Vea también

04.04.2025 11:10 AM

04.04.2025 11:10 AMSomeone is not telling the truth. Donald Trump insists that everything is going well and that the markets will flourish. But the S&P 500 just posted its worst 10-week start after Trump's inauguration since 2001, wiping out $3 trillion in market capitalization. Investors are losing faith in the Republican leader, while Fitch Ratings warns that tariffs are changing the rules of the game. We have entered an entirely new macro landscape. The winning bet of "buy the dip" no longer works.

Following the White House's sweeping import tariffs, the average US tariff rate has jumped from 2.2% to over 20%, marking the sharpest increase since the 1950s. Back then, it triggered a recession. History risks repeating itself. UBS estimates that GDP cloud shrink by 2 percentage points in 2025. Nomura forecasts modest growth of just 0.6%, while Barclays offers a slightly brighter view of a 0.1% contraction. Notably, when Trump took office, the economy was growing at 2.8%. Unsurprisingly, investors are selling dollars and stocks, abandoning the notion of American exceptionalism.

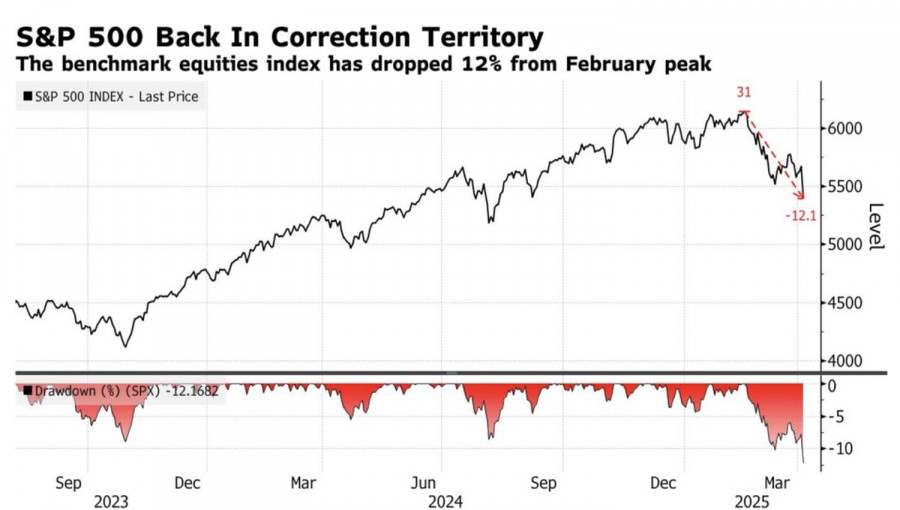

S&P 500 performance in absolute and percentage terms

The S&P 500 has entered correction territory again, although full-blown recessions have historically seen losses of 20% or more — still a long way off. Nonetheless, the index's downward trajectory signals recession risks ahead. Markets are currently pricing in a 48% chance of a downturn in the next 12 months, up from 38% before the White House tariff announcement on April 2, according to Polymarket.

UBS Global Wealth Management downgraded US equities to "neutral" from "most favored" and cut its year-end S&P 500 forecast to 5,800 from 6,400, citing tariff-induced volatility. Hedge funds dumped stocks in March at the fastest pace in 12 years, according to Goldman Sachs.

Wall Street analysts have trimmed their 2025 earnings growth forecasts for US corporates to 9.5% from 13% in January. Despite falling P/E multiples, the current valuation of the S&P 500 at 20 times earnings still looks stretched relative to historical norms.

