Vea también

04.03.2025 01:16 PM

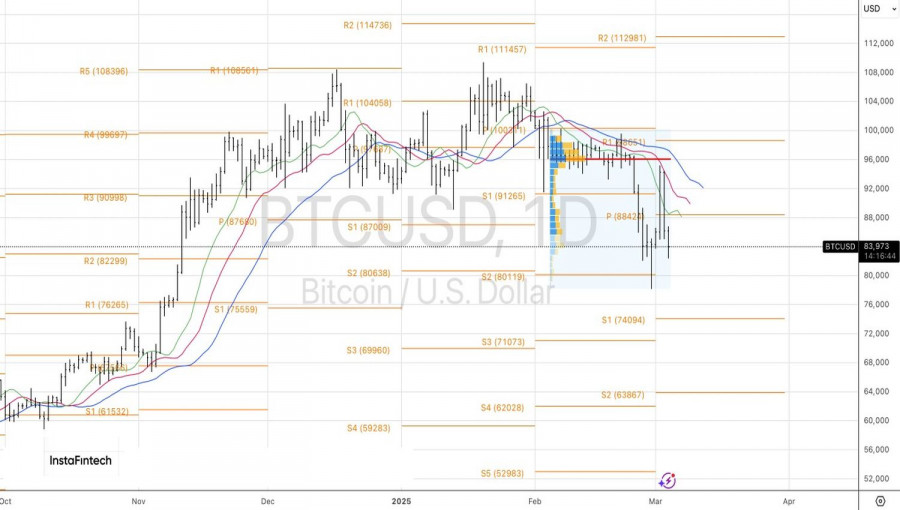

04.03.2025 01:16 PMDonald Trump's mention of a strategic reserve seemed to bring Bitcoin back to life. In reality, however, the BTC/USD rally in early March turned out to be nothing more than a dead cat bounce. Buyers' attempt to restore the bullish trend ended in failure as investors began to doubt the viability of using other tokens.

The crypto winter seems to be back. In February, Bitcoin recorded its worst performance since 2022, when it was in deep depression. However, the launch of crypto ETFs, coupled with Trump's promises of a more lenient approach to the industry and the creation of a strategic reserve, pushed BTC/USD to record highs.

Bitcoin's monthly dynamics

Since then, the token has lost nearly a third of its value due to a deteriorating macroeconomic environment and global risk appetite, capital outflows from specialized exchange-traded funds, the largest theft in cryptocurrency history, and investor disappointment with Trump's promises.

While investors in late 2024 were still hopeful that fiscal stimulus and deregulation would boost the US economy, by early 2025 their views had shifted drastically. The most likely scenario is stagflation, where GDP barely grows while inflation accelerates. Such an environment is extremely unfavorable for US stock indices. Their decline signals a deterioration in risk appetite, dragging the BTC/USD pair down with it.

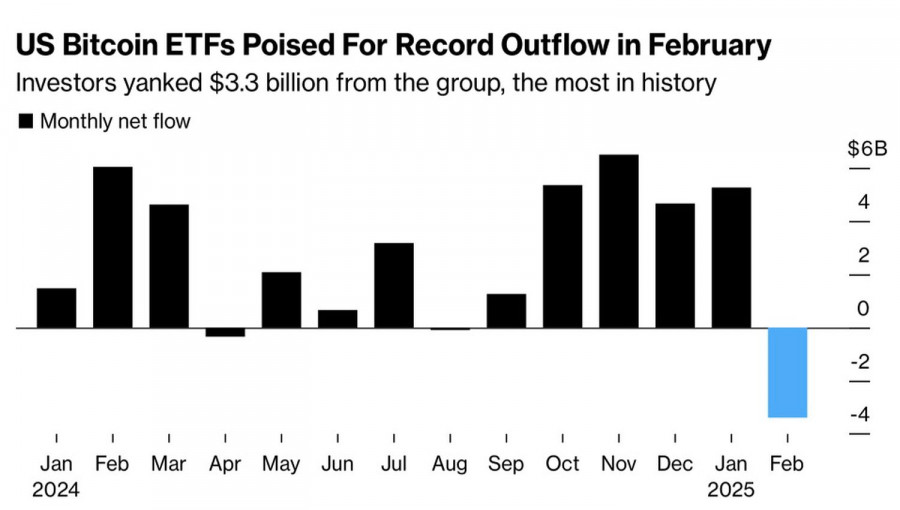

It comes as no surprise that Bitcoin-focused ETFs saw a record $3.3 billion outflow in February, the largest in the funds' history.

Capital flow dynamics in Bitcoin ETFs

The hack of the ByBit exchange and the theft of $1.5 billion in Ether only fueled the panic. The fear of losing money due to low security levels prompted investors to withdraw their funds from crypto systems, accelerating the BTC/USD decline.

Only when Donald Trump announced on social media that the strategic reserve would include not just Bitcoin and Ether but also tokens such as XRP, SOL, and ADA, did cryptocurrencies seem to regain some footing. Investors had almost forgotten about the Republican's promised initiative, and then this happened!

Unfortunately, the BTC/USD rally proved to be short-lived. Initially, it was assumed that the strategic reserve would include confiscated government Bitcoin. All other digital assets would have to be purchased, but Congress has already rejected this idea. It is quite possible that Trump's promises will ultimately prove meaningless. If that happens, a sell-off in the crypto markets is likely to gain further momentum.

Technical outlookOn the daily chart, BTC/USD is experiencing a correction from the bullish trend, which risks evolving into a full-fledged bearish trend. Only a break above the 91,300 level could change the outlook. Therefore, going short remains the preferred strategy until Bitcoin returns to this level.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

El par de divisas EUR/USD continuó su recuperación durante el miércoles en un contexto de calendario macroeconómico absolutamente vacío. Ni siquiera destacamos el único informe del día sobre la inflación

El lunes, la moneda estadounidense se fortaleció considerablemente tras el éxito en la primera ronda de negociaciones entre EE. UU. y China, aunque, en esencia, ambas partes solo acordaron

El par de divisas EUR/USD estuvo prácticamente todo el martes en una tendencia alcista. Uno se acostumbra rápido a lo bueno, y el mercado claramente esperaba una continuación del fortalecimiento

El par de divisas GBP/USD también cayó rápida y alegremente el lunes. EE. UU., representado por el Secretario del Tesoro Scott Bessent, anunció el primer avance en las negociaciones

El par de divisas EUR/USD cayó el lunes como una piedra. ¿Adivinan a quién hay que agradecerle esto? Por supuesto, a Donald Trump. Aunque esta vez, solo de forma indirecta

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.