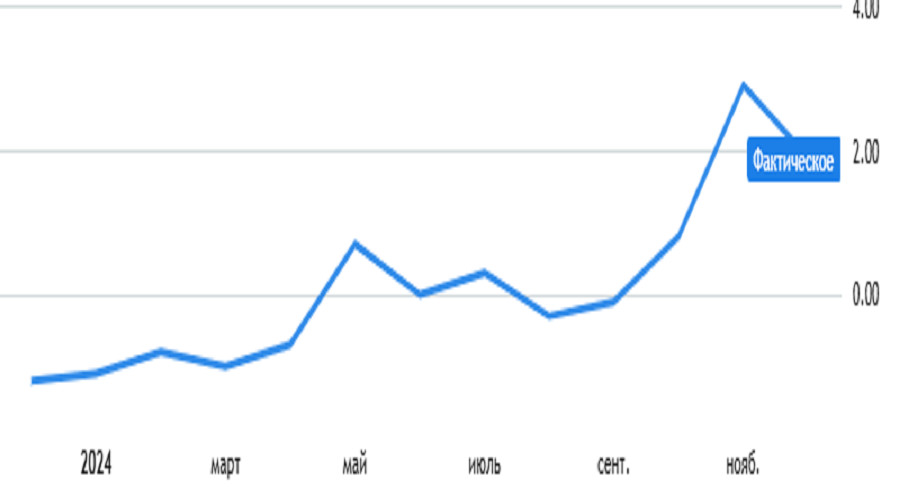

06.12.2024 07:31 AMEurozone retail sales growth slowed significantly from 3.0% to 1.9%, much worse than even the most pessimistic forecasts. Yet, the euro still managed to gain ground. It is impossible to attribute it to the data on unemployment benefits applications because the total number of claims decreased by 14k against a forecast of 1k, making the data slightly better than expected.

The primary reason for this market behavior lies in today's anticipated U.S. Department of Labor report. Recent labor market data prompted investors to revise their forecasts, expecting the unemployment rate to rise from 4.1% to 4.2%. This expectation has fueled the euro's rally. However, the euro could weaken significantly if unemployment remains unchanged and over 200k new jobs are created in nonfarm sectors.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.