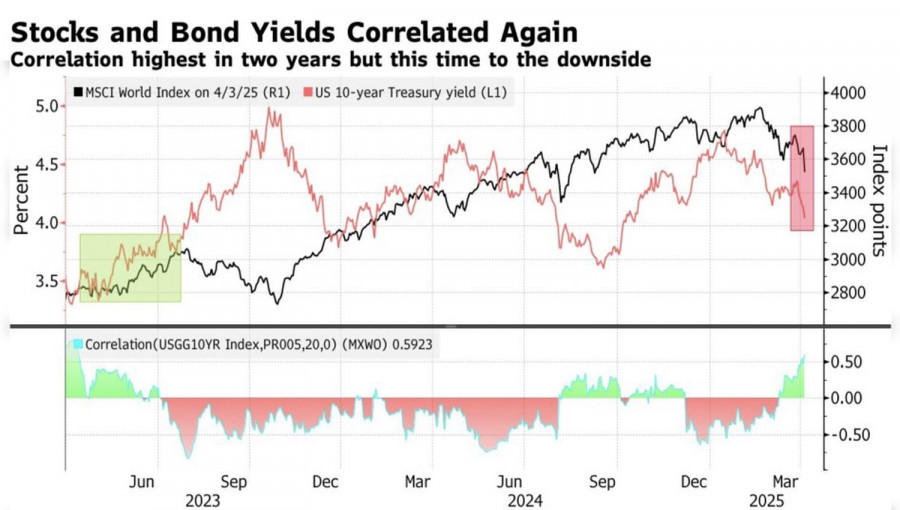

Global equities vs. bond yields

The White House's tariff blitz has not just rocked US markets — global equities are also reeling. Risk aversion has pushed up the correlation between MSCI's global index and 10-year US Treasury yields. At the same time, US equities are underperforming their international peers, putting pressure on the US dollar.

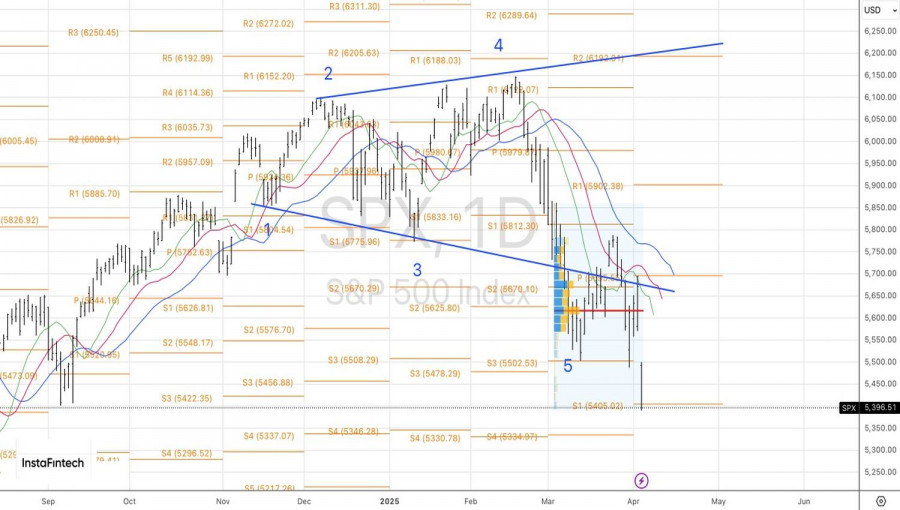

Technically, the daily chart shows that the S&P 500 is still in a correction from its broader uptrend. Both downside targets at 5,500 and 5,400 were hit on short positions. While a brief rebound in the broad index is possible, as long as it trades below 5,500, the bias remains towards selling.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD continuó su crecimiento el miércoles, que había comenzado el martes. Recordemos que el martes el mercado no tenía ninguna razón de peso para deshacerse masivamente

El par de divisas EUR/USD continuó su recuperación durante el miércoles en un contexto de calendario macroeconómico absolutamente vacío. Ni siquiera destacamos el único informe del día sobre la inflación

El lunes, la moneda estadounidense se fortaleció considerablemente tras el éxito en la primera ronda de negociaciones entre EE. UU. y China, aunque, en esencia, ambas partes solo acordaron

El par de divisas EUR/USD estuvo prácticamente todo el martes en una tendencia alcista. Uno se acostumbra rápido a lo bueno, y el mercado claramente esperaba una continuación del fortalecimiento

El par de divisas GBP/USD también cayó rápida y alegremente el lunes. EE. UU., representado por el Secretario del Tesoro Scott Bessent, anunció el primer avance en las negociaciones

El par de divisas EUR/USD cayó el lunes como una piedra. ¿Adivinan a quién hay que agradecerle esto? Por supuesto, a Donald Trump. Aunque esta vez, solo de forma indirecta

El par de divisas EUR/USD continuó negociándose el jueves dentro del mismo canal lateral, claramente visible en el marco temporal de una hora, prácticamente hasta la noche. Tras la reunión

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.